Last year HMRC saw over 800,000 people file their tax return on deadline day, with 36,000 doing so in the hour before midnight.

In light of deadline day, our Pensions and Savings Expert, Charlene Young, provides five crucial tips:

Even if you think you’ll have nothing to pay, you still might need to file a return or you could face penalties starting at a one-off £100 and then £10 per day if your tax return is still outstanding after three months.

You must file a return if you had an income of more than £100,000 for the 2022/23 tax year, or if any of the below applied:

But even if the above don’t apply to you, you might still have to file if you’ve received more than £10,000 from savings and investments in the 2022/23 tax year.

An important step is to get your paperwork in order. There are a few things to check for, including statements of income from saving and investments, as well as gains you’ve made on selling investments outside of an ISA or a pension/SIPP.

Your savings and investment providers would’ve each sent you an annual summary/statement after 5 April detailing what you earned with them for the tax year, as well as details of the gains or losses on any investments you sold in that time.

Remember, cash and returns from investments inside ISAs or SIPPs do not need to be declared because growth and income is tax free.

Interest:

You’ll pay tax on interest earned on your cash savings that exceeds the Personal Savings Allowance, which currently stands at £1,000 for basic rate taxpayers and £500 for higher rate taxpayers. Additional rate taxpayers get no exemption and pay tax on all cash interest they receive.

Successive interest rate rises meant over 1.7 million people were dragged into paying tax on some interest on their cash savings outside of ISAs.

The taxman will check what you’ve declared on your tax return against the information your bank or building society sent them, and any tax already collected by a tax code adjustment that year.

Investment income and gains:

The tax-free allowance for dividends was £2,000 in 2022/23, but it dropped to £1,000 for the 2023/24 tax year. You’ll pay tax on dividends above the allowance at 8.75%, 33.75% and/or 39.35% depending on your other income.

Gains on investments sold:

The tax-free capital gains allowance was £12,300 for 2022/23. CGT will be payable on gains you made when you sold or transferred investments* at a rate of 10% and/or 20%, depending on your other income.

*CGT rate for residential property gains is 18% or 28%

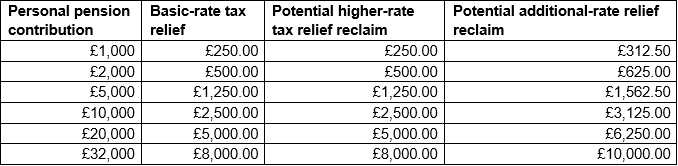

Anyone paying into a SIPP in the 2022/23 tax year would’ve received basic rate relief of 20% automatically. This adds an automatic top up to pension contributions – a £2,000 personal contribution would automatically be boosted by £500 to £2,500 in their pension – but higher rate taxpayers need to claim the extra £500 tax relief they are owed from the Revenue. An additional-rate taxpayer, meanwhile, could claim 25% tax relief from HMRC on top of the 20% relief they receive automatically.

As the size of pension contributions increase, so does the incentive of claiming back any higher rate relief due, as the table below shows.

Source: AJ Bell

Even if you only make a relatively modest pension contribution, you’ll get a cheque worth a few hundred pounds. This can run into the thousands if you make larger pension contributions or you’re able to backdate your claim for previous years.

Many people don’t realise they need to claim for pension tax relief, especially because it is only necessary with some types of pension scheme, but not others. If you are paying into a ‘net pay’ pension scheme, your contributions will be taken from your pre-tax salary, meaning income tax relief is usually paid automatically. As a result, you shouldn’t need to make a claim as you should already have received the tax relief you are due. If you aren’t sure and you pay tax at 40% or 45% it is definitely worth checking if you’re getting the extra tax relief.

Child benefit is withdrawn gradually once you or your partner earn over £50,000. The benefit is completely extinguished once you hit £60,000.

This is a painful part of the tax system for many reasons. Firstly, it introduces an anomaly whereby the effective marginal tax rate for parents in this income band is one of the highest around.

Secondly, many people won’t know what their full year earnings are going to be until they receive an annual bonus, or if they work on commission. That means they may end up claiming the benefit just in case they’re eligible, only to find they have to then pay it back.

Finally, child benefit also gives you a National Insurance tax credit, which can be really important. If one partner isn’t working and the other earns enough that the family can’t keep child benefit, it is still worth claiming. That’s so that the non-working partner gets a credit against their record, which may entitle them to a bigger state pension in the future.

If you need to repay some or all of your child benefit payments and your tax code hasn’t been adjusted already to account for it, you’ll need to repay via self-assessment. Eventually, the taxman will catch up with those who fail to do so, and they may incur an extra penalty as a result.

Even if you’ve already filed, you’ll need to make sure you’ve paid what you owe by midnight on 31 January too.

If you don’t, you’ll start to accrue daily interest from 1 February. The annual interest rate charged by HMRC is 7.75% – the highest level since 2008. Any tax for 2022/23 still left unpaid by March could then face an extra 5% penalty charge on top.

If you’re having difficulty paying, you might be able to agree a payment plan online with HMRC if you owe less than £30,000. Nearly 45,000 taxpayers have done this already according to HMRC figures. You can also apply to reduce your payments on account for the coming year if you think your earnings will be significantly lower than before.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.