Fresh allegations from the International Consortium of Investigative Journalists (ICIJ) about money laundering at HSBC and Standard Chartered, among other leading global banks, may pertain to wrongdoing which is already covered by previously-paid regulatory fines, according to the lenders themselves. But even if that is the case, the story gives the market another reason to wonder whether banks stocks are worth the bother, given their complex business models, the danger that loan books are harbouring a lot of debt that might be about to go sour if the economy turns down again and the threat posed by central banks’ monetary policy.

This is not how central banks see it. They argue that cutting interest rates and Quantitative Easing (QE) lower borrowing costs, creating demand for loans and credit that keep economies going.

“Central banks argue that cutting interest rates and Quantitative Easing (QE) lower borrowing costs, creating demand for loans and credit that keep economies going. But equity markets are clearly not convinced, especially when it comes to banking stocks.”

But equity markets are clearly not convinced. Within the FTSE 350, banks are the third-worst performing sector over the last 12 months (ahead of only Oil Equipment & Services and Oil & Gas Producers) and the second-worst over 10 years (beating just Oil Equipment).

This is also a serious matter for advisers’ and clients’ fund selection strategies when it comes to their strategic allocation to UK equities.

“This is a serious matter for advisers’ and clients’ fund selection strategies when it comes to their strategic allocation to UK equities, whether they are using actively-managed or passive funds.”

From a passive, index-tracker perspective, the Big Five FTSE 100 represent 7% of the FTSE 100’s market capitalisation and, according to consensus analysts’ forecasts, are set to generate 12% of the index’s 2021 profits and 14% of its dividends.

Any advisers and clients who have been looking to go against the flow and look for ‘value’ or ‘event-driven’ funds may well find some banks are prominent in there, too. After all, taking their accounts and analysts’ forecasts at face value, the Big Five all trade at less than 0.5 times book value and offer prospective dividends yields in excess of 5%. In sum, such numbers imply the banks are either in bargain basement territory or epic value traps.

FTSE 100 banks are either deep value or value traps

Source: Company accounts, Sharecast, consensus analysts’ forecasts, Refinitiv data

The problem, at least in the near term, is finding a catalyst that may unlock the value that is implied by those lowly book-value multiples.

Low central bank base rates drag down the interest rates that banks can charge on loans. QE is designed to flatten out borrowing costs, too, so that credit spreads (the premium in interest rate paid by a company to a government) are also relatively narrow.

“The net interest margin on banks’ loan books is under fierce pressure, seriously undermining banks’ profitability and their ability to earn decent returns on equity.”

The net result is that the net interest margin on banks’ loan books is under fierce pressure, seriously undermining banks’ profitability and their ability to earn decent returns on equity.

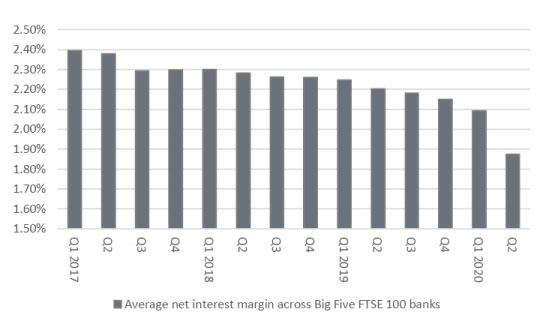

An average decline in the net interest margin across the Big Five FTSE 100 banks of 52 basis points (0.52 percentage points) since Q1 2017 might not sound a lot. But that represents a 22% drop in the lending margin and on their current aggregate loan books of £2.2 trillion. That is the equivalent of £10 billion in interest a year – profit which could have been used to make fresh loans, perhaps, buffer balance sheets or even pay dividends to shareholders.

Big Five FTSE 100 banks’ lending margins are under pressure…

Source: Company accounts

Some advisers and clients could be forgiven for thinking that the Bank of England’s monetary medicine is making banks feel worse, not better.

