The Silver Surfer was the creation of Marvel Comics legend Jack Kirby and the character acted as the herald of Galactus, the devourer of planets. This intergalactic super-being was usually fended off by the Fantastic Four or The Avengers.

From the point of view of clients and advisers, inflation devours wealth as scarily as Galactus consumed solar systems and, rather than turn to superheroes for protection against this potential threat, markets are turning toward something else known for being nearly indestructible: precious metals – gold, and also silver.

“Silver is still trading way below its prior peaks of 2011 and 1979, even if silver’s 34% year-to-date gain in 2020 outpaces that of gold by several percentage points.”

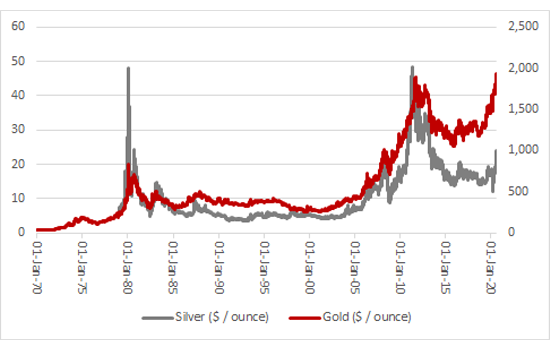

At the time of writing, gold is setting new record highs above $1,900 an ounce but, at $24 an ounce, silver is still trading way below its prior peaks of 2011 and 1979, even if silver’s 34% year-to-date gain in 2020 outpaces that of gold by several percentage points.

Gold and silver are both surging again in 2020

Source: Refinitiv data

Precious metals tends to arouse strong feelings among investors. Some investors love them as a potential hedge against inflation, some against deflation and some against unforeseeable disasters and market dislocations, while others detest them, viewing gold in particular as a barbarous relic or inert useless lump.

“Bulls of precious metals are putting bears to flight right now and there may be three possible reasons why gold and silver are both doing well, with a fourth, specific to silver, also in the mix.”

But bulls are putting bears to flight right now and there may be three possible reasons why gold and silver are both doing well.

Inflation expectations are starting to tick higher again

Source: FRED – St. Louis Federal Reserve database

Inflation expectations are starting to tick higher again

Source: FRED – St. Louis Federal Reserve database

“Gold and silver surged between 2008 and 2011 as the Fed ran its first three rounds of QE but they then lost ground as it looked like the monetary authorities had regained control of the economic situation. The pandemic may have changed all that.”

Gold and silver surged between 2008 and 2011 as the Fed ran its first three rounds of QE but they then lost ground as it looked like the monetary authorities had regained control of the economic situation. The pandemic may have changed all that, and the cost of keeping the show on the road this time around has already been much higher. One question that buyers of gold may already be asking themselves is what action will be taken by the Fed and other central banks next time a recession hits, as the system will feature even more debt and potentially be even more susceptible to an unexpected shock.

There is a fourth angle which pertains to silver only. Unlike gold, silver has industrial uses and as such is a more ‘cyclical’ play, because it is the best conductor of all metals and also has antimicrobial attributes which make it a perfect biocide. Demand from the traditional film photography industry is probably all but gone but these chemical properties means silver is ideal for the medical equipment, electronics, water purification and solar power industries in particular.

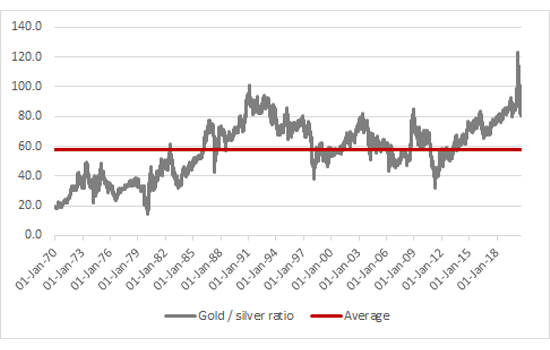

As the world focuses ever-more intently on renewable sources of energy, solar panels could be a big driver of silver demand. Whether this proves more potent than demand for a haven remains to be seen, but historical data does suggest silver is trading cheaply relative to gold. The gold/silver price ratio has averaged 56 since 1970 but an ounce of gold currently trades at 80 times the price of an ounce of silver.

Silver looks cheap relative to gold

Source: Refinitiv data

Unlike gold miners, however, while the HUI Golds Bugs index trades below its average ratio to the metal price, silver miners do not look especially cheap compared to the physical commodity, on the basis of the relationship between the metal and the Solactive Silver miners index.

That benchmark has a fairly limited history and silver miners traded a lot more expensively relative to the metal in 2008 and 2011, so investors who prefer miners to metal still have much to ponder.

Silver miners do not look unduly cheap relative to the metal, according to historic norms

Source: Refinitiv data

Equally, there is no guarantee that silver’s storming run will continue – if COVID-19 is contained and beaten and the economy bounces back more strongly than hoped, then the appeal of haven assets might not be anywhere near as strong.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.