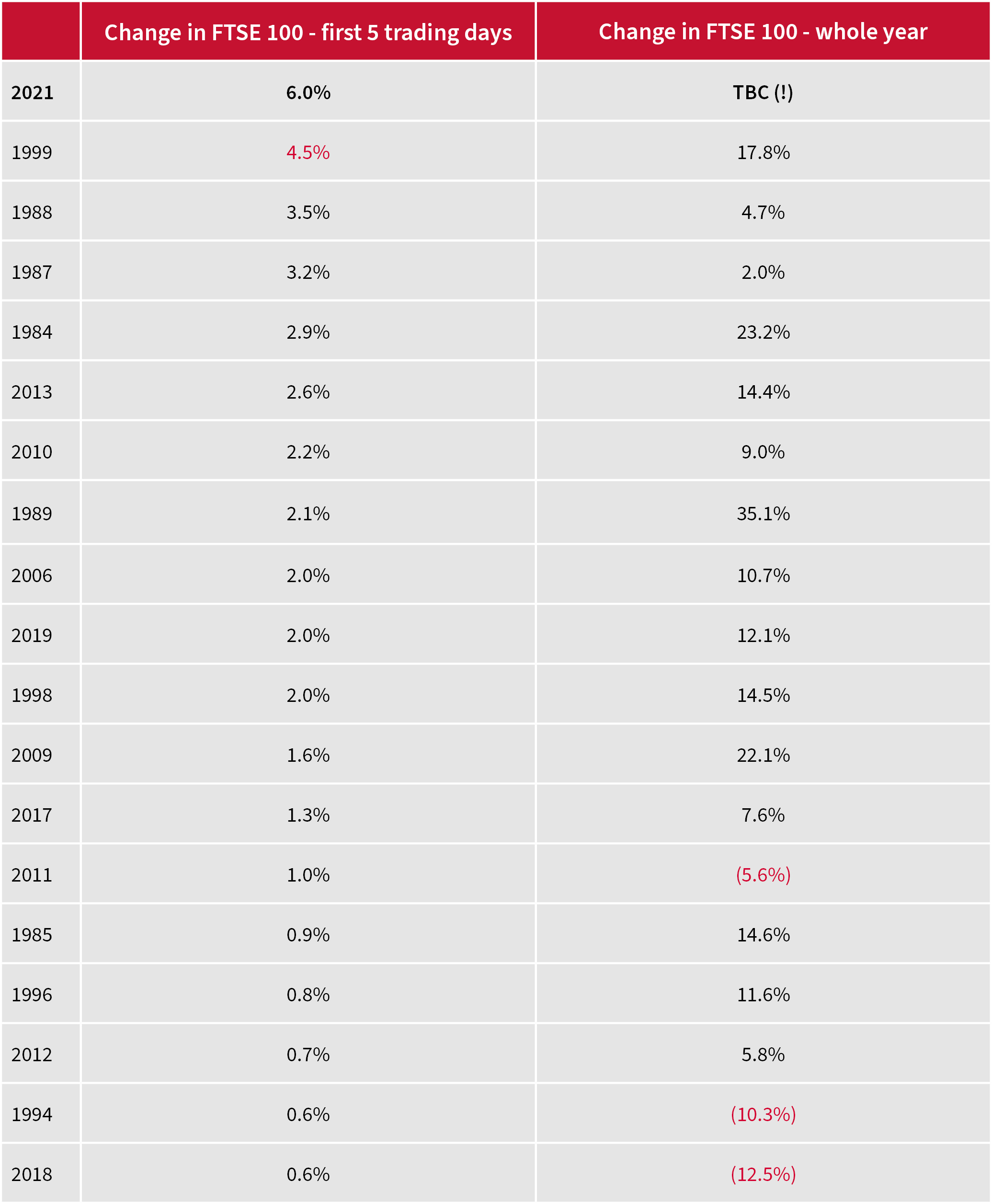

After a rotten showing in 2020, when the FTSE 100 ranked plumb last among major national indices on a local currency, total-return basis, the UK equity market is off to a flyer in 2021. Whether this is a simple case of every dog having its day or the start of a more fundamental turnaround will only become clear with the passage of time, but what is undeniable is that the FTSE 100 has just had its best start to a year in its history, using the capital return over the first five calendar days’ trading as a benchmark.