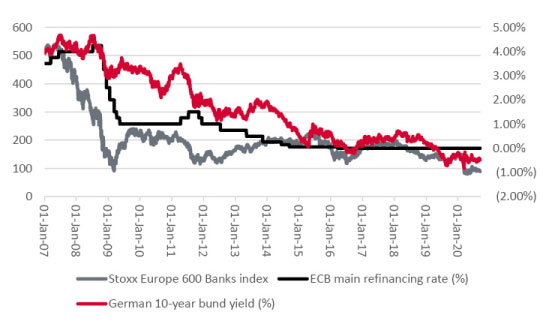

… and lower rates and lower bond yields could be a culprit

Source: Refinitiv data

This trend is evident elsewhere. In Europe, the European Central Bank has been tinkering with zero interest rates (and negative deposit rates) for some time, to no great effect so far as its 2% inflation target is concerned, but with deleterious consequences for banks’ profits and the returns on offer to their equity holders.

Investors in banks in Europe are already accustomed to this punishment…

Source: Refinitiv data

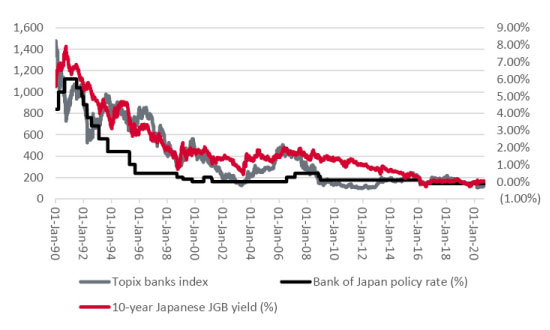

Unfortunately, advisers’ and clients’ chosen fund managers who have built hefty exposure to banks had already been warned of what might come their way. After all, the Bank of Japan has been fighting the effects of the bursting of a debt-fuelled stock market and property bubble since 1990, some 17 years before a similar fate befell the UK, Europe and America. The effects of three decades of QE and zero interest rate policy (ZIRP) upon Japanese banking stocks are all too clear to see, and the Bank of Japan’s record of promoting consistent economic growth and 2% inflation, in line with its target, is spotty at best.

… as are those who have tried (and failed) to call the bottom in Japanese banks

Source: Refinitiv data

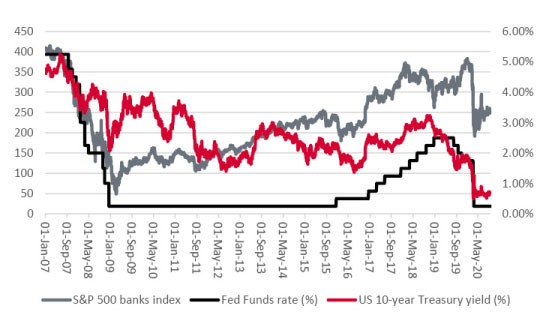

Only US banking stocks have shown any real signs of life in the past few years but the pandemic, a recession and the reversal of Fed policy from tightening to easing appear to have taken care of that in 2020.

Falling bond yields have begun to chip away at US bank stocks too

Source: Refinitiv data

“The disconnect between the market cap weighting and the estimated profit and dividend contribution means that either the FTSE 100 banks are too cheap or the market doesn’t believe the analysts’ forecasts for 2021.”

The disconnect between the market cap weighting and the estimated profit and dividend contribution means that either the FTSE 100 banks are too cheap or the market doesn’t believe the analysts’ forecasts for 2021.

The experience of America’s banks suggests that their profits and share prices need rising bond yields, as that may help lending margins, so that may be the catalyst that contrarian value seekers (or even passive buyers of the FTSE 100 index) crave, although what it could do to their loan books when it comes to sour loans and impairment charges is another matter.

Economic growth and (some) inflation would be potential triggers for bond yields to rise. Central banks continue to strive for both, and ECB President Christine Lagarde and Fed Chair Jay Powell are now calling for further fiscal stimulus to help.

Perhaps the combination of government spending and ultra-loose monetary policy will save the day, at least so far as the banks are concerned. But until governments sanction more spending and higher deficits, banking stocks may continue to recoil from central bank policy statements which promise low interest rates for longer or even the dreaded prospect of negative interest rates, to the detriment of individual bank stocks and perhaps the wider FTSE 100 index.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.