What will Jeremy Hunt’s windfall tax changes mean for energy infrastructure investment in the UK? It’s a fair question and one that’s already generated more than a few headlines.

The bosses of both Shell and SSE have warned their respective companies will have to review their slate of investments because of the changes; changes which have thrown previous “fiscal calculus” up in the air.

On paper their comments might be viewed as brinkmanship, a bit of posturing and bluster in response to penalties on stunning profits which have come at the expense of UK households. But in reality, the government must be hyper-aware that the levies could fundamentally undermine UK plans both for security of supply and the ambition to decarbonise the power market by 2035.

Building and expanding energy infrastructure is a long game; it takes years to plan and even longer to reach fruition.

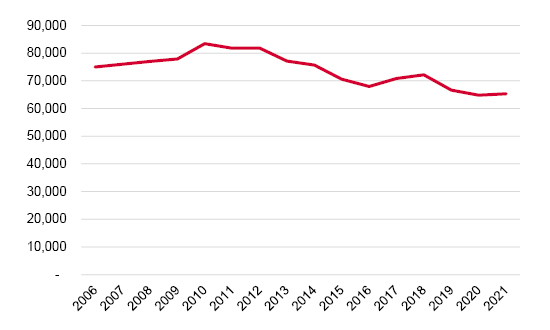

Electricity capacity in the UK with Transmission entry capacity (megawatts)

Source: The Department for Business, Energy & Industrial Strategy

Just because energy prices are sky high at the moment doesn’t guarantee they’ll stay that way. In fact, the assumption is that the current geo-political environment has created an unsustainable market; one which can only head one way.

Consider: it was 2010 when Hinkley C was initially given a tentative green light. It’s been beset with problems (not least COVID lockdowns), but even without the pandemic, building a complex site the size of a small town would inevitably have struggled with both time and budget.

From concept to conclusion every step has to be carefully planned. A skilled labour force doesn’t just magically materialise – it needs to be built – and companies like EDF work alongside colleges and universities to ensure what’s being taught nearby will deliver for both students and potential employers.

Taking that leap requires the knowledge that the investment will generate substantial returns.

Investors have to be wooed; numbers need to be interrogated.

Just because energy prices are sky high at the moment doesn’t guarantee they’ll stay that way. In fact, the assumption is that the current geo-political environment has created an unsustainable market; one which can only head one way.

It’s been fifteen years since I sat next to the boss of a northern utility company at an industry dinner. Our conversation was coloured by the fact that I was a reporter, but despite the obvious caution with which he spoke he was clearly frustrated with the lack of long-term vision the political system allowed.

The election cycle creates short-termism. What possible gain could a government get from green-lighting a series of hugely expensive projects that won’t deliver results until long after those in power have relinquished their seats?

It was a time when a number of older power stations were reaching the end of their lifetimes and questions were being asked about whether any of them could be revitalised or reworked for other fuels. Ultimately only one of the three in question made the change, and Drax is still an integral part of the UK’s generating provision.

The transition to net zero has helped focus political minds, and Russia’s invasion of Ukraine has only served to further highlight the need for the UK to be as self-sufficient as possible when it comes to its energy needs.

The green economy has progressed at speed and projects that once looked a bit woolly are now delivering some serious cash.

The shift to clean green energy has created opportunity and appealed to all investors, not just those hunting for the E in ESG.

Damaging that ecosystem is something the boss of Renewables UK is concerned about. The green economy has progressed at speed and projects that once looked a bit woolly are now delivering some serious cash.

It’s not the windfall tax itself that worries many, in fact the immediate reaction from investors once they’d had chance to scrutinise the small print suggests they’re hyper-aware it could have gone much, much further. It’s more the fact that the electricity generator levy doesn’t, at present, look like it will be subject to any investment allowance.

That’s something that enabled Shell to neatly sidestep the tax in the last quarter, though it had expected to pay a substantial sum early next year. Here again it’s unlikely the tax itself has raised too many eyebrows, but the extension of the tax for another two years, the extra 10%, those are things that are likely to have necessitated the wielding of a very large red pen.

Gas has long been seen as an integral part of the transition process and if that gas can be extracted from the North Sea, if it can add to the Treasury tax take, so much the better.

And this is Mr Hunt’s dilemma. The public are hurting. They’ve been asked to pay more to support our public services at a time their budgets are being squeezed by price rises, with energy taking the biggest bite out of the pot.

A recent survey carried out for AJ Bell found that 81% of those surveyed supported tax rises, and the tax hike that got the biggest support was a windfall tax on energy company profits*.

But additional taxes coupled with a lack of consistency muddies the waters. Is the UK the place for investors in clean energy, or does it now have a great big question mark over it? If we are to make our net zero target a reality the government will have to work hard to convince the industry and investors it’s still the former.

* Data collected by Opinium for AJ Bell between 8-11 Nov 2022. A nationally representative sample of 4,000 UK adults. Q: Which taxes, if any, would you support being increased to help improve public finances?

Past performance is not a guide to future performance and some investments need to be held for the long term

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.