Laith Khalaf, head of investment analysis at AJ Bell, looks at the economic backdrop before the Budget:

This Budget could well be the last chance saloon for Jeremy Hunt. It’s certainly one of the key platforms for the Conservatives to lay out their economic pitch before the general election, so we can expect it to be a highly politicised Budget. Jeremy Hunt may want to make use of the Parliamentary tradition that allows chancellors to have a stiff drink while delivering the Budget, given the high stakes involved, and the fact the UK has slipped into recession. We know the government would dearly love to splash the cash on popular giveaways and create some clear blue water between themselves and Labour on fiscal policy in the bargain. Cuts to National Insurance or income tax would seem most likely, though inheritance tax reform is in with a shout too given its politically divisive nature. Of course, with tax thresholds frozen, any sweeteners announced in the Budget are really sleight of hand. The chancellor will be robbing Peter to pay Peter, taking with one hand and giving with the other.

So much depends on the forecasts from the OBR which dictate how much money the chancellor has to play with. There are a number of conflicting factors at play in the fiscal picture at the moment. The key tailwind blowing in favour of the chancellor is lower interest rates. At the Autumn Statement, the 10 year gilt yield stood at 4.5%, and that is now down to just a fraction over 4%. Bank rate was forecast to peak at 5.4% and to fall to just under 5% by the end of 2024; now the market expects the central bank to cut interest rates to 4.5% over the course of this year. These might sound like small percentages, but the stock of government debt they apply to is so immense that little adjustments can create billions of pounds worth of cash for the chancellor, seemingly out of thin air. Inflation has also fallen further than the OBR expected, reducing the cost of index-linked gilts, which make up around a quarter of the total government debt pile. The positive effect of lower interest rates and inflation on the Exchequer’s debt interest costs should not be underestimated.

On the flipside, recession threatens the chancellor’s piggy bank. In many ways the weak economy in 2023 is a case of sunk costs, especially seeing as tax receipts are largely in the bag, with the notable exception of self-assessment payments. More worrying for the chancellor though will be the effect the recessionary reading has on OBR economic forecasts for the future. Small pen strokes in the wrong direction can spell an unwelcome black hole. The good news is unemployment sits at a low level of just 3.8%, pretty much where it stood at the beginning of 2023, and there are still over 900,000 job vacancies out there. Wages rose strongly over the course of 2023, which is good for tax receipts, though there was a notable slowdown in the growth rate towards the end of the year.

The chancellor won’t have an extra year to balance the books either, as he did in November as a result of the rolling nature of the fiscal targets. This little wheeze yielded up £4.9 billion for Jeremy Hunt in November, paying for half his flagship cut to National Insurance. The fiscal calendar won’t flip over until we pass the end of this tax year in April, so it might be Chancellor Reeves who reaps the benefits should Labour win the general election. Alternatively the current government might decide to steal her thunder by popping in an unscheduled fiscal event between now and then, to use up whatever spare cash fortune might have delivered. Stranger things have happened.

Jeremy Hunt set out very modest reforms to ISAs in his Autumn Statement, none of which amount to the radical simplification savers and investors are crying out for. The Budget could be his final opportunity as chancellor to strip unnecessary complexity out of the ISA rules and demonstrate he is on the side of Brits who do the right thing and save for their financial future.

Given the proximity of the general election, fundamental simplification may be off the table for now. Nonetheless, kicking off a full consultation on ISA simplification could pave the way for a much simpler savings and investing landscape in the future.

In the meantime, there are also improvements that could be made to the existing ISA regime. Scrapping the Lifetime ISA age restrictions, for instance, would make the product more accessible to self-employed workers, many of whom are not saving anywhere near enough for retirement.

The prospect of a ‘British ISA’ should be treated with caution. There is a danger that adding a new ISA confuses ordinary savers and leaves people unsure which ISA is right for them, leading to inertia.

Given most investors have a natural bias towards UK companies and funds anyway, the most straightforward way to boost retail investment in UK companies would simply be to raise the £20,000 ISA allowance, which has remained unchanged since 2017.

