Some regular readers may think it does not take much to puzzle this column at the best of times and there can be no denying that the big picture right now seems to be full of contradictory eddies and whirls which make it particularly difficult for advisers and clients to form a clear-cut view.

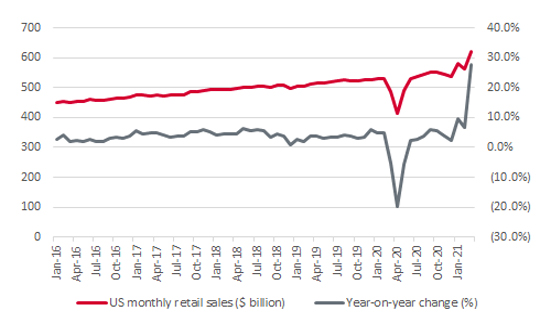

“A stunning surge in US retail sales looks to be testament to the power of America’s unlocking, vaccination programmes, ongoing loose monetary policy from the Federal Reserve and fresh fiscal stimulus, in the form of the latest direct payments to consumers.”

For instance, US retail sales jumped by 28% year-on-year in March, according to data released by the US Census Bureau on 15 April. While allowances can be made for the soft base for comparison offered by the pandemic-hit month of March 2020, the 9.8% month-on-month advance looks to be testament to the power of America’s unlocking, vaccination programmes, ongoing loose monetary policy from the Federal Reserve and fresh fiscal stimulus, in the form of the latest direct payments to consumers – the first direct deposits began to arrive on 17 March.

US retail sales are powering higher

Source: US Census Bureau, FRED – St. Louis Federal Reserve database

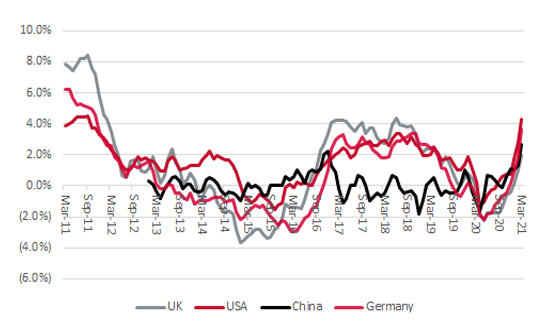

For the same month, the UK showed the fastest increase in producer (or factory gate) prices, just as America and Germany showed the highest rate of increase in nearly a decade. China showed signs of an increase too.

Factory gate price increases hint at the return of inflation

Source: Refinitiv data

Economists will tend to argue that a sustained increase in companies’ input and output costs will eventually force them to raise prices so they can preserve margins. That in turn leads to higher prices for buyers to pay and could begin to stoke inflation, or so the theory goes.

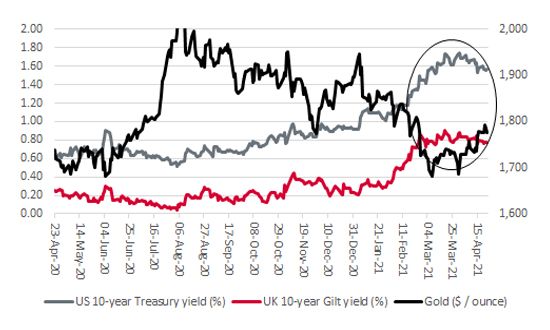

And yet, as this data came through, Government bond yields in the US and UK began to fall, the direct opposite of what investors would normally expect during a robust upturn. After all, who would buy Government papers that offered a yield of say 1.75% a year for 10 years in the US or 0.88% a year in the UK over the same time frame if inflation was about to gallop higher? (Those are the levels at which yields peaked on 31 March.) That would surely be locking in a real-terms (post-inflation) loss.

“The perceived haven (and therefore potential harbinger of doom) that is gold is also beginning to forge some progress for the first time in well over a year.”

Even more intriguingly, the perceived haven (and therefore potential harbinger of doom) gold began to forge some progress for the first time in well over a year.

Haven assets are trying to stage a comeback

Source: Refinitiv data

So how can advisers and clients explain what looks like strong, maybe even inflationary, economic data on the one hand, and an apparent resurgence of interest in haven assets on the other?

To this column’s mind, there are three possible explanations.

This column’s instinct is always to look to the further-flung corners of the markets, in the view that trouble usually starts where investors are operating beyond their normal appetite for risk. Once they get into difficulty at the periphery – in frontier or emerging markets say – they will pull back pretty quickly and hunker down in search of what they view as safety in core, developed markets and hope to avoid any squalls or full-blown storms.

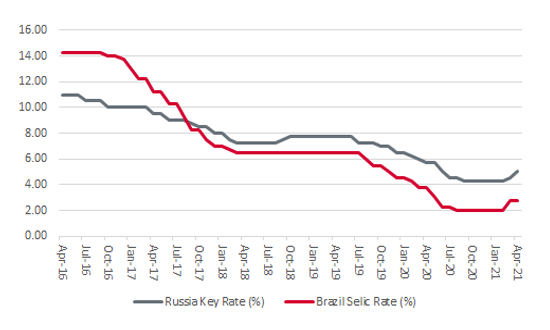

“Interest rate increases in Brazil and Russia caught markets by surprise, especially as they were both overtly designed to combat inflation.”

What is clear is that interest rate increases from Brazil (2.75 percentage points in one go) and Russia (a quarter point and then another half in quick succession) both caught markets by surprise and both were overtly designed to combat inflation.

Do emerging market interest rate increases signify a turn in the monetary tide?

Source: Refinitiv data

Again, this may be something, it may be nothing. But add in the emerging market rate rises to the Bank of Canada’s move to cut quantitative easing by a quarter and the Reserve Bank of New Zealand being told to keep a wary eye on a bubbly housing market and the very, very early signs of monetary tightening are appearing. And for financial markets which have bathed in cheap, abundant central bank liquidity for over a decade, this is a potentially disturbing trend which must be watched carefully, even if it seems unlikely that the Fed, Bank of England, ECB or Bank of Japan are going to turn off the taps for a while.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.