When it comes to saving for and living in retirement, pensions generally lead the conversation. That is to be expected of course, but in my view, ISAs have their own role to play.

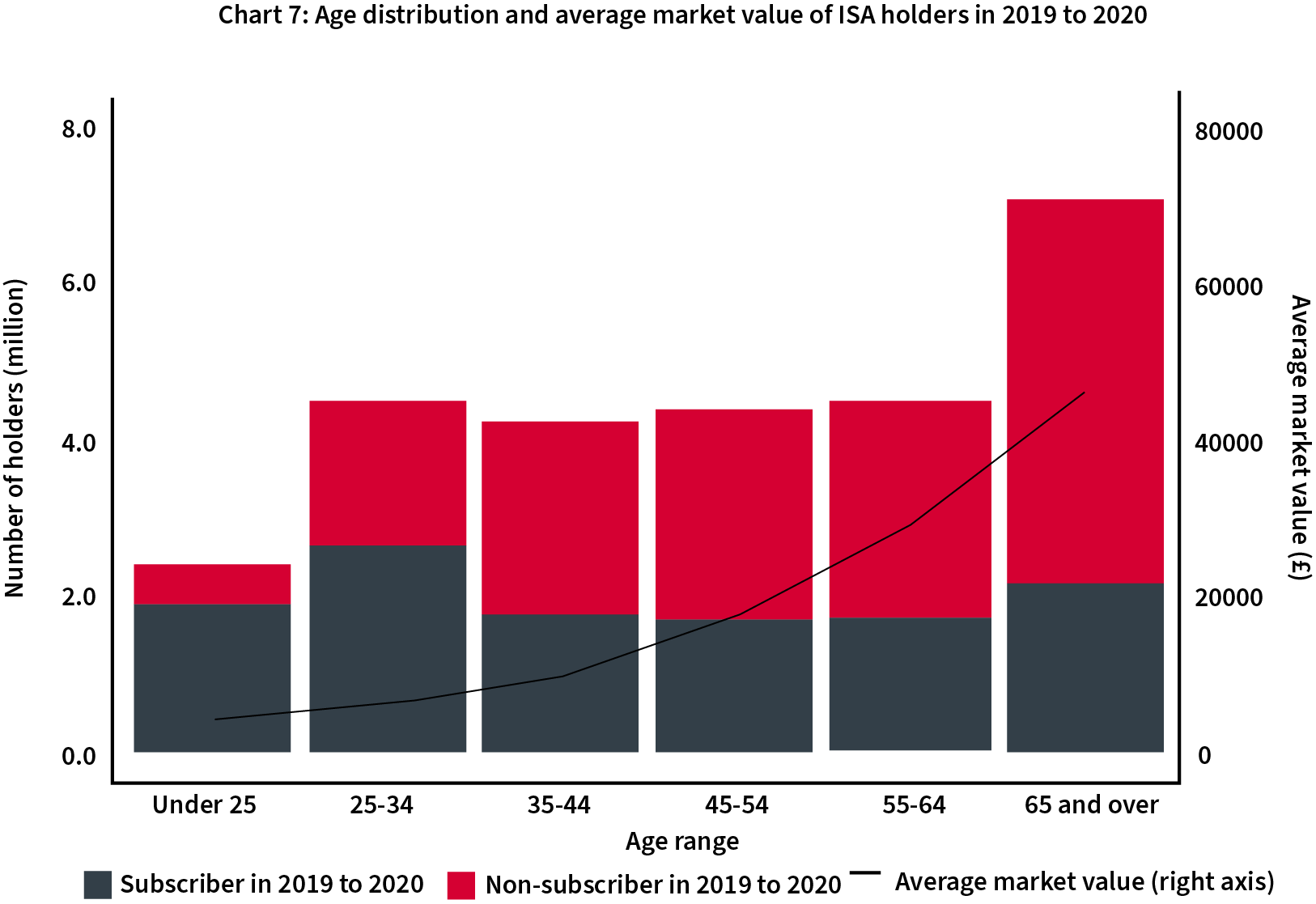

The figures tend to support this, with those released in the government’s annual savings statistics in June 2022 showing that the 65 and over age group represented the largest number of ISA holders in the 2019/20 tax year, with almost 5 million holding an ISA and a further 2.1 million actively saving.

We know what pensions bring to the table and their features should not be overlooked. From tax relief, broader investment choice and the variety of benefit options instigated by pension freedoms introduced in April 2015 to (often inflation-proof) promised retirement income for members of final salary schemes. Have we considered however, how we can use the different ISAs to work in tandem to boost income in retirement further and produce the best outcomes for clients?

ISAs are typically funded by an individual’s taxed income. Unlike pensions there is no tax relief on the way in and no tax deductions on the way out. Adults can pay £20,000 each year into their ISAs. This can be split across the various ISA types available, although only one ISA of each type can be funded during any given tax year.

When looking at alternatives to pensions for retirement, the Lifetime ISA is worthy of consideration. UK residents can open an account upon turning 18. Payments can be made up to £4,000 per tax year and sit within the £20,000 overall ISA subscription limit mentioned earlier. The unique selling point of the Lifetime ISA over its siblings is the 25% government bonus received on payments in.

The primary purpose of the Lifetime ISA is to help people buy their first home, and this generous government top-up is a valuable boost towards this goal. The catch is that withdrawals for any other purpose before age 60, outside of the death of the investor or diagnosis of a terminal illness, are subject to a charge of 25% which can see the investor receive back less than they initially subscribed.

So, what happens after the investor has purchased their first home? Does the Lifetime ISA become redundant? The answer is a resounding no. Investors can continue to pay in until their 50th birthday and receive the 25% bonus, which is essentially the same as basic rate tax relief within a pension and a better deal than having 75% of your pension taxable upon reaching retirement, as long as withdrawals from the Lifetime ISA are carried out charge-free. You can leave them to grow and withdraw them tax-free from age 60 to supplement any pension income.

Looking again at the figures, the national average withdrawal for a house purchase in 2021/22 was £13,192, an increase of almost £700 from the previous tax year. It takes just three years to save this amount assuming the full £4,000 limit is subscribed each year and a 5% annual return on investment after charges.

If an investor begins saving at age 18, withdraws the national average amount to buy their first home and continues subscribing to the Lifetime ISA, they will have £358,070 in their LISA at age 50. This grows further to £583,258 at age 60.

Alternatively, the investor could let their Lifetime ISA do the heavy lifting when saving towards a deposit. Withdrawing £61,000 at age 27 leaves the Lifetime ISA almost exhausted but gets the investor into their home six years before the national average age of 33.4 years, achieving a hefty 25% deposit on the average first time buyer house price of £245,522. Again, by continuing to subscribe on the same basis the account recovers to a value of £227,722 at age 50, £370,935 at age 60.

If your client wants more flexibility over when they can access their savings without worrying about withdrawal charges, they could opt for a stocks & shares ISA instead. Although there’s no bonus available from the government on any subscriptions, withdrawals can be made without charge at any time, whilst crucially, any investment growth and income received will still benefit from a tax-sheltered environment.

It is worth remembering that ISAs fall within the investor’s estate upon their death whereas a pension typically doesn’t. This should be considered when deciding how to allocate an individual’s savings between the various options available and when estate planning comes into view. Other types of ISA can also be used alongside the Lifetime ISA to give the client an optimal blend and who knows, maybe recent calls to consolidate all of the existing ISAs into a single account will be considered in the future.

Sources from Gov.UK, 2022 and Money, 2023

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.