The property limit for the Lifetime ISA has remained stubbornly at £450,000 since its launch in April 2017. If the Lifetime ISA (LISA) limit had increased in line with property prices it would sit at more than £560,000 today.

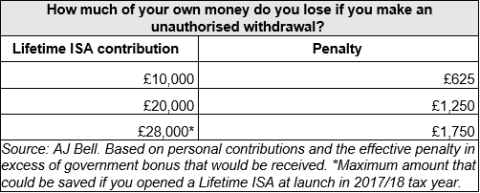

At the other end of the spectrum, it is inevitable some savers will be struggling and will find they need to dip into their LISA sooner than planned.

During the pandemic the government reduced the withdrawal charge on Lifetime ISAs from 25% down to 20%, to allow people to access their savings penalty-free if they found their finances squeezed during the crisis. Disappointingly, this was restored to 25%, rather than changed permanently.

It feels impossible that the government doesn’t view the current cost-of-living crisis in the same way. Reducing the exit fee would be a low-cost move for the government that would help first-time buyers who saved into their Lifetime ISA in good faith but, due to soaring inflation, now need to dip into their savings.

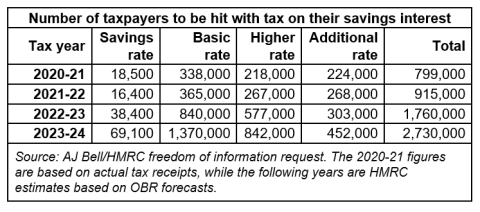

We continue to call on the chancellor to end the freeze on the personal savings allowance, which has remained at the same level since 2016.

The number of people set to pay tax on cash savings interest is estimated to rise by a million this tax year alone (see table), as a consequence of the frozen threshold which has not been adjusted to reflect inflation and rising interest rates. This includes over 1.4 million basic rate taxpayers and low earners, demonstrating that this tax is impacting everyday Brits as well as wealthy individuals with large sums in cash.

Individuals pay tax on interest they earn on cash savings that exceeds the personal savings allowance, which currently stands at £1,000 for basic rate taxpayers and £500 for higher rate taxpayers. Additional rate taxpayers get no exemption and pay tax on all cash interest they receive.

Tax bills are paid either through self-assessment or deducted from income through a tax code adjustment. Many won’t be aware they owe the tax until HMRC sends them a letter to change their tax code to deduct the money from their payslip. It shouldn’t be the case that ordinary savers are caught up in tax complexity for doing the responsible thing and building a savings pot.

Doubling the personal savings allowance would mean that £20,000 held in a 5% savings account would not be taxed for basic and higher rate taxpayers, ending the penalty on those who do the responsible thing by building up a cash savings buffer for a rainy day.

The chancellor looks set to announce tax cuts aimed at making work more rewarding.

The freezing of tax thresholds has had a serious impact on people’s finances, and the OBR recently estimated* that by 2028/29 the freezing of tax thresholds will see around four million extra taxpayers, three million more moved to the higher rate of income tax and another 400,000 paying the additional rate.

Restoring increases to tax thresholds will ensure more people pay the tax rate appropriate to their income, considering recent wage inflation.

Another option would be further cuts to NI, although the Autumn Statement changes announced last year are still not yet fully in place, with rates for the self-employed still to come down. This is a more targeted tax cut since it isn’t paid by those over state pension age, so the tax cut only applies to workers.

*Source: OBR economic and fiscal outlook (November 2023) – https://obr.uk/efo/economic-and-fiscal-outlook-november-2023/

The government long ago pledged two key reforms to auto-enrolment but is yet to set out a timetable for introducing the changes. There is no better opportunity to issue the necessary consultation and start the countdown clock for implementation.

Lowering the minimum age at which someone first qualifies for auto-enrolment from 22 to 18 will capture millions of savers from an earlier age.

Likewise, removing the lower earnings band could significantly boost how much people save for retirement – particularly those who don’t earn much, including part timers and women. Someone earning £15,000 could see their contributions soar from £700 to £1,200 a year – an increase of over 70%.

