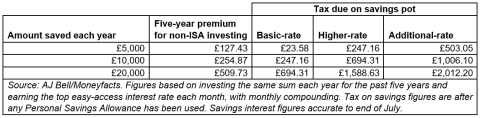

The number of people using an ISA dropped dramatically after the Personal Savings Allowance launched in 2016, as it meant the majority of people wouldn’t pay tax on their savings. On top of that, savers chased the higher returns on offer from non-ISA accounts. That logic worked fine while interest rates were low, but now a combination of higher interest rates and more people being pushed into the next tax bracket thanks to frozen allowances means vastly more people are paying tax on their savings.

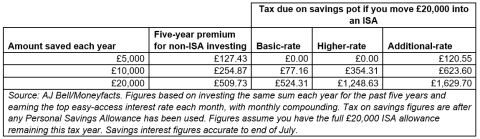

Those with considerable cash stashes can’t just shovel it into an ISA, as the £20,000 annual limit means it will take multiple years to move their entire cash savings into the tax-free accounts. In the meantime they will be handed tax bills for the interest on their savings. These figures lay bare just how short-termist the move to shun ISAs was. The additional interest generated over the past five years has been wiped out in a single year for most people by the higher tax bills they are now facing.

The mantra until now has been that you only need to use an ISA if you’ll pay tax on your savings, but that’s not the case. You should consider both your current situation and your future one: you need to think about whether you are ever likely to pay tax on your savings. For those with smaller savings pots it’s less of an issue, partly because you’re less likely to breach your Personal Savings Allowance and partly because you can move all your savings into an ISA in one tax year.

But anyone building up wealth over time runs the risk of paying tax on their savings and not being able to quickly move it all into an ISA. Even for moderately wealthy people who have decent savings pots, or who are likely to be pushed into the next income tax bracket and lose some or all of their personal savings allowance, an ISA today will keep the taxman away tomorrow.

Fortunately for savers the difference between the top cash ISA rate and the top non-ISA account isn’t vast. Currently, according to Moneyfacts, the top ISA easy-access account pays 4.43% compared to the top non-ISA equivalent of 4.81%. On £10,000 of savings that only equates to an extra £38 a year.

This is a cautionary tale that ISAs aren’t just for times of high interest rates or when you’ve hit the tax-free Personal Savings Allowance limit, it’s a good idea to consider them far before you’re hit with a tax on your savings to ensure you protect your money from the taxman’s clutches in the future.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.