No sooner had this column raised the question as to whether its status as the single-best performer within the FTSE 350 over the last five years meant that the good news was all in the price for the Industrial Metals and Mining sector (see last week) than the grouping promptly fell out of bed. Sharp share price falls last week reflected easing investor concerns over inflation, as central bankers trotted out soothing commentary, and a pull-back in iron ore prices as China reportedly sought to cool a red-hot market. Such is the curse of the commentator.

It still remains to be seen whether galloping factory gate price inflation – where the latest readings from China and the USA are 6.8% and 6.2% respectively – translates into a sustained increase in consumer prices, and that one forces central banks to ease off on quantitative easing (QE) or even raise interest rates.

But markets remain sceptical that the current burst higher in raw material prices will last. Analysts’ forecasts for miners’ earnings are one indicator of this, as estimates imply a drop in the big diggers’ earnings in 2022 and 2023, as discussed here last week.

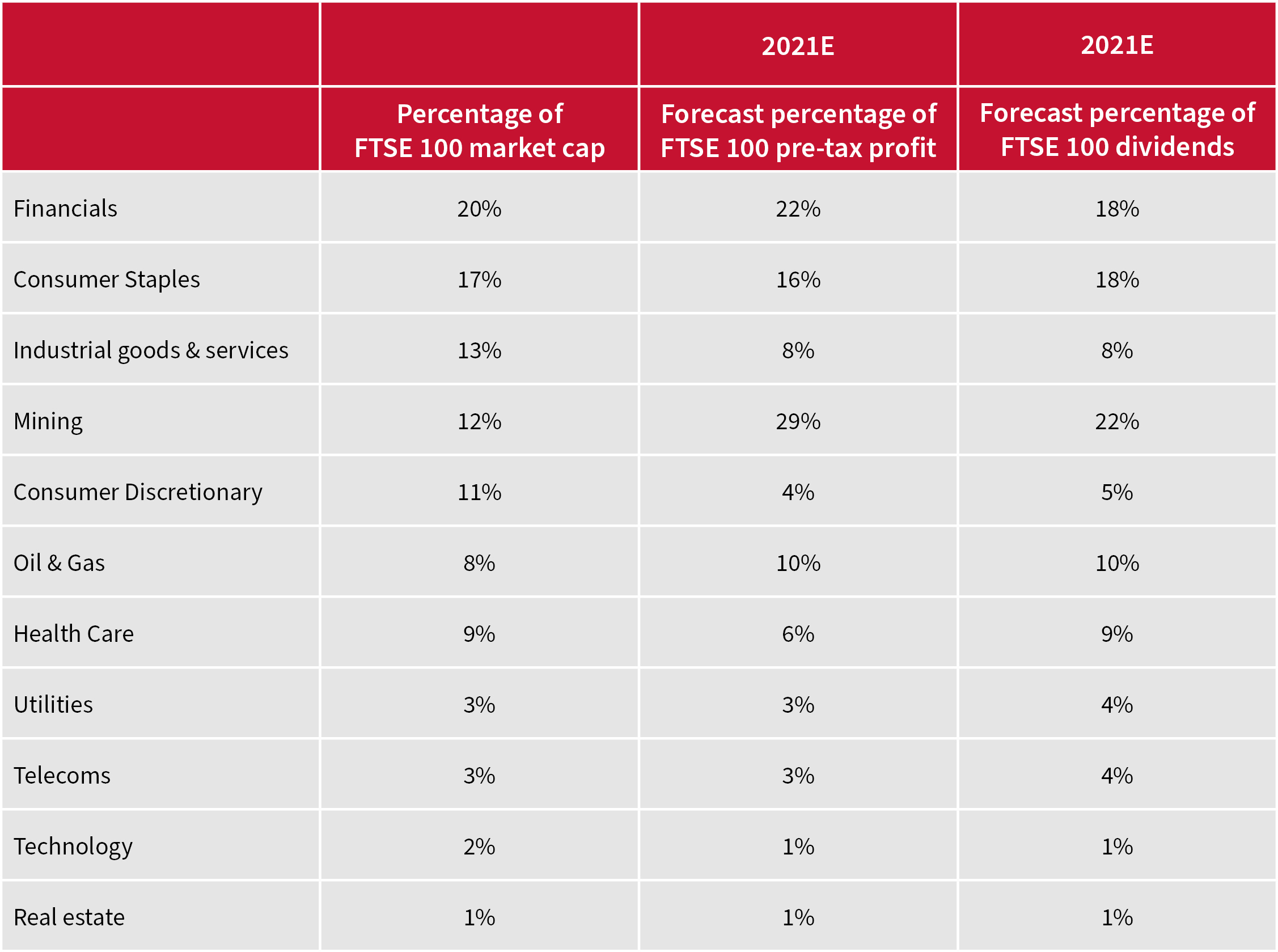

“Miners are expected to generate 29% of the FTSE 100’s pre-tax profit and 22% of its dividends in 2021, but the big seven stocks represent just 12% of its current market cap.”

This can be seen in another way. Miners are expected to generate 29% of the FTSE 100’s pre-tax profit and 22% of its dividends in 2021, but the big seven stocks represent just 12% of its current market cap.

Miners’ aggregate market cap implies analysts feel 2021’s forecast profits are not sustainable

Source: Refinitiv data, MarketScreener, consensus analysts’ forecasts

That again implies that analysts do not believe 2021’s raw materials price boom and miners’ profit surge is sustainable. That has potential implications for investors who like to pick individual stocks or those who prefer to glean their access to the UK equity market via funds, whether they are actively managed or passively run.

Further advances in commodity prices could mean the FTSE 100, and instruments that seek to track its performance, offer further upside potential. The same could be said of dedicated mining funds or UK equity collectives with overweight positions in mining stocks.