FTSE 100’s fast start looks promising for the rest of 2021, if history is any guide

Source: Refinitiv data

“It is eye-catching to see how the FTSE 100 has generated positive capital returns on every occasion bar one when it has begun the year with an opening-week gain of 1% or more.”

The past is no guarantee for the future, as all advisers and clients know (and the numbers show that a bad start does not guarantee a bad overall outcome). Even so, it is eye-catching to see how the FTSE 100 has generated positive capital returns on every occasion bar one when it has begun the year with an opening-week gain of 1% or more. That exception was 1987 and even that year looked like plain sailing until October, although a nasty reckoning then followed with the Crash.

That episode shows that trouble can come when it is least expected and, as part of any risk-management review, advisers and clients will look at what can go wrong. There is a saying that “bull markets end when the money runs out” and, at the moment, there seems to be no shortage of cheap cash upon which financial markets can feast, as central banks continue to run ultra-loose monetary policy and governments around the world continue to provide fiscal support to their economies, racking up huge budget deficits in the process.

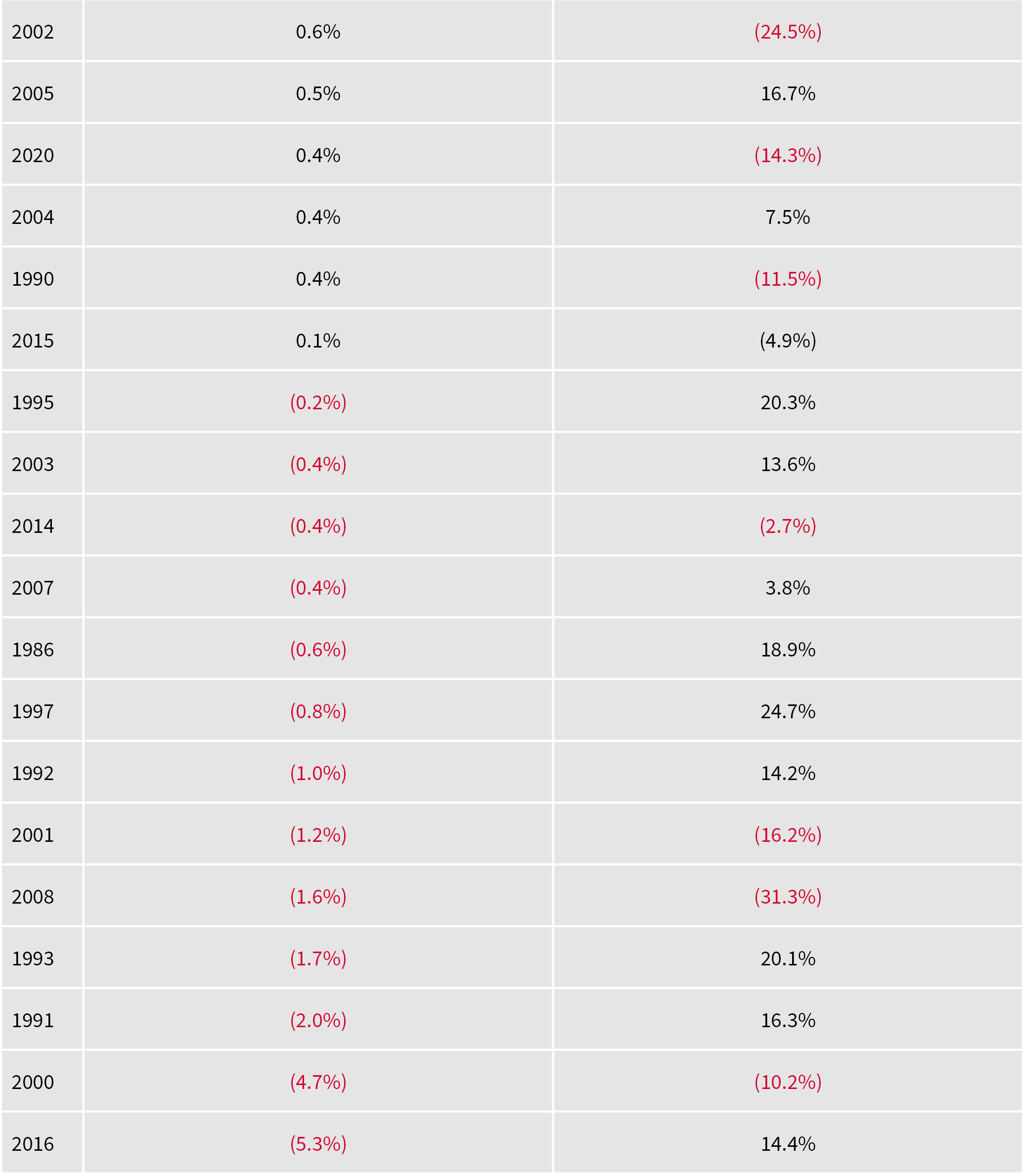

“Spotting misallocation of capital is important when it comes to market tops. In 1999–2000 and 2006–7, overpriced merger and acquisition deals had a role to play. So did a very active market for Initial Public Offerings (IPOs) and secondary sales of stock by either vendors or companies themselves.”

So perhaps advisers and clients need to start wondering where all of this money could go, or what could soak it up, to end the bull run. Spotting misallocation of capital is also key. In 1999–2000 and 2006–7, overpriced merger and acquisition deals had a role to play. So did a very active market for Initial Public Offerings (IPOs) and secondary sales of stock by either vendors or companies themselves. Many of those IPOs were in what turned out to be overpriced tech, media and telecoms stocks in 1999–2000, while miners and junior oil explorers, property stocks and financial investment vehicles took centre stage in 2006–7 (and more of the last-named in a moment), to eventual great cost to buyers of this new paper.

