Saving and investing for the next generation is not always at the forefront of the planning process for clients and their families, and understandably so. August’s announcement from The Public Accounts Committee highlighting that £1.7bn remains unclaimed from Child Trust Funds (CTFs) is a timely reminder of this.

So, I thought I would use my column this month to put forward the case for digging out any old paperwork, tracing any forgotten-about funds and generally re-engaging young adults with their childhood savings.

A useful starting point is to visit the government's find a child trust fund service. This can be done either through an online or postal request.

Before we go further, it is worth making the point that CTFs remain a perfectly acceptable savings option and this is not a call to shun them. Launched in 2005 for children born between 1 September 2002 and 2 January 2011, the scheme was designed to give children an early step up on the financial ladder. Most received a £250 voucher from the government when the account was created, with those in care or from low-income families receiving an additional £250. Further top-ups were allowed up to the subscription limit during the tax year in question. In the current tax year this is £9,000.

The child can take control of their CTF from 16 but cannot access their funds until their 18th birthday

The CTF scheme closed to new applications in January 2011, with the Junior ISA assuming its place later that year. The final CTF accounts will mature in 2029.

From a planning perspective, the age of the child is the key in determining the options available to them. We will categorise them into the following groups:

A transfer to a Junior ISA can be considered for the youngest group.

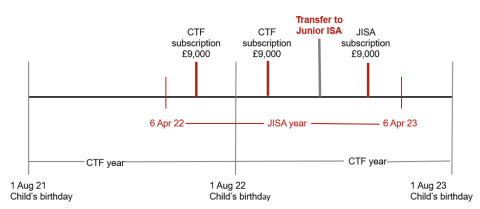

The subscription limit remains £9,000 but runs concurrently with the tax year rather than resetting on the child’s birthday as with CTFs – so keep in mind the planning opportunity that allows the CTF to be funded after the child’s birthday and the Junior ISA to be funded after the transfer, all within the same tax year.

CTF to Junior ISA transfers are permitted before the former matures – provided the transfer is conducted in full, as it is not possible to hold both accounts. The transfer should be completed within 60 days of opening the Junior ISA, and the registered contact must be the same for both accounts. Ensuring both accounts are consistent at the application stage is key, as there is little time to lose.

As with CTFs, savings cannot be withdrawn from a Junior ISA until the child reaches 18, unless they die or become terminally ill.

These are undoubtedly the golden years of childhood investing and should be used wherever possible. As well as the Junior ISA we have just covered, the teen becomes eligible for an adult Cash ISA from their 16th birthday. The rules permit subscriptions into both accounts, opening a very cool £87,000 of tax-free savings headroom for those born after 6 April.

Another option is to leave the CTF intact and open a Cash ISA to run alongside it, again presenting the same “double funding” opportunity.

At age 18 the CTF will mature and for those who have already opted to transfer, the Junior ISA will convert to its adult variant. Both accounts will require administrative action to keep them in good standing, so it ought to be an important checkpoint in your family financial plan. Last week’s report from the cross-party selection of MPs estimates that almost 1 million 18 –20-year-olds have matured CTFs sitting unclaimed, which suggests more could and should be done at this point.

Whilst the CTF could simply be withdrawn, other options at this stage include transferring the balance to a Stocks and Shares ISA for those who want to try their arm in the stock market whilst retaining instant access to their savings. Crucially, the transfer does not use up any of the £20,000 ISA annual subscription limit, so that remains available for fresh savings. Those looking at a first-time property purchase can ponder a Lifetime ISA to collect the 25% government bonus, although this will be limited to a payment or transfer from the matured CTF of £4,000 and the overall limit will reduce accordingly. For those happy to keep their funds locked away long term, a SIPP contribution could be an option, with tax relief available on member contributions of up to 100% of their earnings, or £2,880 net where the individual has yet to step into the world of work.

Whichever path is chosen, there is clearly lots to consider for your clients. Product suitability will come to the fore, and each will require their own tailored solution based on their aims and objectives for young adult life. The first step in the process, however, is to track down those CTFs, even if it’s just to check on their performance, review investment options and then to explore the alternatives available.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.