The collapse of Silicon Valley Bank and the latest round of strife to engulf Credit Suisse (CSGN:SWX) are once more putting the spotlight on monetary policy, and begging the question of whether central banks may already be running it too tightly, as they hike interest rates and seek to shrink their balance sheets through Quantitative Tightening (QT).

“As interest rates and bond yields rise, we are now discovering what may be the genuine cost of money, with the result that capital is treated with more care and respect as risk appetite wanes.”

The two banks’ weak risk controls are the biggest problem by far, as both institutions have been poorly run, but this column is inclined to suggest that another reason for their woes is not the sharp interest rate increases pushed through by central banks in the past year, but the lengthy period of ZIRP and QE which preceded it. A period of central bank manipulation to keep the cost of money artificially low – albeit you can argue for good reason in an era of the Great Financial Crisis, the European Debt Crisis and COVID-19 – encouraged risk taking on an epic scale. As interest rates and bond yields rise, we are now discovering what may be the genuine cost of money, with the result that capital is treated with more care and respect as risk appetite wanes.

“The 1998-2000 bubble paled into insignificance compared to that of 2020-21 but the vibrant party has now given way to a hangover.”

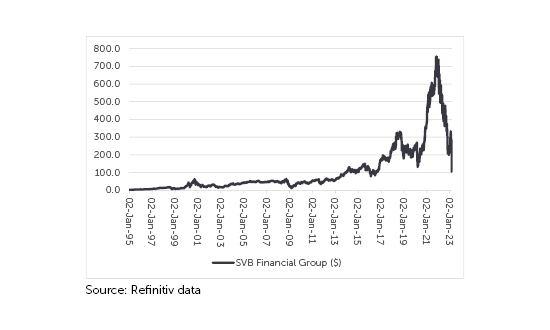

Just look at the share price chart for Silicon Valley Bank. In the technology, media and telecoms bubble of 1998 to 2000 it soared from $15 to $65 but then collapsed and gave all of that back between 2000 and 2002 as the bubble burst. It then took the stock eleven years to get back to $65, only for it to then go wild amid a rush of technology floats and fresh deposits from newly minted (multi)millionaire entrepreneurs, and soar to a peak of $753 in November 2021. The 1998-2000 bubble paled into insignificance compared to that of 2020-21 but the vibrant party has now given way to a hangover. SVB had crashed to $106 before the suspension of its stock.

The 2020-21 boom in SVB shares way outstripped the 1998-2000 TMT bubble

Source: Refinitiv data

“But it is not just Silicon Valley Bank that shows this boom-and-bust pattern.”

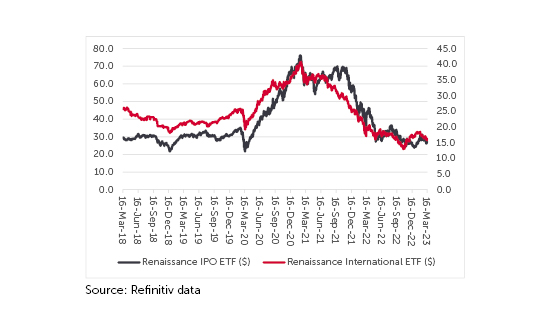

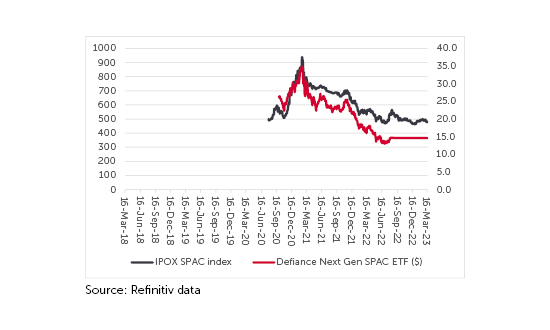

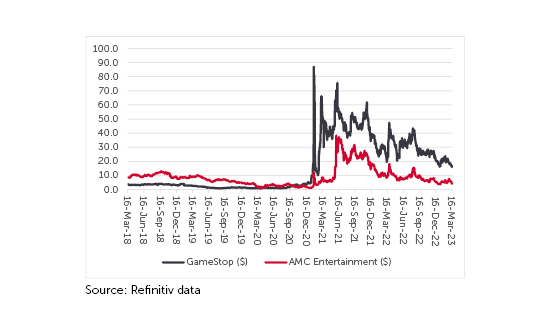

But it is not just Silicon Valley Bank that shows this boom-and-bust pattern. Just look at the price charts of the rash of Initial Public Offerings (IPOs) that came to market (as benchmarked by a pair of US-listed exchange-traded funds, or ETFs): Special Purpose Acquisition Companies, set up to go and buy other, unspecified firms (where one specially-created ETF has already ceased to trade); and meme stocks, like GameStop and AMC Entertainment.

Hot initial public offerings have turned cold

Source: Refinitiv data

Special Purpose Acquisition Vehicle Companies (SPACs) have lost their way

Source: Refinitiv data

Meme stocks cannot seem to break a price trend of lower highs and lower lows

Source: Refinitiv data

“It is almost as if the last three years never happened. Prices that went up like a rocket have come down like the stick, back to where they were, if not lower. The tide of cheap liquidity that carried these assets higher has started to go out.”

It is almost as if the last three years never happened. Prices that went up like a rocket have come down like the stick, back to where they were, if not lower. The tide of cheap liquidity that carried these assets higher has started to go out and, as Warren Buffett noted, “only when the tide goes out do you discover who has been swimming naked.”

“These asset price drops, last autumn’s gilt market chaos and now banking shivers show it may not be easy for the central banks to extricate themselves from ZIRP and QE without something breaking somewhere.”

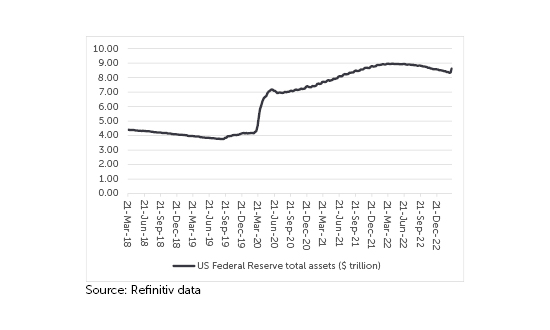

These asset price drops, last autumn’s gilt market chaos and now banking shivers show it may not be easy for the central banks to extricate themselves from ZIRP and QE without something breaking somewhere. The US Federal Reserve’s balance sheet is starting to expand again, although this is because of banks tapping it for liquidity rather than a return to QE.

The Federal Reserve’s balance sheet is expanding again

Source: Refinitiv data

Markets have been baying for a pause in interest rates and then a pivot to rate cuts, but in the hope of a cooling in inflation and a gentle economic slowdown, not in response to fresh financial market chaos. They may have to be careful what they wish for. A return to rate cuts, or even QE, at a time when inflation is still above target, might not be the positive sign that markets are seeking, if the reason for the policy pivot is either a faltering economy, a blockage in the financial systems’ plumbing, or both.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.