In the end Boris Johnson might – just – outlast Theresa May as Prime Minister, but financial markets are now wondering who will come next and what policies they will bring with them.

So far, the UK’s leading equity indices, and sterling, are taking the latest ructions in Westminster in their stride. They are doing so even if share- and stakeholders in any public or private company would never tolerate a company being run in such an incompetent fashion as the current Government, where plotting and shimmying up the greasy pole seem to be more important than helping the population confront the twin threats of inflation and a possible recession. Any board member caught behaving in such a way would surely be publicly excoriated.

“History suggests it takes more than a new incumbent in 10 Downing Street to really get the stock market going.”

No matter. The FTSE All-Share is up, and the pound is making minor gains against the dollar and euro as investors consider who the next PM will be and hope for greater domestic political stability. However, history suggests it takes more than a new incumbent in 10 Downing Street to really get the stock market going.

If he makes it until autumn, Boris Johnson will (just) outlast Theresa May

Source: www.britannica.com. * To 7 July 2022

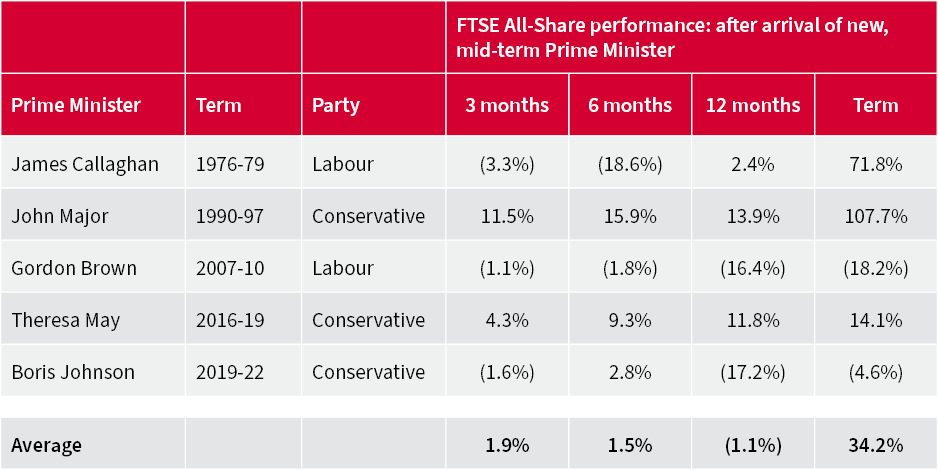

Since the inception of the FTSE All-Share in 1964, five Prime Ministers have taken office mid-way during a Parliament, following the departure of their predecessor – James Callaghan and Gordon Brown for Labour, in 1976 and 2007, and John Major, Theresa May and Boris Johnson for the Conservatives in 1990, 2016 and 2019 respectively.

On average, the FTSE All-Share made no progress at all under the quintet during their first 12 months in the hot-seat, rising on average by 1.9% over the first three months of the new PM’s tenure, gaining 1.5% over six months and coming in slightly down over a year.

FTSE All-Share initially seems indifferent to a change in PM

Source: Refinitiv data

“We must all accept that the past in no guarantee for the future. But this dataset, even if it relatively narrow, seems to suggest that while political stability is welcome, there are many other factors at work when it comes to how the stock market performs.”

We must all accept that the past in no guarantee for the future. But this dataset, even if it relatively narrow, seems to suggest that while political stability is welcome, there are many other factors at work when it comes to how the stock market performs.

There is then a wide range of stock market returns during the tenures of those five mid-term Prime Ministers.

The FTSE All-Share galloped higher under John Major, as the UK came out of recession and the economy got a huge boost from 1992’s devaluation of the pound, and embarrassing ejection from the Exchange Rate Mechanism. It also gained under James Callaghan, as the All-Share continued to advance from its multi-year low of early 1974 and investors looked for some kind of protection from inflation, which continued to spiral, thanks to the oil price shocks of 1973 and 1979 and such questionable policies as windfall taxes, demand subsidies and price controls.

In contrast the index did relatively little under Theresa May’s stewardship, as the nation wrestled with the implications of 2016’s Brexit vote and share prices drew succour from weakness in the pound, while it lost ground under both Boris Johnson and Gordon Brown. Brexit uncertainty, COVID-19, the Russian invasion of Ukraine and a resurgence of inflation hardly helped Johnson’s cause (nor did his occasionally fractious relationship with big business), while Gordon Brown found the Great Financial Crisis dropping into his lap, to thoroughly confound his prior statement that the days of boom and bust were at an end, if nothing else.

The economy’s performance will help to shape stock market performance, but Government and central bank policy and global events can have a say, too.

“Ultimately it is corporate profits and cash flows – and the price (or valuation) investors are prepared to pay to access them – that really dictate how the FTSE All Share will perform."

And ultimately it is corporate profits and cash flows – and the price (or valuation) investors are prepared to pay to access them – that really dictate how the FTSE All Share will perform.

With a dividend yield of around 4.2%, the FTSE All-Share can be seen as a 23.8-year duration bond (as this is how long it would take advisers and clients to get their money back, assuming no change in dividends or share prices).

This shows exactly why shares should be treated as a (very) long-term investment and why the role of short-term politics should not be over-emphasised, as very few Prime Ministers have lasted for much more than one full term of office, at least since the inception of the FTSE All-Share in 1964, and their tenures, if anything, seem to be getting shorter – and shorter.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.