Some advisers’ and clients’ interest may therefore be piqued by the announcement of planned stock flotations by Moonpig, Foresight Group and Dr Martens at the start of 2021, even if the specifics of the individual companies will be left to their preferred UK equity managers to assess.

In some ways, these new flotations could be a good sign.

They suggest that capital markets are working well and doing what they are supposed to do, which is provide capital that companies can use to invest and hire, create wealth and ultimately help the economy to grow.

Fund managers may also see them as a chance to buy into new, exciting stories that generate capital gains or welcome income over the long term for their clients, or at least offer the potential for a quick turn if a deal looks like it is going to be hot and the shares are going to spike.

However, a sudden flood of new market entrants might also be warning sign, on the grounds that you can have too much of a good thing.

“Not surprisingly given the circumstances, and especially last spring’s stock market rout, newcomers to the London market were relatively few and far between in 2020, although the pace did pick up in the second half and some deals, such as THG, proved to be absolute winners.”

Not surprisingly given the circumstances, and especially last spring’s stock market rout, newcomers to the London market were relatively few and far between in 2020, although the pace did pick up in the second half and some deals, such as THG, proved to be absolute winners.

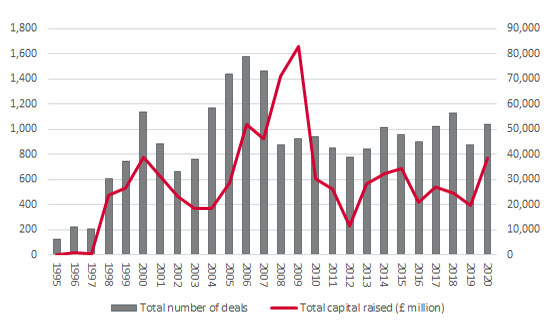

Overall, the number of new issues and IPOs in London last year was the second-lowest since 2009 and the end of the Great Financial Crisis, according to data from the London Stock Exchange (only 2019 was lower).

New issue activity has been relatively quiet in the UK for some time

Source: London Stock Exchange

Over £7 billion was raised by primary offerings, the highest figure since 2017, and that exceeded the sums generated by market newbies in 2009, 2012, 2015, 2018 and 2019.

