Yesterday’s Budget was short on surprises, with most of the key announcement already having been briefed to the national media in advance.

Key changes announced today include the proposed introduction of a British ISA, a further cut to National Insurance rates for both employed and self-employed workers, relaxation of the ‘high income’ child benefit tax charge, and a proposed summer date for the Government’s forthcoming NatWest share offer to retail investors.

The Chancellor announced plans to launch a new UK ISA (although he referred to it as a ‘British ISA’ during his speech in parliament), with an annual subscription allowance of £5,000.

This will be in addition to the existing £20,000 ISA allowance, with all investments restricted to UK assets.

A consultation on the plans will run until 6 June 2024, with the Government proposing that the UK ISA would be restricted to UK shares, gilts and UK corporate bonds. The consultation also suggests preventing holders keeping cash in the accounts, effectively forcing them to invest the money in UK assets.

There is still much to be confirmed and the proposals could yet change considerably, especially given that any future UK ISA product is likely to be introduced after the next General Election.

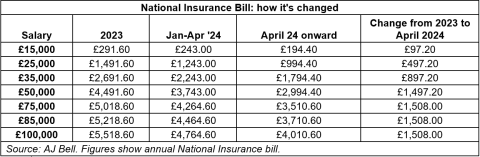

The Government has announced a further cut of 2 percentage points to National Insurance, following the cut previously announced at the Autumn Statement and which applied to employed workers’ payslips from January this year.

In aggregate, it means a cut of 4 percentage points to the entry rate of National Insurance since December 2023, with better paid workers seeing a £1,508 boost as a result of the cuts.

It is worth bearing in mind that income tax thresholds have been put into deep freeze, creating a so-called ‘fiscal drag’ effect that has pulled many people into a higher rate of income tax.

For many taxpayers, these changes will only go part way to making up for the additional tax they’re paying as a result of the freeze on income tax thresholds and the personal allowance.

Self-employed NI will also be cut further. Around two million self-employed people will see a boost to their earnings from next month, as their National Insurance bill drops significantly. The previously-announced changes from the Autumn Statement were due to come in from April but have now been superseded by a further significant cut to rates. It means that the National Insurance rate for Class 4 contributions paid by the self-employed has been cut from 9% to 6%, at the same time as the Government has scrapped Class 2 contributions.

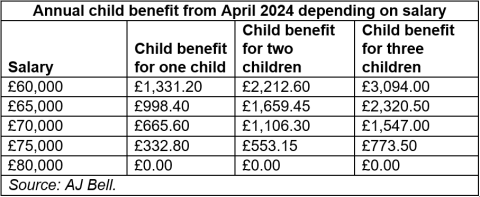

Under the current system, child benefit is gradually withdrawn for those earning more than £50,000 a year. It means households with one earner bringing home £60,000 a year currently get nothing (they can still claim child benefit, but repay it through the high income tax charge).

Under the Government’s proposed reforms, the point at which child benefit begins to be withdrawn will increase to £60,000.

Those earning between £60,000-£80,000 a year will see their child benefit gradually withdrawn. So this is good news for those households with earnings of between £50,000-£80,000 who would previously have had to repay any child benefit claimed, but will now be eligible for at least some of it.

Looking further ahead, the Government says it wants to reform the system so that eligibility is based on a couple’s combined earnings. Currently, a sole earner on £60,000 gets no child benefit while two earners each on £49,000 will get the full benefit. The reforms could change that, although they aren’t pencilled in until April 2026. Much could change before then.

The Government has previously pledged to launch a retail share offer for NatWest, giving ordinary investors a chance to buy a chunk of the bank, which remains partially under state ownership.

The Chancellor signalled this could happen in the summer ‘at the earliest’, declining to set a clear timetable for the sale.

There is a fine line to tread here, since the Government needs to balance getting a good deal for the taxpayer, while also offering an enticing opportunity for investors without suppressing the value of shares already in circulation.

Disclaimer: Remember that the value of investments can change, and you could lose money as well as make it. How you're taxed will depend on your circumstances, and tax rules can change. ISA and tax rules apply.

These articles are for information purposes only and are not a personal recommendation or advice.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.