Robert Rhea’s outline of a bull market in his tome, The Dow Theory, which dates back to 1932, still seems relevant today: ‘There are three principal phases of a bull market: the first is represented by reviving confidence in the future of business; the second is the response of stock prices to the known improvement in corporate earnings, and the third is the period when speculation is rampant – a period where stocks are advanced on hope and expectations.’

Less well known may be the flipside of that, namely Rhea’s analysis of the three classic phases of a downturn: ‘There are three classic phases of a bear market: the first represents the abandonment of hope upon which stocks were purchased at inflated prices; the second reflects selling due to decreased business and earnings, and the third is caused by distress selling of sound securities, regardless of their value, by those who must find a cash market for at least a portion of their assets.’

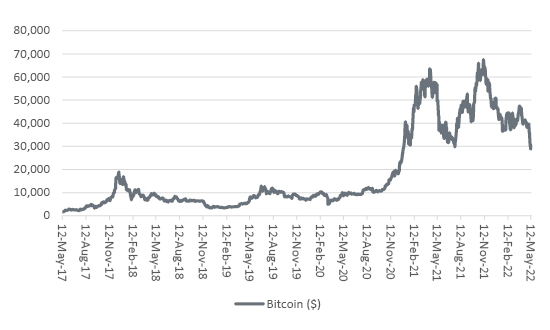

Wild events in the cryptocurrency markets, and frightening talk, at least on social media, of people being ruined, and even committing suicide, evoke bad memories of the crashing bear market of the 1930s when even the famed Boy Plunger, Jesse Livermore, killed himself after one too many failed attempts to buy US equities on the dips.

Everyone will have an opinion on crypto and where we may be in Rhea’s cycle, whether they are interested and have exposure or not.

Everyone will have an opinion on equities, too, and on where we are in the market cycle here. This will shape, in turn, how they think about the exposures they have and the current balance between risk and reward in certain countries, sectors, themes or specific stocks.

“You can argue that all market booms and busts follow Rhea’s pattern. The really hard bit is working out how long the good times and bad times may last and what may prompt sentiment to turn, either up or down.”

You can argue that all market booms and busts follow Rhea’s pattern. The really hard bit is working out how long the good times and bad times may last and what may prompt sentiment to turn, either up or down.

One simple rule is probably that bull and bear markets go on for a lot longer than you think likely, although the former genuinely last a lot longer than the latter. In addition, market tops are a process, often characterised by multiple peaks as bulls refuse to believe it is all over and keep trying to forge new highs, while bottoms are usually an event, as capitulation takes over and sentiment is well and truly washed out.

“A useful guide to turning points may be to look at where the market action has been hottest or, to be less kind, most speculative. Bull markets crack at the periphery first and trouble then filters through to core assets as confidence wanes.”

A useful guide to turning points may be to look at where the market action has been hottest or, to be less kind, most speculative. Bull markets crack at the periphery first and trouble then filters through to core assets as confidence wanes. It could be argued that the cryptocurrency crumble is one early sign of trouble ahead that may force crypto holders to liquidate other assets to stay afloat (assuming they have any).

Has a ‘crypto winter’ cooled ardour for Bitcoin?

Source: Refinitiv data

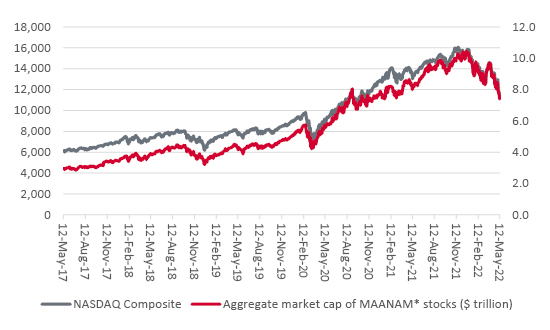

Other areas that have seen frantic action have also starting to look less healthy.

“Even purportedly ‘safe’, reliable names are under pressure, weighed down by the lofty expectations and even loftier price tags.”

