The boss of electric vehicle charging provider PodPoint, Erik Fairburn, recently told the Sunday Express he believed the switch to EVs would bring about the demise of the petrol station as we know it. It’s an interesting and not so far-fetched view of the future.

The length of time it takes to charge up an EV will require us to think even more creatively and presents some interesting opportunities for investors to consider.

Think about the way we already live our lives. When Asda opened the first ever supermarket petrol station back in 1967 many may have raised an eyebrow, but by 2019 the Petrol Retailer’s Association estimated that almost half (49%) of all petrol bought in the country was from supermarkets although they accounted for less than 20% of all forecourts. Price will undoubtedly have played a part but so will lifestyle. Before Covid slowed our pace, time had become the most precious of commodities and any opportunity to multi-task was seized upon. Pairing the weekly shop with filling up the car made sense, and if you could shoehorn in a quick coffee and a stop off at the dry-cleaning booth as well, so much the better.

EV drivers will be captive consumers and they’ll want to top up wherever they’re doing business.

The length of time it takes to charge up an EV will require us to think even more creatively and presents some interesting opportunities for advisors and investors to consider. It’s no accident that PodPoint’s struck a deal with Tesco to up the number of charge points available in shoppers’ car parks, or that other supermarkets have been making similar upgrades to their offer. EV drivers will be captive consumers and they’ll want to top up wherever they’re doing business. Smart adjustment to retail parks could turn them into EV honeypots. Easy access and plentiful parking make them ideal locations and many already mix retail and hospitality to good effect. Going forward we’re likely to see that offer diversify further to include more leisure activities – gyms and soft play rubbing shoulders with personal services like hairdressers and beauticians. LondonMetric Property PLC has already scented the opportunity, signing a deal at the start of the year with forecourt giant MFG to house charging hubs at six retail locations.

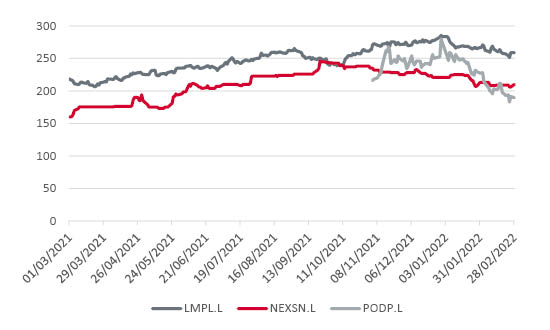

12 month performance of companies with an eye on EV growth

Source: Refinitiv

It’s an offensive move by MFG, the UK’s largest independent forecourt operator which is itself said to be the target of a potential takeover. But if the PodPoint CEO is on the money, if petrol stations are on borrowed time, why would the business be on anyone’s radar – least of all private equity stalwart Fortress? Location, location, location is probably the answer and Fortress already has a roster of UK businesses that could fit nicely into the idea of hub venues. When MFG’s current owner Clayton Dubilier & Rice snapped up Morrisons there was plenty of speculation that the two businesses might work very nicely hand in hand, but it’s unlikely the competition watchdog would have been in agreement considering its stance on all the comings and goings at Asda whose new proprietors also own a large number of UK petrol stations. EVs are changing the game and the players are positioning themselves to come out on top.

When you look at the rate at which UK drivers have been making the switch to electric vehicles over the past couple of years you can understand why so many investors are casting their eye over the space.

If motorists make the switch the infrastructure will have to follow, but without the infrastructure in place many motorists won’t feel confident that the switch can be made.

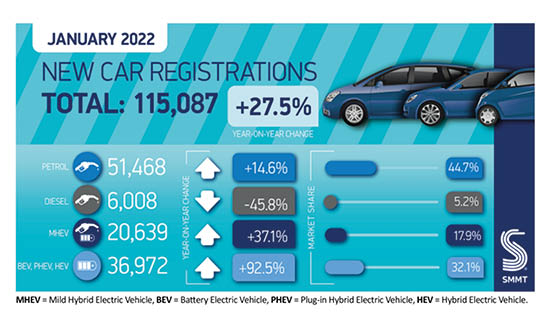

One in six new cars registered in 2021 was electric according to figures from the Society of Motor Manufacturers and Traders – a 568.9% increase between 2019 and 2021 and a trend that has continued into 2022. But the number of standard chargers increased by just by 69.8%: a staggering shortfall which will require quick action if the big switch isn’t to stall, particularly as the record cost of fuel might just push more people than ever to ditch their combustion engines for a shiny ’22 plate EV.

EVs account for one in six car registrations in January

Source: SMMT

Many commentators have described it as a chicken and egg situation. If motorists make the switch the infrastructure will have to follow, but without the infrastructure in place many motorists won’t feel confident that the switch can be made. But the clock is ticking, and 8 years won’t be enough time to install enough capacity for every driver to make the change, especially those who don’t have an option to charge up at home. It will need big changes, big investment and will mean big revenues for businesses like Nexus Infrastructure PLC. It’s eSmart Networks recently reported a 310% revenue jump in FY 2021 with an order book up 255% year on year.

The UK’s not ready for its next chapter but the story is already being written. Will it end with the demise of petrol stations and opportunities for shopping centres and high streets, or will it just add to the appeal of supermarkets as fuel points? Whilst some change will be organic most of it must come from a plan, deals between businesses, mergers and acquisitions, and, for advisors and investors, opportunities – if they’re looking in the right places.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.