If September hasn’t already delivered the annual squabble about when is an acceptable moment for the heating to be flicked on, October certainly will and this year’s debate will come with an added frisson.

Wholesale gas prices have skyrocketed. The energy price cap that helps keep a lid on things for consumers still bears a relationship to this wholesale market and is looking to enjoy a record rise even though it was set before this latest spike.

“The massive and rapid increase in gas prices has already brought a number of small suppliers to their knees.”

UK wholesale gas prices

Source: Refinitiv

The massive and rapid increase in gas prices has already brought a number of small suppliers to their knees and looks set to fundamentally redraw the market.

There’s a myriad of reasons for the surge. These run from last year’s cold snap – which ate into UK stocks – delayed maintenance on oil platforms – which has led to decreased supply – and a disappointing contribution from renewables over the summer, all while demand has been increasing as global economies reopen.

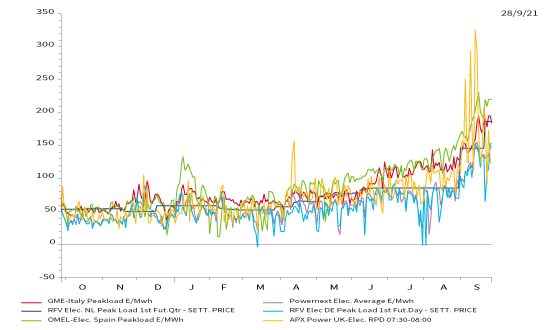

Like many countries, the UK also relies on gas to produce electricity and here’s another chart to make bill-payer’s wince. Yet another reason there have been so many headlines suggesting this winter could be record-breaking for all the wrong reasons.

Wholesale electricity prices across Europe

Source: Refinitiv

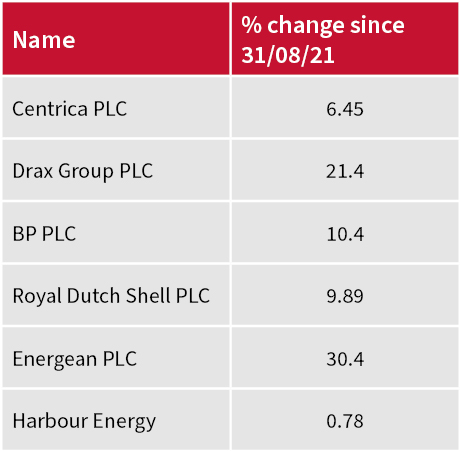

But the thing about shortages and price pressures is that, for every loser, there’s usually a winner and this is playing out in the energy market. Just look at the upward trajectory in share price enjoyed by oil giants BP (BP.) and Royal Dutch Shell (RDSB) in the wake of the weekend’s queues at petrol pumps.

“Regulation designed to open up the marketplace seems at the moment to be having the opposite effect.”

In the first six months of the year, Centrica (CNA)-owned British Gas lost 114,000 customers, a trend that had become fairly routine.

In the last few weeks, though, it’s been a different story, with the number of accounts swelling by 440,000. Any customers taken on at the moment might well be loss-making but it’s the long-term gain that Centrica will be considering.

And customers are likely to be sticky at the moment, nervous about jumping back to a collection of smaller suppliers which is likely to get increasingly modest in number.

While the number of participants in the market is unlikely to return to just a ‘big six’, there are suggestions that the 40-plus still standing as autumn approaches could be halved by the end of the year.

Regulation designed to open up the marketplace seems at the moment to be having the opposite effect.

Though the UK is far from the only country wrestling with price rises, it is facing a particularly tricky time. Over the past two decades, I’ve spoken to numerous ministers and their shadow counterparts about the UK’s energy strategy, and all have stressed the importance of diversity, security of supply and a steady transition to cleaner and greener sources of power.

Companies making gains

Source: Sharepad 27 September 2021

“Whilst it’s often easy to spot potential winners, it’s not always as straightforward to fathom where the biggest losers will emerge.”

Looking at a stunning surge in its share price over the past month, advisers can see many investors consider that Drax’s (DRX) proposition delivers all three. Whatever your take on biomass, which has proved controversial, there’s no getting away from the fact that electricity produced by Drax isn’t affected by the vagaries of British weather and that the ability to fire up at the flick of a switch will undoubtedly be prized.

There’s also the little issue of CO2; very few people really knew how important a couple of fertilizer plants operated by, until now, obscure US firm CF Industries were to the UK economy before the last few weeks. Drax’s carbon capture and storage plans could add to UK supply before the end of the decade.

And that’s the biggest lesson advisers and investors should learn from the current energy crisis: whilst it’s often easy to spot potential winners, it’s not always as straightforward to fathom where the biggest losers will emerge and it’s also easy to forget the contribution fossil fuels make to our critical infrastructure in unexpected ways.

I doubt many people saw rising gas prices and feared for our Christmas turkey. Yet the Government’s deal with CF Industries is on the clock and there is no guarantee what will happen once the three weeks agreed comes to an end.

There’s little doubt at least a portion of the rising energy costs being incurred by industry will be passed onto the consumer – a consumer already having to pay their own inflated bills.

The only thing that seems certain is that we can’t guess what’s coming next. The last 18 months have shaken and stirred global economies and the road back to normality is beset with potholes.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.