The plunge into bankruptcy of the Softbank-backed, self-styled ‘construction industry disruptor’ Katerra spares specialist US equity fund managers the decision over whether to buy into what would have doubtless been an eventual Initial Public Offering (IPO). Katerra had been given ‘unicorn’ status – a valuation in excess of $1 billion – before it ran out of cash, so fund managers may have ducked one there, although another Softbank firm, WeWork, is still seeking a US listing, albeit via a deal with a Special Purpose Acquisition Company (SPAC), rather than the more traditional flotation route.

“As John Brooks wrote in his book The Go-Go Years: The Drama and Crashing Finale of Wall Street’s Bullish 60s, “If one fact is glaringly obvious in stock market history, it is that a new issues craze is the last stage of a dangerous boom.””

This may seem like an esoteric point, but it really matters. As John Brooks wrote in his book The Go-Go Years: The Drama and Crashing Finale of Wall Street’s Bullish 60s, “If one fact is glaringly obvious in stock market history, it is that a new issues craze is the last stage of a dangerous boom.”

This is because sellers see their chance to cash out at fat prices as buyers are lured in by rising markets and prevailing bullish sentiment. The way in which multi-billion-dollar valuations at both WeWork and Katerra just melted away is perhaps confirmation of that warning and advisers and clients with exposure to UK equities might like to therefore keep a close eye on trends in the new listings market in London.

The bad press surrounding the initial poor performance of both the Deliveroo and Alphawave IP flotations may suggest that the London market is far from overheating when it comes to new issues and that, as a result, such concerns may not be warranted.

“The 43 IPOs to have taken place on the London Stock Exchange so far in 2021 appear to have struck a good balance. The average gain provided to those who were able to buy at the listing price is 24%.”

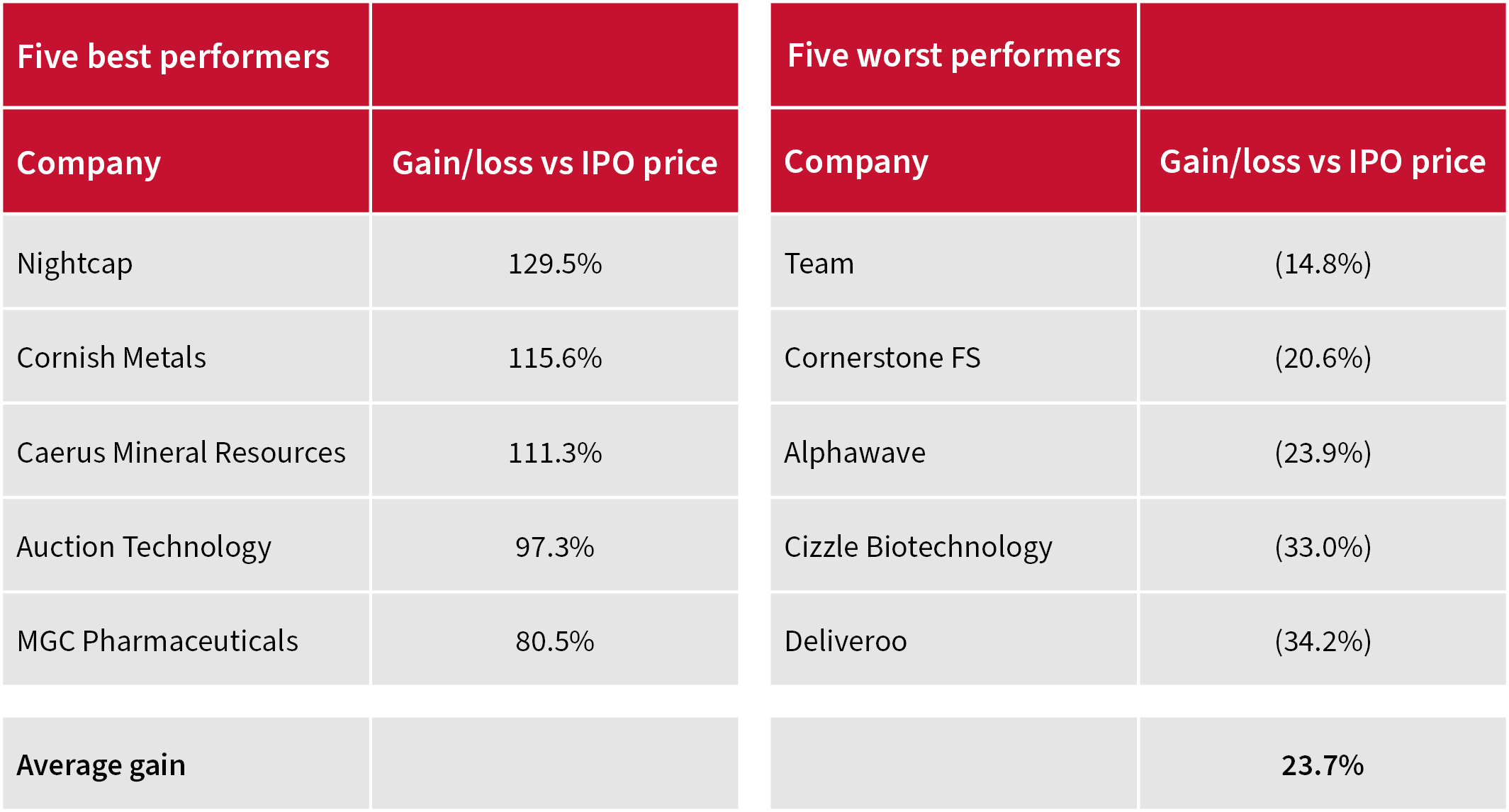

If anything, the 43 IPOs to have taken place on the London Stock Exchange so far in 2021 appear to have struck a good balance. The average gain provided to those who were able to buy at the listing price is 24%.

