The old saying that buying higher-risk investments guarantees higher returns is one of investing’s biggest fallacies. If buying higher-risk assets ensured higher returns all the time, then they would not be high-risk, would they, because of the certain premium returns? The best way to get the best risk-adjusted return from a security is to pay a low valuation for it, because that hopefully manages the downside risk and leaves potential for upside. Advisers and clients do not get paid for taking risk in a willy-nilly fashion. They get paid by seeking out value, as part of their risk-management process.

“Alas, valuing a single company or an entire stock market is more of an art than a science and there is no ‘right’ answer, but one yardstick seems to be coming back into fashion after a lengthy period out in the cold.”

Alas, valuing a single company or an entire stock market is more of an art than a science and there is no ‘right’ answer, but one yardstick seems to be coming back into fashion after a lengthy period out in the cold.

This is the so-called ‘Rule of 20’ and it is getting a new airing because it makes inflation one of its key considerations when it comes to establishing whether a single stock or benchmark stock index is cheap, expensive or fairly valued.

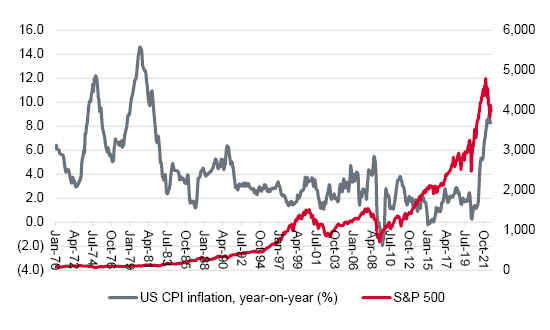

Is the latest surge in inflation a threat to equities in the USA …

Source: US Bureau of Labor Statistics for inflation data, Refinitiv data

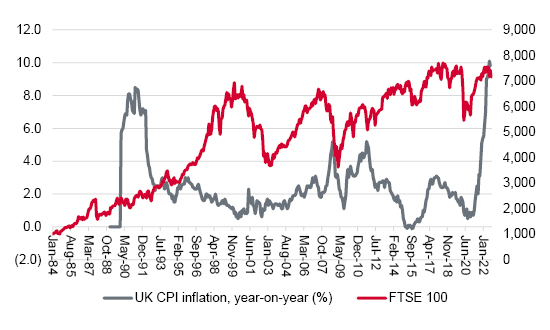

… and the UK?

Source: Office for National Statistics, Refinitiv data

The origins of the ‘Rule of 20’ are shrouded in mystery, but the legendary US fund manager Peter Lynch is thought to have been an active proponent when he was managing Fidelity’s Magellan fund with such distinction from 1977 to 1990.

“Lynch … argued that a fair multiple, or price, for a stock was 20 minus the rate of inflation (or, put another way, the rating plus inflation sum to 20).”

Lynch, also well-known for his assertion that the acronym IPO stood for ‘It’s Probably Overpriced,” argued that a fair multiple, or price, for a stock was 20 minus the rate of inflation (or, put another way, the rating plus inflation sum to 20). For example, if a stock or index was trading on 11 times earnings and inflation was 2%, then the theory would be that there could be some value to be had. Conversely, a market or company that was trading on 18 times earnings when inflation was 8% was seen as overvalued.

Advisers and clients could then debate whether it was best to use historic or forward (forecast) earnings, especially given the notorious unreliability of analysts’ forecasts, at least for cyclical and economically-sensitive industries, or stock markets and indices which are heavily reliant upon them for their earnings streams.

“The current rate of inflation in the USA is 8.3%, according to the US Bureau of Labor Statistics. Applying the Rule of 20 that means a fair price/earnings (PE) multiple for the US equity market is 11.7 times.”

The current rate of inflation in the USA is 8.3%, according to the US Bureau of Labor Statistics. Applying the Rule of 20 that means a fair price/earnings (PE) multiple for the US equity market is 11.7 times.

Oh, dear. The S&P 500 index stands, at the time of writing, at 3,901 and Standard & Poor’s analysis is looking for earnings per share of $210 for 2022. That implies a PE of 18.5 times, to suggest the US equity market is way, way overvalued – by as much as 35% to 40%, even assuming that a $210 earnings forecast is any good.

The situation looks a little less black if 2023 forecasts are used. S&P expect $240 in earnings next year, to put the S&P index on 16.3 forward earnings. That is still too high by some 30%, unless earnings forecasts start to rattle higher very quickly, or inflation starts to tumble. As discussed in this column, the bad news is earnings forecasts are leaking lower in the US right now, not sidling higher.

“In the UK, the prevailing rate of inflation is 9.9%. That implies the FTSE 100 should trade on 10.1 times forward earnings.”

In the UK, the prevailing rate of inflation is 9.9%. That implies the FTSE 100 should trade on 10.1 times forward earnings. For 2022, the FTSE 100’s £2 trillion market cap and 2022 consensus earnings forecasts for a net profit of £192 billion put the index on just 11.3 times forward earnings. For 2023, analysts’ aggregate net profit estimate for the FTSE 100 stand at £200 billion, to put the UK’s benchmark index pretty much at fair value – again unless earnings estimates rise, or inflation falls. Investors must decide for themselves whether either scenario is likely and therefore whether UK equities represent good value or not.

The reliability of, and volatility in, earnings forecasts again explains why this is more of an art than a science. If earnings boom, then US and UK equities may be cheaper than thought. A deep recession could mean that earnings collapse. That would bloat the earnings multiple, and be in itself deceptive, as it would give the adviser or client little means of pricing in what an earning recovery could look like.

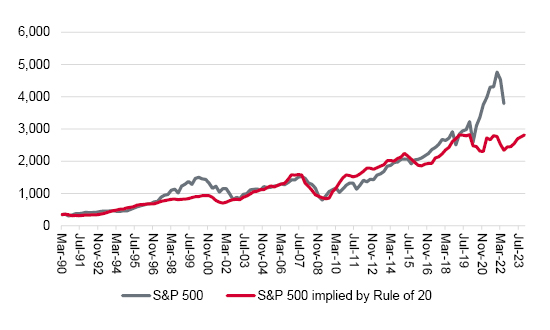

Nor can the ‘Rule of 20’ be seen as a clinical market timing tool. It suggested that US equities were overvalued from late 1997 but it took investors two (frenzied) years to get the message and the rule has been warning of danger since early 2020.

Rule of 20 suggests US equities are looking overvalued

Source: Standard & Poor's earnings forecasts, US Bureau of Labor Statistics for inflation data, Refinitiv data for S&P 500 index

“The methodology does at least permit advisers and clients to factor inflation into their thinking. It will also help them to understand why rampant inflation had such a devastating impact upon share price performance in the 1970s, when equities were viciously derated, and why disinflation proved such a powerful driver of stock market gains in the disinflationary 1980s, 1990s and 2010s.”

However, the methodology does at least permit advisers and clients to factor inflation into their thinking. It will also help them to understand why rampant inflation had such a devastating impact upon share price performance in the 1970s, when equities were viciously derated, and why disinflation proved such a powerful driver of stock market gains in the disinflationary 1980s, 1990s and 2010s.

"Past performance is not a guide to future performance and some investments need to be held for the long term.”

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.