Lurid stories continue to emerge as the courts, regulators and creditors continue to sift the wreckage of the FTX cryptocurrency exchange, its trading and research arm Alameda and the financial affairs (and reputation) of their founder Sam Bankman-Fried.

FTX’s implosion adds to the growing list of accidents to befall the cryptocurrency ecosystem, after Luna and the Three Arrows hedge fund’s failure, the bankruptcy of broker Voyager and demise of lender Celsius. More seem possible as the ripples from FTX spread. Crypto trading platform BlockFi is pausing client withdrawals, broker Genesis is seeking to raise capital (as its CEO’s Twitter feed declares he is ‘now on vacation’) and the US-traded Grayscale Bitcoin Trust (GBTC) trades at a huge discount to its net asset value.

“Three lessons can be immediately drawn, namely ‘never invest in anything you do not understand’, ‘never invest in anything that is not regulated’ and ‘always be wary of upstart firms that sponsor a flagship sports stadium’. Beyond those, three crushing ironies are also apparent.”

Three lessons can be immediately drawn, namely ‘never invest in anything you do not understand’, ‘never invest in anything that is not regulated’ and ‘always be wary of upstart firms that sponsor a flagship sports stadium’. Beyond those, three crushing ironies are also apparent:

1. FTX ultimately failed because the world’s leading crypto platform, Binance, lost confidence in it and pulled out its assets. This is hardly a glowing endorsement of cryptos, stable coins and digital tokens.

2. FTX then tried to bail itself out by raising $8 billion in fiat currency, the very sort of money that crypto-supporters were trying to eschew (replace?) in the first place.

3. Once an investor puts cash in the bank, the bank invests that cash and treats it as a liability on its balance sheet. Once an investor puts crypto onto a platform, the exchange owes that digital currency to the investor and may trade or lend or leverage it accordingly. Neither the bank nor the crypto platform can meet mass withdrawals – a ‘run’ – so crypto fans have simply found the same risk of reliance upon an intermediary in different form, and an unregulated version of it for good measure.

Lessons learned are well and good, but the key issue now is what happens next, and what are the implications for the crypto asset class and financial markets more widely?

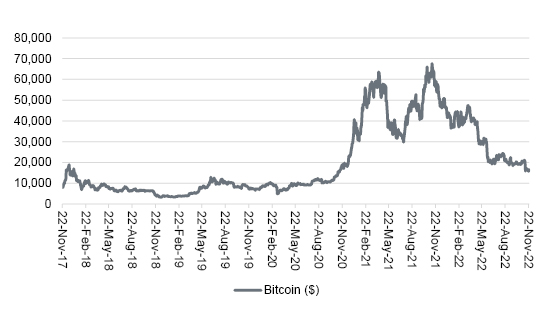

Bitcoin has lost a fifth of its value since news of FTX’s financial troubles first broke, yet it could surely have been worse. This column assumes the fall-out in equity and bond markets would be much greater if the world’s fifth-largest investment bank or investment platform were to fail. Some may therefore treat Bitcoin’s price resilience with suspicion rather than approbation.

“Some may therefore treat Bitcoin’s price resilience with suspicion rather than approbation. Even then, however, Bitcoin has lost three-quarters of its value since the November 2021 peak, just shy of $68,000.”

Even then, however, Bitcoin has lost three-quarters of its value since the November 2021 peak, just shy of $68,000.

Bitcoin is down by 75% from its highs

Source: Refinitiv data

“This will tempt sceptics to argue that the crypto bubble is starting to go pop, especially as the asset class’s trajectory closely follows that outlined by Charles P. Kindleberger in his magisterial study of similar episodes, ‘Manias, Panics & Crashes’.”

This will tempt sceptics to argue that the crypto bubble is starting to go pop, especially as the asset class’s trajectory closely follows that outlined by Charles P. Kindleberger in his magisterial study of similar episodes, Manias, Panics & Crashes. It establishes a typical sequence of events that can be seen through the history of previous market crazes, ranging from the South Sea Bubble of 1720 through to British canals (1790s), Latin American mines (1820s), US equities (1920s), Japanese equities and property (1980s) and global technology stocks (1990s), to name but a few.

Looking at the patterns of past bubbles may help advisers and clients duck the next disaster which will, inevitably, unfold at some stage. This is because the details may change from mania to mania, but human behaviour clearly does not, and the running order feels pretty consistent:

“Advisers and clients can judge for themselves where they feel cryptocurrencies stand in this cycle (assuming they accept the view the cryptos did indeed enter bubble territory in the first place).”

Advisers and clients can judge for themselves where they feel cryptocurrencies stand in this cycle (assuming they accept the view the cryptos did indeed enter bubble territory in the first place). They may even take the view we are nearing the bottom and that there could be a time to take a closer look, providing the asset class fits with their overall strategy, asset allocation and risk parameters.

Echoes of history

Equally, if Kindleberger’s model holds firm, there could be more bad news to come, especially if central banks stay the course, and keep hiking rates, to take away at least a chunk of the cheap liquidity that did so much to fuel interest in crypto in the first place. As interest rates rise, and Quantitative Easing (QE) is being (slowly) withdrawn, the cost of money, and returns on cash, are going up. This may force markets to treat money with more reverence and take less risk.

“As interest rates rise, and Quantitative Easing (QE) is being (slowly) withdrawn, the cost of money, and returns on cash, are going up. This may force markets to treat money with more reverence and take less risk.”

This could have implications for other, potentially bubbly assets, including equities, bonds, property, art, wine, sports cars and thoroughbred racehorses. All have seen some meteoric price increases during the era of zero interest rates and QE, and some are already rapidly retreating, as we can see in more speculative areas of the stock markets, such as Initial Public Offerings (IPOs) and Special Purpose Acquisition Companies (SPACs).

If there is any good news, it is that the aggregate crypto market value is just $825 billion, down from a peak of $3 trillion according to the website www.coinmarketcap.com. If regulators just leave crypto alone, in the view it will go to zero all by itself, that would equate to the loss of just 2.5% of the American S&P 500 stock index. That should not be enough to destabilise anything, although that may depend upon how much money has been borrowed using cryptos as collateral.

Past performance is not a guide to future performance and some investments need to be held for the long term

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.