Five best and worst performing IPOs in London to date in 2021

Source: London Stock Exchange, Refinitiv data.

“Nor does the amount of capital raised seem excessive, at £3.3 billion, according to data from the London Stock Exchange. This is the highest figure since 2015 but it pales compared to the first five months of 2006 and 2007 and also clearly lags the first five-month tally for 2000 and 2001, when tech, media and telecom (TMT) companies rushed to list and sell stock to the unwary enthusiast.”

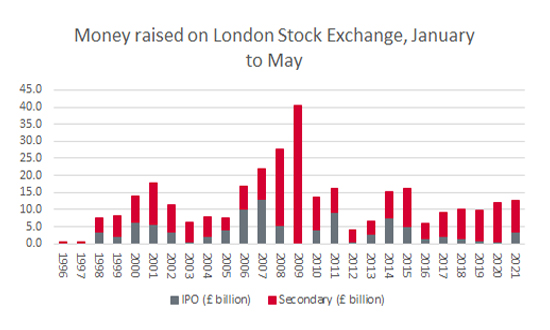

Nor does the amount of capital raised seem excessive, at £3.3 billion, according to data from the London Stock Exchange. This is the highest figure since 2015 but it pales compared to the £10 billion and £13 billion raised in the first five months of 2006 and 2007 respectively, after which trouble arrived in no uncertain terms, to again back up Brooks’s analysis of how the US equity boom of the 1960s came unstuck in the early 1970s.

The first five-month tally for 2021 also lags the boom of 2000 and 2001, when tech, media and telecom (TMT) companies rushed to list and sell stock to the unwary enthusiast.

Better still, the flow of secondary deals so far seems digestible, as companies whose shares are already listed have raised £9.5 billion in the year to date. It may be the highest figure since 2015 but again it lags the peaks of 2008–09 and 2000–02.

Primary and secondary offering activity in London in 2021 is way below prior peaks

Source: London Stock Exchange

Even though share prices and valuations were collapsing, backers of TMT firms were still willing sellers on the latter occasion because they knew the game was up. Perhaps therefore the real warning sign is not so much a rush of (potentially) dud IPOs but a string of secondary offerings that come regardless of how well – or badly – the IPO went.

Fund managers with exposure to Deliveroo and Alphawave IP will no doubt be taking particular note in this case, although this column is intrigued by commodities broker Marex Spectron’s decision to list on the London Stock Exchange.

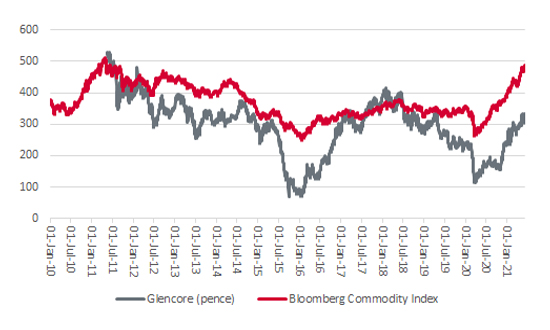

Again, the stock-specific niceties may be of little direct interest to advisers and clients. But the proposed flotation could be a good test of the current surge in commodity prices. If anyone should know a good time to buy – or sell – it is surely a broker who is an expert in their field, so Marex’s move to give existing investors a chance to liquidate some of their investment now is intriguing, given that the Bloomberg Commodity index is trading very close to its all-time highs of 2008 and 2011.

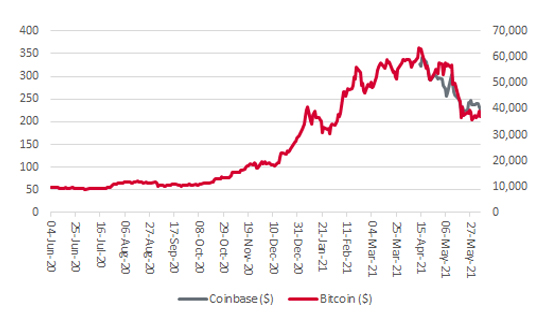

Advisers and clients, as well as their appointed fund managers – putative would-be buyers of the stock – could be forgiven for asking themselves whether the sellers may know anything they do not. After all, cryptocurrency exchange Coinbase appears to have called the top in Bitcoin, at least in the short term.

Has the Coinbase IPO called the top in Bitcoin?

Source: Refinitiv data

Moreover, the last big commodity trader which came to market in London was Glencore. It did so in 2011 – barely a month after the Bloomberg Commodity index peaked that April at 513, a level to which it is yet to return.

Glencore floated at the top of the last commodities boom

Source: Refinitiv data

However, it may not be to be too cynical.

“It may not be to be too cynical, especially as the aggregate amount of money raised by IPOs and secondary placings in 2021 to date is £12.8 billion, far less than the £8 billion in share buybacks and £30 billion of dividends paid out by London-listed firms so far in 2021”.

The aggregate amount of money raised by IPOs and secondary placings in 2021 to date is £12.8 billion. London-listed firms have, so far, handed out over £8 billion via share buybacks and declared some £30 billion in dividend payments. Bull markets tend to wither when the money runs out and it does not look like we are reaching that stage, at least just yet.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.