On the other hand, the government are clearly aware the measures will increase the cost of employer pension contributions paid by UK companies, big and small. There are also some concerns about an increase in contributions leading to a rise in employees choosing to opt out, so it is right to consult on the detail behind these plans.

However, the government now needs to make good on its promises, over six years after agreeing to these changes and five months after the original Act has passed. It now urgently needs to take the next step to helping more people save more money in a pension and consult with the industry and others on how to make that happen.

The Budget will likely come too soon for any significant update on the work being led by the FCA and Treasury, with the ongoing consultation due to close this week.

The chancellor could still use the Budget to signal the government’s continued commitment to this crucial project, which now has some welcome cross-party backing after Labour recently indicated its support for the review.

Ensuring millions of Brits can get the support they need when making often complex financial decisions is critical to boosting people’s financial resilience. Promoting the value of regulated advice and reforming guidance rules so people who don’t take advice can receive more personalised help can both play a significant role in improving consumer outcomes in this area.

The government has already committed to a bumper 8.5% increase to the state pension from April, and the chancellor will surely use his opportunity at the despatch box to remind voters of the coming rise to pension incomes.

With Labour reported to be planning to retain the state pension triple-lock among election pledges in its next manifesto, he may even hint at whether the Conservatives plan to do the same.

The triple-lock is clearly seen as a vote winner, particularly among older sections of the electorate, but at some point the government will need to come clean about the aim of the policy and the future of the UK state pension more broadly. Given how central the state pension is to people’s retirement planning, an independent review of the state pension, covering both the amount people receive and when they receive it, could be necessary to build consensus and deliver the long-term certainty people crave.

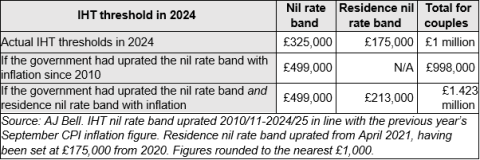

Cutting IHT would clearly be a major headline-grabber. Despite the fact few estates are actually liable to IHT, with less than 4% paying any death duties whatsoever, it is still a deeply unpopular tax.

Jeremy Hunt has reportedly described it as ‘pernicious’ and it would clearly delight backbenchers were he to raise the threshold for IHT, cut the rate of tax from 40%, or even abolish IHT altogether.

One thing to bear in mind is that if Jeremy Hunt were to cut inheritance tax there could be unintended consequences for London’s junior stock market. Many AIM shares are free from IHT if held for two years or more, and a cottage industry exists to provide consumers with professionally managed portfolios specifically designed to mitigate IHT by investing in London’s junior market. DIY investors can also hold AIM shares through a broker to the same effect. Drastically cutting back inheritance tax could undermine the need for this protection and with it demand for AIM shares, though the effect this might have on market pricing is hard to gauge.

One of the most unpleasant quirks of a complicated tax system, the ‘High Income’ tax charge on child benefits means once one partner earns over £50,000, the benefit is gradually eroded, eventually being revoked entirely for those earning more than £60,000.

It doesn’t matter what your household income is, so a family with a single earner paid £60,000 gets nothing, whereas two parents paid £50,000 each can claim the full amount.

That £50,000 earnings threshold has been locked in place, despite rising wages – if it had increased in line with inflation it would be at £65,000 today. As a result the number of families getting child benefit payments has dropped to its lowest level since records began, with the continual freeze on the so-called ‘high income’ threshold hitting more and more parents.

A total of 683,000 families opted out of getting the payments, according to the latest figures, accounting for 1.05 million children. If these families had been eligible they could have claimed £1.15 billion in additional support.

Government could look to change this in an effort to increase its appeal to parents and those hoping to start a family. An extension of the current ‘free’ hours childcare scheme is being rolled out from the Spring and extending eligibility for child benefit could be another measure designed to help families.