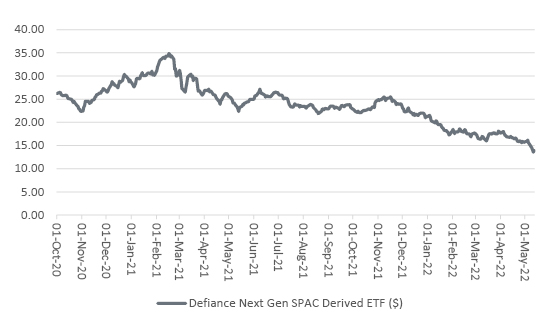

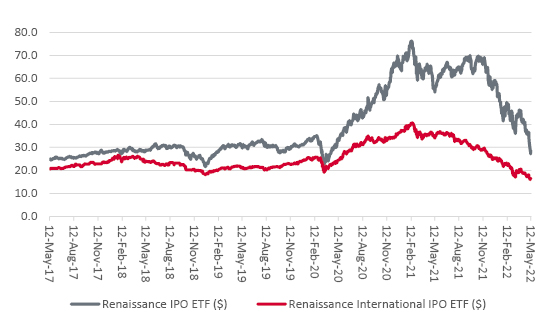

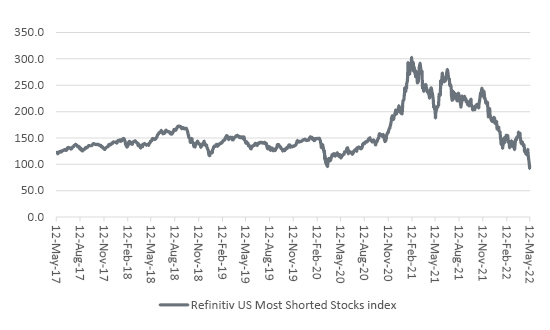

Special Purpose Acquisition Company (SPAC) deals are performing poorly (and new transactions are getting a cool reception). Initial Public Offerings (IPOs) are doing badly, at least on average. The Reddit crowd’s efforts to ramp hedge funds out of their short positions are petering out. More speculative names with big market caps that deliver only losses (or profits that are tiny compared to their market caps) are being taken to the woodshed, as can be seen in the bear market that already characterises the NASDAQ. And even purportedly ‘safe’, reliable names are under pressure, weighed down by lofty expectations and even loftier price tags.

Share price performance of SPAC deals is fading fast …

Source: Refinitiv data

... and IPOs are struggling to sustain their offering prices

Source: Refinitiv data

Most shorted stocks are falling

Source: Refinitiv data

Even the allegedly safest of names have been on the slide.

Source: Refinitiv data. *Meta Platforms, Amazon.com, Apple, Netflix, Alphabet and Microsoft.

None of this is to say the bull market is over. Central banks could yet try to breathe new lift into the long upward run with more unorthodox policy. But right now, inflation is their biggest concern, not supporting markets. That could change at some stage, if recent history is any guide, but it might not be able to change quite soon enough to prevent further bouts of volatility, if nothing else.

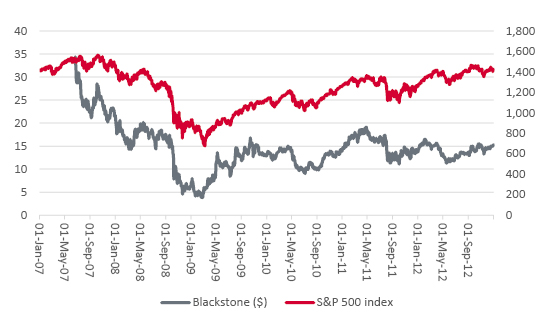

“Anyone looking for the next warning sign might perhaps look to another industry that has boomed but has turned a net seller, of itself, through stock market flotations – private equity.”

For markets to regain their momentum, the areas above need to stabilise and start to advance. Anyone looking for the next warning sign might perhaps look to another industry that has boomed but has turned a net seller, of itself, through stock market flotations – private equity. Petershill and Bridgepoint both floated in London in 2021. Neither share price has covered itself in glory. Those with long memories will recall how Blackstone’s New York listing was neatly timed – for the sellers – in 2007, just ahead of the smash. It took almost seven years to get back to its $31 flotation price (before then, in fairness, storming higher).

Will private equity stocks be a useful indicator this time around?

Source: Refinitiv data

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.