‘You cannot buck the market’ is taken as axiomatic by many investors and it may be that Saudi Arabia is finding this out the hard way, as it attempts to bend the oil price to its iron will. A fresh production cut from Riyadh, and an extension to the decreases initially agreed in April through 2024, is providing little support to oil prices in the wake of this month’s OPEC+ meeting in Vienna (4 Jun). Nevertheless, from a risk management perspective, it could be unwise to forget about the price of crude altogether, or even assume it will stay stuck in the $70-to-$80-a-barrel range.

“From a risk management perspective, it could be unwise to forget about the price of crude altogether, or even assume it will stay stuck in the $70-to-$80-a-barrel range.”

OPEC+’s influence is not as great as might first appear. Members of the 13-nation OPEC cartel and its ten allies, such as Russia, control less than half of global oil production between them. This may explain why oil traders are hardly running for cover even as Riyadh sanctions a cut in production of one million barrels of oil a day, or 1% of global output, from 1 July and gets OPEC+ to extend the 1.2 million-barrel-a-day cut announced in April into next year. Reports of dissatisfaction among other OPEC members who are itching to increase output, notably Nigeria and Angola, may also be dampening the impact of the Saudi Arabian initiative.

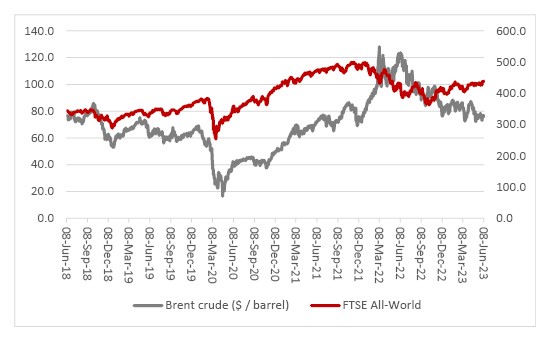

An even bigger issue facing the oil price may be ongoing concerns over the possibility of a global recession, or at least a slowdown. In this context it is intriguing to note that equity markets seem content to price in a so-called ‘soft landing’ or even no recession at all. As such, either share buyers or oil traders are going to be wrong at some stage.

Oil and global equity prices are heading in different directions

Source: Refinitiv data

If it is oil traders who are wrong, then heaven help them for two reasons.

First, oil demand could come in higher than expected.

“Traders have reportedly been building up short positions against crude, so if the price starts to go against them, they may need to buy oil to close out and that could give the commodity’s price a lift.”

Second, traders have reportedly been building up short positions against crude, so if the price starts to go against them, they may need to buy oil to close out and that could give the commodity’s price a lift. Once sentiment is so one-sided, it does not take much to get the price going in the other direction and while it is very hard for investors to gauge – other than by wading through the data provided by America’s Commodity Futures Trading Commission (CFTC) Commitment of Traders’ Reports – the impact of traders’ positioning (and who is net long and net short) should never be underestimated.

The fundamentals for oil may not be as bad as the market seems to think, either. It is rare for oil demand to drop, even during recessions, and whether we like it or not, hydrocarbons are likely to be a major source of energy for the globe for some time to come, as we seek to manage the transition toward a more renewable future and net zero by 2050.

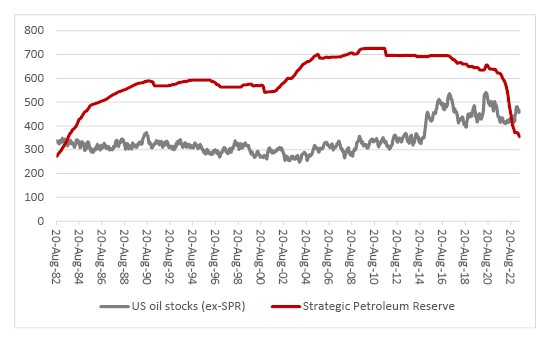

“America has run down its Strategic Petroleum Reserve to just 355 million barrels, the lowest mark since 1983 and way below its 714-million-barrel capacity.”

It may therefore be unwise to underestimate demand, especially as America has run down its Strategic Petroleum Reserve to just 355 million barrels, the lowest mark since 1983 and way below its 714-million-barrel capacity. For reasons of energy independence and national security it seems likely that the USA will have to top up again at some stage.

The US has run down its Strategic Petroleum Reserve to near-40-year lows

Source: US Energy Information Administration

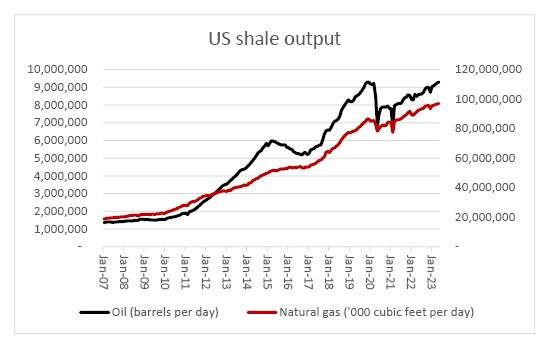

However, growth in shale oil production in the USA appears to be slowing down, especially in the key Permian Basin, according to the Energy Information Administration, data which may inform the International Energy Agency’s forecasts that global hydrocarbon supply may grow more slowly than demand in 2023 (and demand is actually seen hitting a new all-time high).

The boom in US shale output could be slowing

Source: US Energy Information Administration

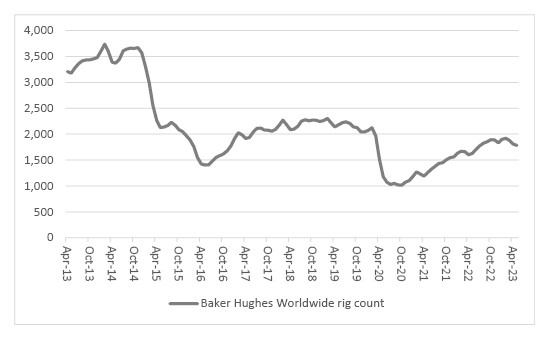

“The number of active rigs on a global basis is already down 8% from February’s high of 1,921.”

Data from Baker Hughes shows that active rig numbers in the USA are down by more than 10% from 2022’s highs, at 696, presumably in response to weaker oil and gas prices. The number of active rigs on a global basis is already down 8% from February’s high of 1,921. If demand does keep rising, there is a risk that there will not be enough supply available.

Active rig numbers are dwindling as oil and gas prices sag

Source: Baker Hughes

The result of that could in turn be sharp oil price increases, the last thing that traders currently seem to expect, although any such price spike could lead to the demand destruction (and decisive action to secure new energy sources) that environmental campaigners crave, even if the price could be inflation. That is something that neither central banks nor consumers nor equity investors will necessarily want to see, but while policymakers can sanction money printing, they cannot conjure up oil when it is needed, so their influence on crude is certainly less than that of OPEC+.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.