If the government wishes to encourage investment in UK listed firms and stop them fleeing to the US, one of the things it could look at is the Stamp Duty charged on share transactions. Each time an investor buys a UK share they pay 0.5% of the value of the transaction in Stamp Duty (or more commonly now for electronic transactions, Stamp Duty Reserve Tax). So the government takes a £50 tithe if you want to buy £10,000 AstraZeneca shares, but not if you want to buy Amazon shares as these are listed outside the UK.

Clearly this creates a further reason for individual investors to favour overseas over domestic investment in addition to vastly superior performance of the US equity market in recent years. It also creates a drag on the performance of UK equity funds which pay the tax on the transactions. Over £40 billion has been withdrawn from these funds by UK investors in the last eight years, and weak relative fund performance is a big swing factor. Stamp Duty on shares brings in around £3 to £4 billion a year for the Exchequer, so it’s not insubstantial, but cutting it could provide a boost for the UK stock market and reduce the cost of capital for UK-listed firms.

Aside from the idea of reforming Stamp Duty on UK shares, which the fiscal position may not permit at the current juncture, there is one egregious anomaly in the system which is overdue correction. Investment trusts currently pay Stamp Duty on UK shares they buy within the fund, and UK investors then also pay Stamp Duty when they buy investment trusts. The result is double taxation for investment trust buyers, which puts them at a disadvantage compared to investors in open-ended UK equity funds doing an identical job just within a different fund structure.

It’s a well-worn phrase for a reason, an Englishman’s home is his castle, and there are plenty of younger voters desperate to pull up the drawbridge on a home of their own. But cutting stamp duty is only one way to stimulate the housing market and as a tool it’s a particularly blunt one that historically has come with the by-product of higher house prices.

Reports that the chancellor is considering pulling 99% mortgages out of his bag of tricks have also been met with concern. Even if people will find it much easier to raise a 1% deposit, they’ll still have to meet monthly mortgage payments which will stretch many incomes to the limit and could result in those people getting trapped in negative equity if house prices fall quickly.

A recent investigation by the Competition and Markets Authority (CMA) has revealed the scale of the issue surrounding housebuilding in the UK particularly when it comes to the kind of affordable homes many people, especially those on lower incomes, want to live in.

This is an issue that needs a long-term solution which is unlikely to be delivered by a government which seems to be heading out the door.

Jeremy Hunt is under increasing pressure to use the budget to stimulate economic growth through targeted business-focused measures rather than headline tax giveaways.

VAT cuts might not be as sexy as a penny off income tax but for sectors like hospitality it could make the difference between keeping the doors open or not. With increases in the national living wage already baked in, many businesses are deeply concerned about rising wage costs at a time people’s decline in disposable income is making them think twice about spending their money on an evening out.

Whilst many people pushed the boat out and enjoyed a meal out over Christmas, January has been dire, and a slew of bars and restaurants have issued profit warnings, with industry bodies warning that without additional support many businesses will become increasingly vulnerable.

After Covid a VAT cut provided a temporary lifeline for many bars, restaurants and tourist attractions, allowing them to slash prices to attract more people through the doors.

Businesses fear that without similar intervention now they will be forced to once again hike their prices, something consumers are likely to balk at as they become increasingly inflation weary.

But price increases have delivered extra income to the Treasury with January’s VAT take up by £0.3 billion compared to the same period the year before, so any cuts would need to be carefully factored into the big picture.

It’s not a VAT cut but a VAT rebate that’s high on the list of London’s luxury retailers’ wish list. The Treasury believes the so-called tourist tax nets around £2.5 billion in revenue, but hundreds of high street names have taken exception to that figure and will be keeping a close eye on the OBR’s own assessment.

They’ve been campaigning hard to get the VAT rebate for tourists reinstated by claiming doing so would create a tourist boom and that the government had overlooked the impact the tax would have on tourists’ spending decisions in areas like hospitality and leisure activities.

But whilst the chancellor has promised to look again at the impact of the ‘tax’, reversing it wouldn’t be something the average household would benefit from, which is likely to push it to the bottom of Mr Hunt’s to-do list.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.