Today’s (18 February) Congressional hearing in Washington looking into what happened with shares in GameStop (GME:NYSE) should make for fascinating listening. A host of luminaries – including Vlad Tenev from Robinhood, Ken Griffin from Citadel, Steve Huffmann from Reddit, high-profile retail trader Keith Gill (‘Roaring Kitty’) and Gabe Plotkin of Melvin Capital, the hedge fund pummelled by GameStop’s meteoric, if short-lived, surge – will all testify on Capitol Hill. Meanwhile, the American markets’ key regulator, the Securities and Exchange Commission, is planning to produce a report to see what lessons can be learned.

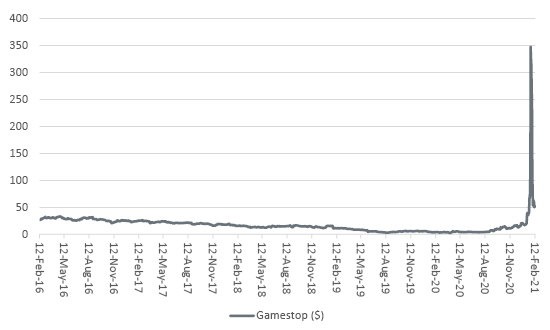

GameStop appears to have hit the buffers – at least for now

Source: Refinitiv data

“History suggests that more regulation will come, but only after a deeper, longer, bear market across equities more generally that inflicts pain on a far greater number of investors and traders than the shenanigans involving GameStop.”

This column’s suspicion is that tighter regulation will follow – but not yet. History suggests that will only come after a deeper, longer, bear market across equities more generally that inflicts pain on a far greater number of investors and traders than the shenanigans involving GameStop. That is when the real hunt for scapegoats and the apportionment of blame will begin, with hedge funds probably top of the list – even if, as Edward Chancellor writes in his excellent history of financial speculation Devil Take the Hindmost: “Although short-sellers are invariably blamed for the collapse of stock markets, the problem is really caused by long-only buyers during the preceding bull market, who push stocks to unsustainable levels. No government has yet seen fit to ban stock purchases during a stock market bubble.”

The tricky bit is defining a bubble. Former US Federal Reserve chairman Alan Greenspan went on the record as saying bubbles could only be spotted after the fact, after they have burst – by which time it was too late. Several current Fed officials, including chair Jay Powell, are now vigorously rebutting arguments that fresh bubbles are sprouting up everywhere, from GameStop to Special Purpose Acquisition Companies (SPACs), to new company flotations and beyond.

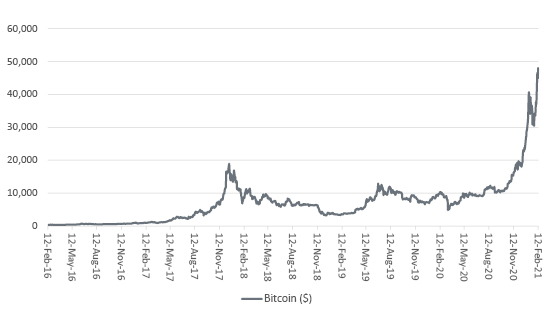

Bitcoin keeps barrelling higher

Source: Refinitiv data

“One way to judge whether markets are in a bubble (or not) is to follow the classic cycle of bubbles outlined by Charles P. Kindleberger in his magisterial history of financial mayhem, Manias, Panics and Crashes.”

One person’s bubble is another’s bull market and profit opportunity (as owners of bitcoin will tell you). One way to judge whether markets are in a bubble (or not) is to follow the classic cycle of bubbles outlined by Charles P. Kindleberger in his magisterial history of financial mayhem, Manias, Panics and Crashes. The details of each episode may change but human behaviour clearly does not and the running order is consistent. Advisers and clients can therefore decide where in this cycle we might be right now.

That takes us back to whether regulation is the only answer. This above potted history of every bubble from Dutch tulips in the 1620s through to American housing in 2007 would suggest not. Every meltdown has prompted regulation of some kind – from Sir John Banham’s Act in 1734 in the UK through to the Dodd-Frank Act in 2010 in America – but to no ultimate avail.

This is because human behaviour does not change (and the memory of prior disasters ultimately fades). As Warren Buffett once tartly put it: “People start being interested in something because it’s going up, not because they understand it, or anything else. But the guy next door, who they know is dumber than they are, is getting rich and they aren’t. And their spouse is saying, can’t you figure it out, too? It is so contagious. It’s a permanent part of the system.”

“If we are in a bubble, then advisers and clients face an invidious choice: either to be wrong by taking profits and calibrating risk too early or to be wrong by trying to get out too late.”

Everyone will have their own views on whether we are in bubble territory or not and, if so, in which asset classes. But if we are in a bubble, then advisers and clients face an invidious choice: either to be wrong by taking profits and calibrating risk too early or to be wrong by trying to get out too late.

How advisers and clients go about addressing that challenge will be a matter of personal taste, financial circumstance and risk appetite, but industry professionals will generally take the latter option (at least based upon this column’s experiences as an equity analyst at a leading investment bank for 12 years). It is less obvious that you have erred (and less career-threatening) if you go over the cliff with everyone else, instead of standing aside as asset prices surge higher. Plus, even if a forecast of imminent doom is right, no thanks are offered, only blame to the Cassandras who sowed the first seeds of doubt.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.