And with only a select number of names announcing plans for an IPO so far in 2021, it is too early to be pressing the panic button about a deluge of new issues swamping investors and snuffing out the UK market’s attempt to forge a sustained bull run.

The £7.3 billion raised in 2020 came nowhere near the £31 billion of 2006 and £27 billion of 2007, right before trouble hit and the bear market began, or the £18.7 billion peak of the prior cycle in 2000.

But advisers and clients need to be on their guard. The US market has shown signs of an overheated new offerings market, especially given the post-listing surges in names such as Airbnb and DoorDash, the coming to market and the lofty valuations at which many new entrants have gone public and the torrent of Special Purpose Acquisition Companies (SPACs) that have listed, in a manner that is eerily reminiscent of 2006–7 on both sides of the Atlantic.

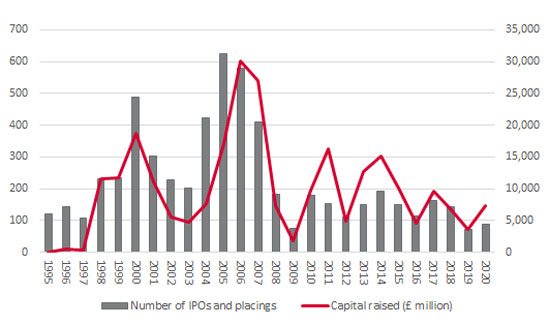

“The US market has shown signs of an overheated new offerings market. The UK is showing no real signs of any of those, which is reassuring, although advisers and clients will also want to keep an eye on secondary offerings too, since they can also soak up cash that could otherwise be deployed elsewhere.”

The UK is showing no real signs of any of those, which is reassuring, although advisers and clients will also want to keep an eye on secondary offerings too, since they can also soak up cash that could otherwise be deployed elsewhere.

Over 950 secondary deals, including rights issues, placings for cash, open offers, subscriptions and further issues took place in 2020, perhaps understandably as many companies tapped their shareholders for fresh liquidity to help see them through the pandemic and the subsequent recession. London-listed and quoted firms raised over £31 billion, the highest figure since 2008–9 when companies were again in cash-raising, crisis-management mode.

Secondary issuance began to pick up in 2020 as many firms scrambled for cash

Source: London Stock Exchange

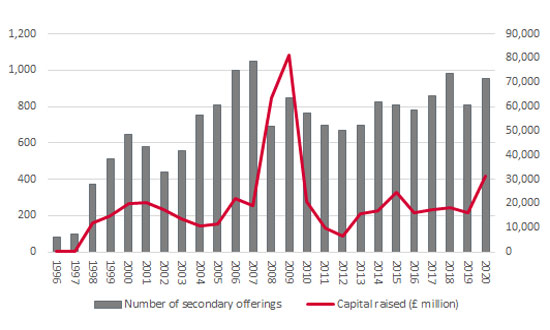

That meant the total cash raised across primary and secondary deals reached nearly £39 billion, again the highest mark since 2009. Couple that with hefty cuts to dividend payments and a collapse in share buyback activity and it is no surprise that the UK stock market’s headline indices struggled to make headway in 2020.

Total UK equity issuance picked up in 2020 just as dividends and buyback activity fell

Source: London Stock Exchange

Dividend payments are expected to rebound this year and buyback activity could conceivably start to pick up, too, should the global economy really begin to gain traction in the wake of vaccination programmes.

This remains far from certain, however, and advisers and clients do need to be on their guard in case the steady flow of new deals becomes a flood, especially if deal quality starts to flag and certain hot or popular sectors witness very high levels of activity. This is not a problem in the UK, as Foresight Group, Dr Martens and Moonpig all come from different sectors and industries, but advisers and clients might like to make sure that their chosen fund managers bear in mind Warren Buffett’s warning, should copycat deals start to proliferate:

“First come the innovators, who see opportunities that others don’t. Then come the imitators who copy what the innovators have done. And then come the idiots, whose avarice undoes the very innovations they are trying to use to get rich.”

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.