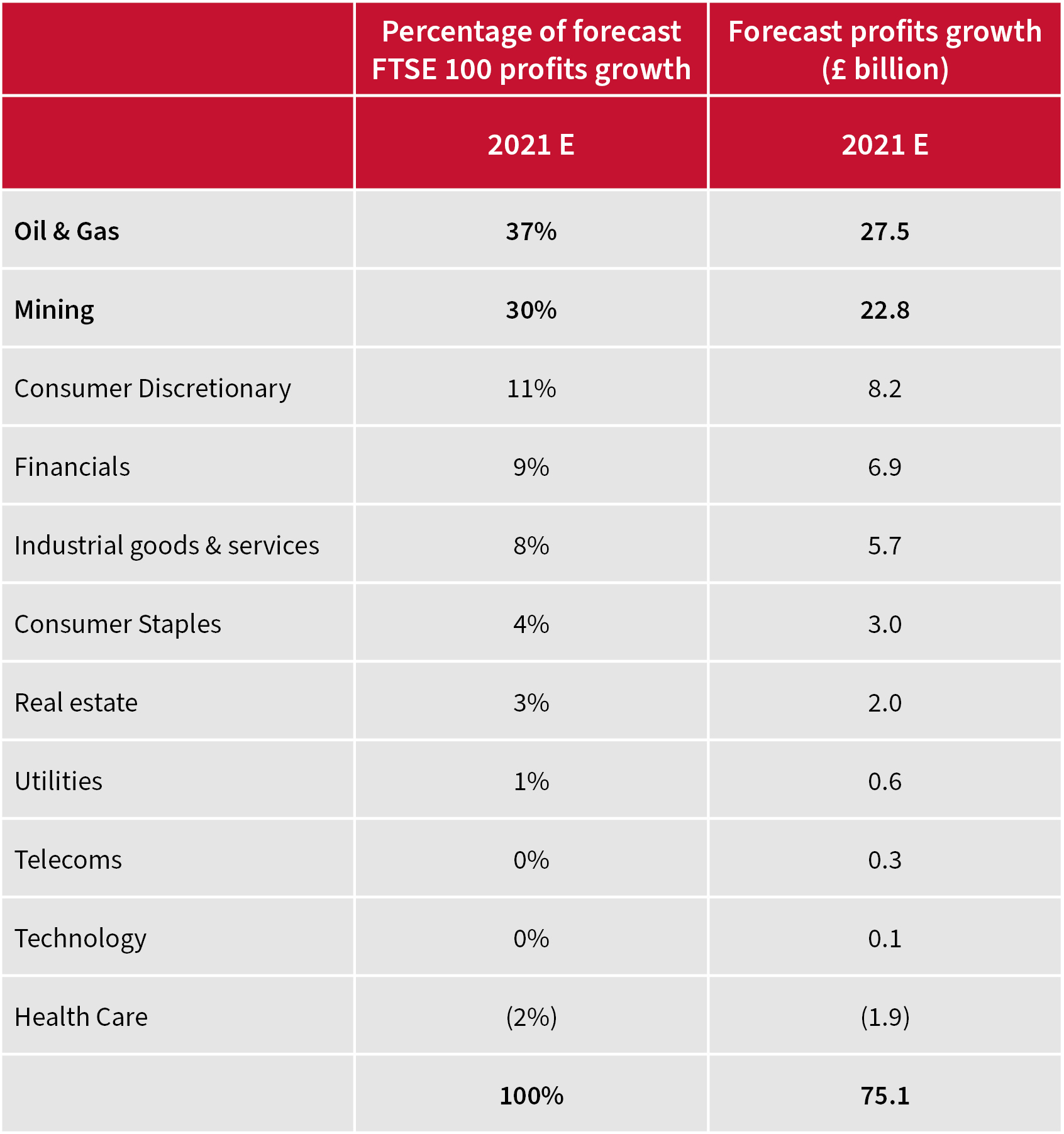

But the FTSE 100 does not offer just exposure to precious and industrial metals, when it comes to the commodities complex. It is also home to two of the world’s oil majors, BP and Shell. The price of crude is more than double the level of a year ago and earnings are expected to rocket here as a result.

