Pension sharing orders can help achieve a “clean break” when it comes to dividing the finances of a divorcing couple. But what happens when an ex-spouse or civil partner approaches their own retirement – does a pension credit affect their options in a SIPP? In this article, Charlene Young explores the key points advisers need to know.

When a client receives a pension sharing award from their ex-spouse, the funds are known as a “pension credit”. In England, Wales and Northern Ireland, a pension credit is calculated as a percentage of the ex-spouse or civil partners pension fund(s) and the value transferred to a pension in the client’s own name. In Scotland, the pension credit can also be noted on the sharing order as a monetary amount.

The client will be able to transfer to another scheme of their choice if the credit is from a personal pension or private sector occupational scheme. Where the credit is coming from an unfunded public sector scheme, an internal transfer (also known as shadow membership) will usually be the only option.

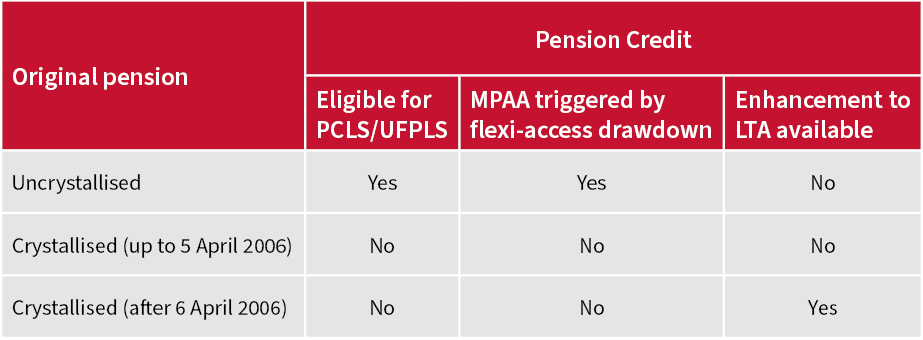

Where the pension credit is transferred to a personal pension or SIPP in the receiving client’s name, the options at retirement depend on whether or not the original member’s pension was in payment (crystallised) or uncrystallised.

Although the pension credit will be held in the client’s own name, whether or not they can receive a tax-free lump sum will depend on whether the original pension was already in payment.

If the pension credit was awarded from uncrystallised funds then it will be a ‘qualifying pension credit’. This means a tax-free pension commencement lump sum (PCLS) or uncrystallised funds pension lump sum (UFPLS) can be taken in the usual way.

If it was derived from crystallised funds (those already in payment) the credit will be a ‘disqualifying pension credit’ and have no entitlement to a tax free PCLS. This is because the original member is deemed to have already used the tax-free lump sum entitlement. A UFPLS will also not be available as these lump sums must be paid with a fixed 25% tax-free.

It is possible that a pension credit could be part qualifying and part disqualifying.

Any income taken under flexi-access drawdown from the disqualifying element will not trigger the money purchase annual allowance (MPAA). This is in contrast to income taken from any qualifying pension credit or funds resulting from the member’s own contributions that are designated into flexi-access drawdown.

The type of funds the pension credit came from will also affect the recipient’s lifetime allowance (LTA).

A qualifying pension credit is derived from uncrystallised funds. When the client comes to take retirement benefits, the benefits will be tested against their LTA in the usual way. This will be the standard LTA unless they have LTA protection.

This will also apply to disqualifying pension credits where the original pension member started their retirement benefits before 6 April 2006 (i.e. before A-day).

However, where a pension credit was disqualifying but was derived from funds that came into payment on or after A-day, the recipient will be able to apply for an enhancement to their own LTA – the pension credit factor. This is because the funds would have already been tested against the LTA when they first came into payment for the original member.

Pension credit factors are not granted automatically: an application needs to be made to HMRC within six full tax years of the pension credit being paid. The factor is calculated by dividing the value of the disqualifying pension credit by the prevailing LTA on the effective date of the pension sharing order and is always rounded up to two decimal places.

Let’s consider Zainab, who received a disqualifying pension credit in 2017. Her adviser helped her to apply for a pension credit factor and this was confirmed by HMRC to be 0.38.

Zainab has been advised to enter income drawdown and wishes to withdraw a small amount of income before the end of the current tax year. She has no entitlement to PCLS from the funds related to the disqualifying pension credit but she will still be able to draw a PCLS from the SIPP funds relating to her own contributions before and after her divorce.

Zainab’s SIPP has a total value of £600,000 which she fully crystallises. To calculate Zainab’s enhanced LTA, the pension credit factor is applied as follows:

Current standard LTA * (1+pension credit factor) = [£1,073,100 * (1+0.38)]

The standard LTA for 2021/22 is £1,073,100 giving Zainab an enhanced LTA of £1,480,878

By crystallising her whole SIPP, Zainab will use 40.51% of her enhanced lifetime allowance. [(£600,000 / £1,480,878) * 100].

This article was previously published by Professional Adviser

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.