Rising interest rates and frozen tax thresholds will combine to push another million taxpayers into a little-known tax trap this year, new data obtained by investment platform AJ Bell reveals.

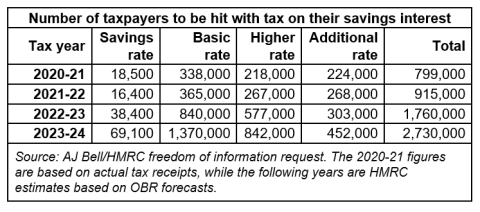

In the 2023-24 tax year it is estimated that over 2.7 million individuals will pay tax on cash interest, up by a million in a single year.

The total includes nearly 1.4 million basic rate taxpayers, a figure which has quadrupled in just four years.

The figures from HMRC reinforce the growing scale of the issue first highlighted by the investment platform business last month.

We previously called for the Chancellor to double the personal savings allowance so that those with rainy day savings aren’t caught out by tax on savings.

Today’s figures re-emphasise the case for increasing the threshold for taxing savings income. We estimate that around 1 in 20 basic rate payers will be paying tax on cash interest, rising to 1 in 6 higher rate payers and around half of additional rate payers. In total, taxpayers are expected to hand £6.6bn to the Treasury this year from tax on the interest they earn.

The business is calling on the Chancellor to end the freeze on the personal savings allowance, which has been set at the same level since 2016. Doubling the personal savings allowance would ensure households aren’t taxed on rainy day cash savings up to £20,000, with the top easy access account now paying 5%. Although, with some savings accounts offering 6%, a basic-rate taxpayer could hit the Personal Savings Allowance with around £16,700 in savings, or £8,400 for a higher rate taxpayer*.

Individuals pay tax on interest they earn on cash savings that exceeds the Personal Savings Allowance, which currently stands at £1,000 for basic rate taxpayers and £500 for higher rate taxpayers. Additional rate taxpayers get no exemption and pay tax on all cash interest they receive.

Tax bills are paid either through self-assessment, or deducted from income through a tax code adjustment. Many won’t be aware that they owe the tax until HMRC sends them a letter to change their tax code changed to deduct the money from their payslip.

That tax hit will compound the fact cash savings are losing value in real terms, with savings interest lagging well behind the rate of inflation.

These figures highlight just how many taxpayers are facing a tax bill for their savings interest this year – a huge leap when compared to last year. The combination of higher interest rates and people having shunned ISA accounts in recent years means that the number paying tax on their savings has more than tripled in the past four years.

Rising rates and a frozen Personal Savings Allowance means some individuals are being taxed despite having relatively modest pots of cash set aside for a rainy day. To add insult to injury, because inflation is so high, they aren’t even making a real return on their money – yet they are still being taxed.

The tax threshold is also contradictory to government policy in other areas. Interest rates have risen, in part to encourage people to save money rather than spend it and reduce demand in the economy to bring down inflation. So it doesn’t make much sense to tax people at the same time. What’s more, households are generally encouraged to keep their finances in a stable position by holding a rainy day fund in case of a financial emergency. This is something the government shouldn’t be punishing with a tax regime that takes money away from people trying to do the right thing.

Until a brown letter lands on their doormat some people won’t even realise they owe tax on cash interest. Those filling out a self-assessment tax return will declare any savings interest, and subsequent tax due. But, for those taxed under PAYE, HMRC will calculate any tax due based on information sent to them by banks and building societies. It means many taxpayers will find there is a deduction made from their payslip each month, often before they’ve even realised they owe any money to the taxman.”

*5% easy access from Tandem. Top fixed rate savings accounts now exceed 6% based on Moneyfacts data

Individuals can protect their savings from the taxman using ISAs and some people affected will likely now choose to move savings into an ISA wrapper. A maximum of £20,000 can be saved in ISAs annually on a ‘use it or lose it’ basis, so those who have built up a larger sum won’t be able to shelter all their savings from tax.

Many people chose not to use ISAs for cash savings in recent years, with low interest rates meaning interest earned fell within their Personal Savings Allowance. In many cases non-ISA accounts also offered better rates, but for some people the benefit of fractionally higher rates outside an ISA will now be wiped-out by tax.

Premium bonds from NS&I offer a secure way to hold cash. Rather than a set interest rate, prizes of £25 to £1 million are paid monthly. The big perk is that any prizes are free of tax. However, the return on Premium Bonds is not guaranteed and you might never win a prize, so anyone choosing this option needs to be prepared to make no return on their money.

For some households it may be advantageous to split cash savings between a couple. If your partner has an unused Personal Savings Allowance cash could be held in their name instead. The same applies if they have an unused ISA allowance. Equally, if one half of the couple is a lower taxpayer, it might make sense for them to have the bulk of the savings so you pay a lower tax rate on the savings interest.

If you’ve just tipped over into the next tax bracket, and seen your Personal Savings Allowance halved or wiped out you can use your pension to bring you back down into the lower income tax bracket. When you contribute to your SIPP, the gross value of the contribution has the effect of extending your basic rate tax band, meaning that you could avoid tipping into the higher-rate band.

While everyone should have a cash savings buffer, history suggests that investing is likely to deliver a better long-term return.

Individuals can invest £20,000 a year in a stocks and shares ISA. They can also put money in a cash ISA in the same tax year, although the combined contributions mustn’t total more than the £20,000 limit.

In addition to stocks and shares ISAs, the annual allowance on pension contributions now stands at £60,000, allowing individuals with retirement in mind to set aside considerable sums and benefit from tax free growth, as well as up-front pension tax relief to boost their contributions.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.