The UK’s economic performance, and the returns from its leading stock market indices, continue to attract plenty of brickbats.

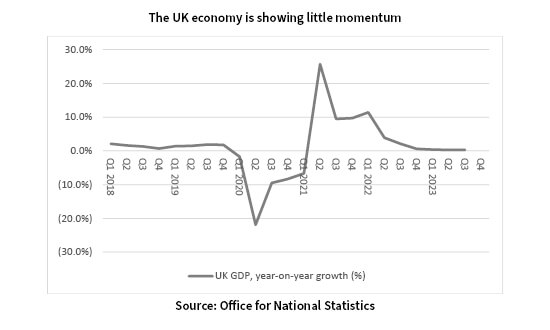

The economy looks to be stagnating, if the Office for National Statistics’ numbers are anything like a reliable guide. Although that is a debate for another day, four consecutive quarters of year-on-year growth below 1% do not inspire confidence, especially if you share this column’s view that life begins to the left of the decimal point.

The UK economy is showing little momentum

Source: Office for National Statistics

Meanwhile, the FTSE 100 is just 7% higher than it was at the turn of the last century, after twenty-three years’ huffing and puffing. (The total return of 159% is a little more like it, but even that equates to a compound annual growth rate of just 4%).

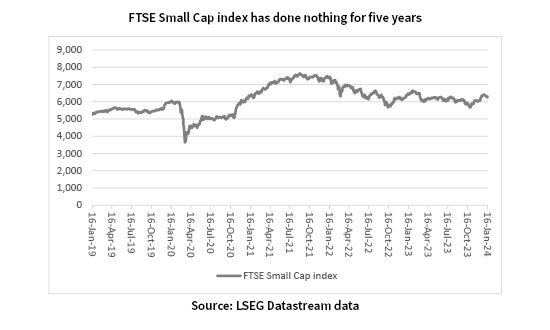

It is possible to accentuate the positive. Since 31 December 1999, the FTSE Small Cap has put up a much better show, as it has doubled in value.

“The FTSE Small Cap’s index is broadly consistent with the trajectory of the UK economy – a slump in 2020, when COVID-19 and lockdowns hit output hard; a dramatic recovery as the Government and Bank of England liberally applied fiscal and monetary stimulus; and then a gradual return to trend (?) as the bills for that ‘free’ money appeared in the form of higher taxes, higher interest rates and higher input costs (inflation).”

But even here the sceptics have been handed ammunition, as this benchmark had made almost no progress at all over the past five years. The FTSE Small Cap’s index is broadly consistent with the trajectory of the UK economy – a slump in 2020, when COVID-19 and lockdowns hit output hard; a dramatic recovery as the Government and Bank of England liberally applied fiscal and monetary stimulus; and then a gradual return to trend (?) as the bills for that ‘free’ money appeared in the form of higher taxes, higher interest rates and higher input costs (inflation).

FTSE Small Cap index has done nothing for five years

Source: LSEG Datastream data

“The Small Cap malaise may therefore fit with the narrative of British economic woe. But advisers and clients should note that small cap stocks are making heavy weather of it on a global basis, too.”

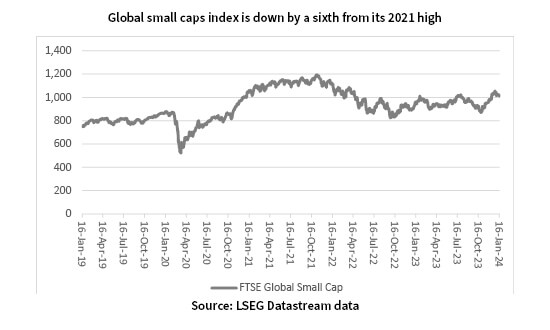

This makes sense, because small caps are more likely to be attuned to local economic events rather than global ones: they are younger in their development, so will have less breadth in terms of product, less depth in terms of management and less reach in terms of geography. The Small Cap malaise may therefore fit with the narrative of British economic woe. But advisers and clients should note that small cap stocks are making heavy weather of it on a global basis, too.

This is potentially less good news. Sliding small caps may (just about) fit with the prevailing narrative of a cooling in inflation, a ‘soft’ economic landing and a pivot to interest rate cuts from central banks. But if the gentle slide picks up pace, it may be suggestive of a harder landing. Equity and bond markets may therefore get the rate cuts for which they are baying, but for the ‘wrong’ reason, namely a sharp economic slowdown (or even a ‘hard’ landing).

The FTSE Global Small Cap index, which comprises 5,873 stocks with an average market capitalisation of $1.3 billion, is down by a sixth from its autumn 2021 peak. Industrials and technology are the two largest sectors by weighting, at 16% and 13% respectively.

Global small caps index is down by a sixth from its 2021 high

Source: LSEG Datastream data

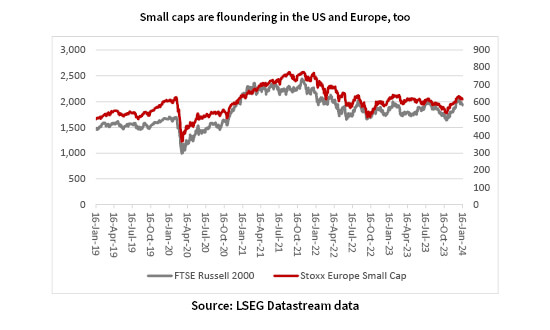

The global benchmark has a 61% weighting toward the USA and advisers and clients could be forgiven for thinking this should help. It clearly does not, and that may raise some questions over the health of the US economy, too. The official GDP numbers, powered largely as they are by federal Government spending, look good, but perhaps the foundations are not as strong as they seem. The inability of America’s main small cap index, the Russell 2000, to challenge former highs is a potential concern and the index is actually down by a fifth from its 2021 zenith, to leave it technically in a bear market.

“The picture is no better in Europe either, where the small caps are also down by more than 20% from their highs and making little fresh headway for good measure.”

The picture is no better in Europe either, where the small caps are also down by more than 20% from their highs and making little fresh headway for good measure.

Small caps are floundering in the US and Europe, too

Source: LSEG Datastream data

Any fresh upward momentum in small caps stocks on either side of the Atlantic could therefore be a positive sign. But the current weakness throws into even greater relief, from a US and global perspective, the role of the Magnificent Seven of Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA and Tesla, all of whom bask in the glow of the market’s current enthusiasm for Artificial Intelligence (AI), to one degree or another. They equate to 30% of the S&P 500’s $40 trillion market capitalisation between them and their rise is doing much to support gains in the broader index. The rise of the US is, in turn, boosting broader indices such as the FTSE All-World benchmark.

“Similarly bifurcated markets were evident in 1967-68 (when technology and growth stocks were all the rage), 1970-73 (the ‘Nifty Fifty’) and 1998-2000 (technology, media and telecoms companies). All three booms ended with busts, and with all of the gains in the headline indices wiped away.”

Similarly bifurcated markets were evident in 1967-68 (when technology and growth stocks were all the rage), 1970-73 (the ‘Nifty Fifty’) and 1998-2000 (technology, media and telecoms companies). All three booms ended with busts, and with all of the gains in the headline indices wiped away. It was possible to make good money on each occasion, none of which were a flash in the pan. But no-one rang a bell when it was time to get out and anyone who just held on finally had to give best to the market’s Cassandras.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.