Two weeks ago, this column looked at the history of bear markets in the field of UK equities. Unfortunately, that analysis has proved to be rather timelier than anticipated, since the FTSE All-Share has just entered the eleventh such downturn in its 58-year history and the FTSE 100 its fifth bear phase since its launch in 1984.

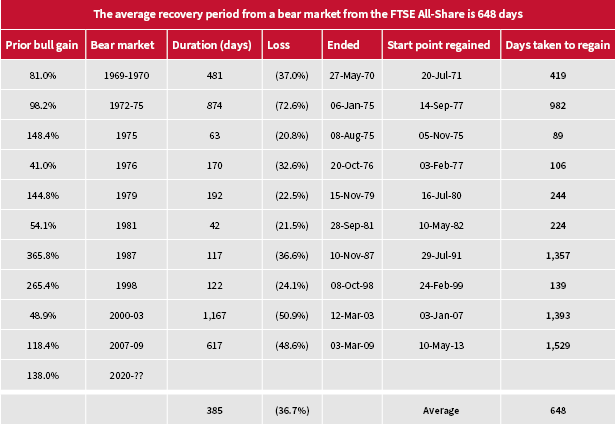

To recap, the average bear market in the FTSE All-Share has lasted 385 days and served up a 37% drop in the index, although that covers a wide range: the shortest bear market was just 42 days (1981) and the longest 1,167 (2000–03), while the smallest loss was 21.5% (also 1981) and the worst drop was 72.6% (1972–75).

With the FTSE All-Share already down by 31% in just 55 days, advisers and clients could be forgiven for at least pondering whether the worst may be over.”

With the FTSE All-Share already down by 31% in just 55 days, advisers and clients could be forgiven for at least pondering whether the worst may be over. That may depend upon the length and geographic breadth of the COVID-19 outbreak, the scale and sort of fiscal and monetary policy response and the duration and depth of any recession that ensues owing to the disruption to both global supply chains and global demand.

But it should nevertheless be instructive to look at how long it has typically taken the All-Share to recover the ground lost during a bear market, to see if this gives advisers and clients any guide as to when they might like to start averaging their way back in, or at least start doing their research on possible recovery picks.

The good news is that on all 10 prior occasions, the FTSE All-Share has completely recaptured the ground lost during the previous bear market.”

The good news is that on all 10 prior occasions, the FTSE All-Share has completely recaptured the ground lost during the previous bear market. You might think this does not sound like a big deal, but ask any adviser or client with experience of, and exposure to, the Japanese stock market and you might think otherwise: the Nikkei 225 peaked at 38,916 on 31 December 1989 and 31 years later it stands at 17,431.

The bad news is that on eight out of ten occasions, it took the index longer to make up the ground than it did to lose it.”

The bad news is that on eight out of ten occasions, it took the index longer to make up the ground than it did to lose it. This is partly down to the character of bear markets, which by their nature have tended to be relatively nasty, brutish and short (rather like recessions, compared to economic upturns). It is also just mathematics: if an index halves, it has to double to get back to where it started.

The average time it has taken the All-Share to recover a bear-market loss is 648 days, compared to the 385-day average market downturn.

Again, however, there is a wide range. It took the benchmark just 89 days to bounce back from its 63-day, 21% pummelling in 1975. But it needed 1,529 days to pick itself up after the crunching 2007–09 downturn which featured in the Great Financial Crisis with a 49% peak-to-trough decline.

The average recovery period from a bear market for the FTSE All-Share is 648 days

Source: Refinitiv data

It does appear that the longer the preceding bull market and the bigger the gain, the longer the recovery period that is needed. The hangover that followed the 1998–99 and 2003–07 parties suggests as such, although the bear market of 1987 was very, very short and that was sandwiched in between the huge advances of 1981–87 and 1987–98.

All may not be lost this time around, despite the length and extent of the preceding gain, although there is one other phenomenon of which advisers and clients need to be aware, namely the bear market rally.

There is one other phenomenon of which advisers and clients need to be aware, namely the bear market rally, which often turn into bear traps for the unwary, who were tempted into a ‘buy-on-the-dip’ strategy, only to quickly find themselves in trouble.”

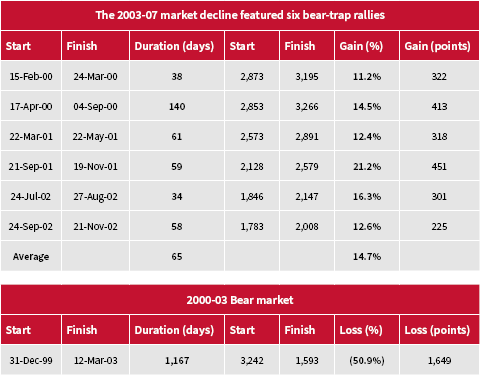

Bear markets are actually littered with sharp advances which cruelly turn out to be nothing more than bear traps for the unwary, who were tempted into a ‘buy-on-the-dip’ strategy, only to quickly find themselves in trouble. The 2003–07 and 2007–09 market drops were classic examples.

The 2000–03 bear market, which followed the collapse of the technology, telecoms and media bubble, witnessed six major rallies in the All-Share. Those advances generated a combined gain of 2,030 points between them, even as the index declined by 1,649 points from top to bottom, showing how much additional pain would have been suffered by anyone who was tempted to pile into the market by these rallies.

The 2003–07 market decline featured six bear-trap rallies

Source: Refinitiv data

The 2007–09 bear run was no less vicious or unforgiving. Seven rallies just led bulls and dip-buyers to the slaughter as even their 2,420-point cumulative gains could not stop a three-year 1,690-point, peak-to-trough decline.

The 2007–09 market decline featured seven bear-trap rallies

Source: Refinitiv data

This is particularly relevant today, after last Friday’s 9.8% gain in America’s S&P 500. Bulls will try to fight back. But before that spectacular surge, nine of the S&P’s best single-day percentage gains since 1964 have come during bear markets. The exception was 10 March 2009, which was the very first day of the eleven-year bull-run that has just ended. Fingers crossed we get a repeat this time, though history might just be against it.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.