A ‘Code Red’ for humanity. That’s how the UN phrased its stark warning on climate change, and a quick glance at news headlines highlight heatwave-induced wildfires in California, Greece, and Italy: events that used to happen once a generation, now occurring more and more frequently.

The blame is laid squarely at our feet – human activity. From the cars we drive, the clothes we buy and the fuel that heats our homes, our lives have come with consequences and it’s time to pay the piper.

“With change comes opportunity and advisers and their clients should consider what British society and British homes will look like in 10 years’ time.”

And consumers will have to pay, whether it’s in the switch from petrol to electric vehicles (EVs), replacing gas boilers with hydrogen ones or installing heat pumps, or shifting eating habits. With change comes opportunity and advisers and their clients should consider what British society and British homes will look like in 10 years’ time.

Investors have already waded deep into the pool of ethical investing and the Government’s much-anticipated green bonds will make it easier for people to use their cash to support environmental change.

But there are other opportunities to explore even beyond our borders, such as in the US – where President Biden’s anticipated infrastructure bill is focusing minds.

In the UK, now lockdowns have come to an end, the Government is under increasing pressure to do more than just talk – especially with November’s COP26 summit in Glasgow looming.

It has said it’s committed to build back better and its 10-point plan for a green industrial revolution puts our homes firmly at its heart. And it’s not hard to understand why.

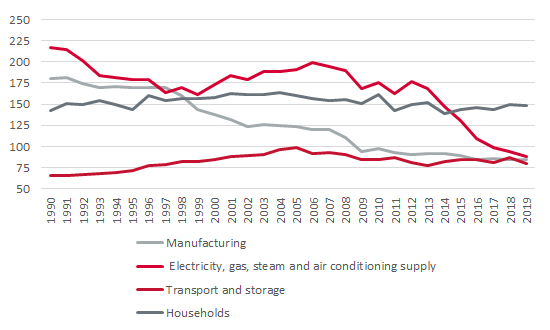

UK greenhouse gas emissions

Source: Office for National Statistics

“Tackling household energy use has to be a priority and a strategy is due to be published in the autumn. But already companies like Centrica are salivating at the potential opportunities.”

Our homes are still the highest overall contributors to greenhouse gas emissions in the UK. In order to achieve the 78% cut to overall emissions the Government has pledged to make by 2035, tackling household energy use has to be a priority and a strategy is due to be published in the autumn. But already companies like [BOLD] Centrica (CNA) are salivating at the potential opportunities.

During a recent earnings call, you could feel the expectation coiled inside the company’s new boss, Chris O'Shea. And it’s not just utilities strategising for a piece of the action; ‘Big Oil’ is also positioning itself to provide cleaner, greener fuel like hydrogen, though a study out this week has cast doubt on hydrogen’s environmental credentials.

Wherever the energy comes from, it will have to be cost effective or heavily subsidised for consumers to swallow the change, at least in the short-term.

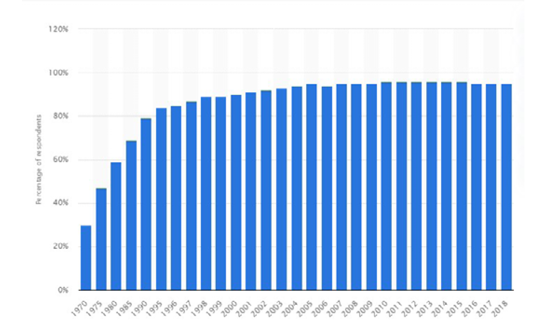

Percentage of households with central heating systems in the UK 1970–2018

Source: STATISTICA

The last time our homes underwent this kind of fundamental change was in the 1970s. Then, the switch from coal fires and immersion heaters was as much about status as a lifestyle boon. Then, the investment came with an immediate dividend for the consumer: every room could be lived in even in the depths of winter and the open plans we now prize became a possibility.

Today, 95% of all homes boast central heating, and the majority are powered by gas. Changing to heat pumps or some other less carbon-intensive method of keeping our homes warm will take every one of the 14 years the Government has projected and a few more beside. Think of the building work, the retail sales and the infrastructure investment – not to mention the cost to consumers of installing a new heating system.

Whilst the switch to EVs is more advanced, there is still a long road ahead and, like heating, price is a major issue even if competition is beginning to make an impact.

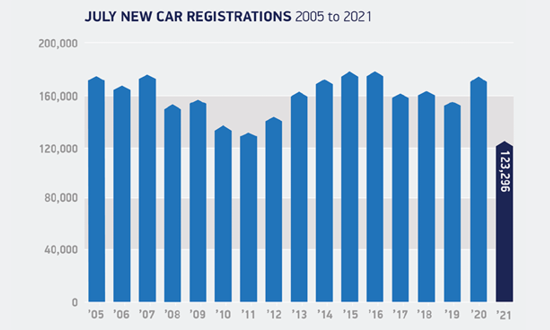

UK new vehicle registrations July 2021

Source: SMMT

EV ownership has exploded during lockdown and in July’s figures for new car registrations, almost 30% were electric and 20% more were what’s termed ‘mild hybrids’.

“Advisers and their clients need to be alive to other opportunities that this ‘Code Red’ situation might create.”

Tesla has remained steadfastly popular with investors but they’re also taking another look at traditional carmakers, judging that current issues with semi-conductors shortages are transient and the outlook over the next few years is one of decent growth as these companies take their own slice of the EV pie.

Advisers and their clients need to be alive to other opportunities that this ‘Code Red’ situation might create in what will have to be a pretty rapid reaction on the part of consumers and governments to avert a really serious climate crisis.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.