Oils are expected to be the FTSE 100’s biggest profit growth generator in 2021

Source: Company accounts, MarketScreener, consensus analysts’ forecasts

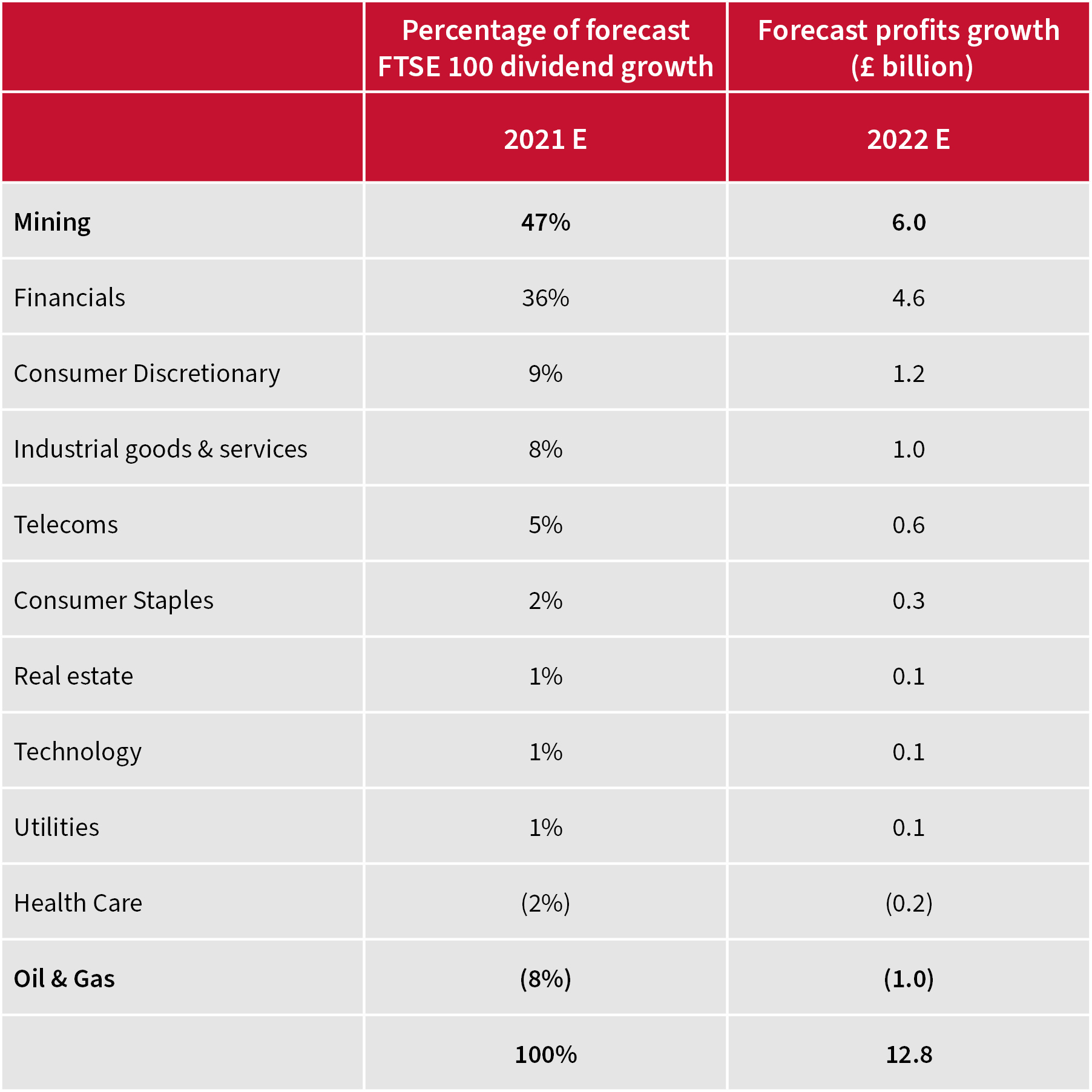

However, unlike the miners, the oils are not expected to provide much by way of dividend growth in the wake of last year’s cuts from both BP and Shell. Scepticism about the future of oil prices is also reflected in how the oil’s percentage contribution to the FTSE 100’s market cap (8%) reflects their forecast contribution to profits and dividends this year (10%).

Oils not expected to generate higher dividends in 2021

Source: Company accounts, MarketScreener, consensus analysts’ forecasts

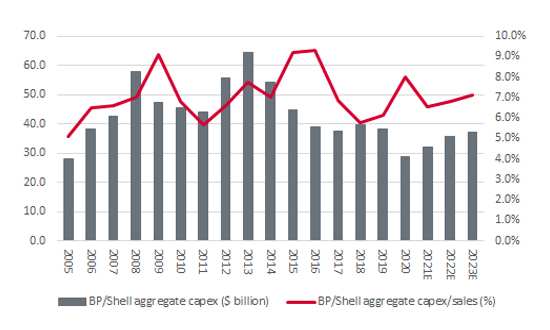

“In some ways, the investment case for oils is similar to that of the miners: demand has collapsed but could rebound if the economy picks up strongly in the wake of the pandemic while supply growth is limited.”

Yet, in some ways, the investment case for oils is similar to that of the miners: demand has collapsed but could rebound if the economy picks up strongly in the wake of the pandemic while supply growth is limited. BP’s and Shell’s forecast combined capex-to-sale ratio of 6.6% in 2021 is a lot nearer to its recent lows than its highs.

Big oil firms’ capital spending is still relatively restrained

Source: Company accounts, MarketScreener, consensus analysts’ forecasts

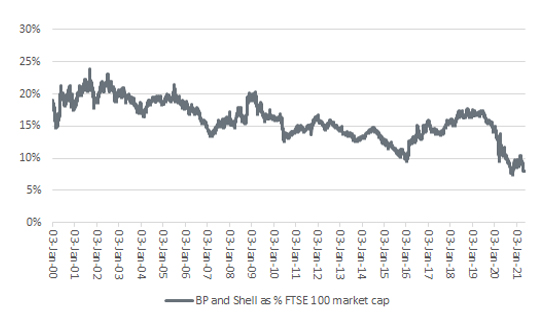

Better still, unlike the miners – whose shares have done well – the oils are loathed. BP’s and Shell’s market cap contribution to the FTSE 100 stands near its lows for this century.

“BP’s and Shell’s market cap contribution to the FTSE 100 stands near its lows for this century, which may reflect ethical and environmental concerns as much as it does financial and operational ones.”

Big oil is still out in the cold with investors

Source: Company accounts, MarketScreener, consensus analysts’ forecasts

This may reflect ethical and environmental concerns as much as it does financial and operational ones, as well as the prospect that the world is trying to move away from hydrocarbons as fast as it can. But the globe relies on oil not just for fuel but for vital lubricants, plastics and chemicals, which could be around for a good while yet, whether we like it or not. And it will take time before renewables provide more power than oil and gas.

Perhaps Big Oil could be more capable of providing an upside surprise in the event of an inflationary recovery than the miners, to the benefit of UK equities – although we cannot discount the possibility that BP’s and Shell’s hefty investments to pivot away from oil and gas help them politically and benefit wider society without bringing them much by way of financial benefit, owing to the (rising) costs involved.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.