The FTSE 100 continues to paddle gently sideways – it is summer after all. The UK’s benchmark index has gone nowhere since May and still stands around 10% below its May 2018 peak of 7,779.

“The vagaries of the FTSE 100 should not cloud the good news elsewhere. The FTSE 250 and FTSE Small Cap indices trade at an all-time high and the FTSE AIM All-Share is very close to doing the same.”

Yet the vagaries of the FTSE 100 – with its exposure to the some of the more unpredictable (miners and oils), indigestible (banks) and stodgy (drinks, tobacco, food retailers) sectors –should not cloud the good news elsewhere. The FTSE 250 and FTSE Small Cap indices trade at an all-time high, the FTSE AIM All-Share is very close to doing the same and the FTSE Fledgling is not far away from its loftiest mark since 2017.

Farther afield, the America’s S&P 500 and NASDAQ Composite and Europe’s Stoxx 600 also stand at fresh all-time peaks.

“Yet five tried-and-trusted tests of market sentiment look a little less conclusive than you might expect, which may be something to bear in mind given how elevated valuations are in certain arenas, notably the US.”

So rather than focus on the rather misbegotten FTSE 100, advisers and clients should perhaps look at the wider picture – and then ask themselves whether the good news can keep rolling or whether something is about to sneak up on them and derail global equities’ momentum. Regular readers will know that this column has five tried-and-trusted tests for this and intriguingly all of them look fairly inconclusive right now. Put another way, they do not shout out that a fresh bullish surge is a certainty, which may be something to bear in mind given how elevated valuations are in certain arenas, notably the US.

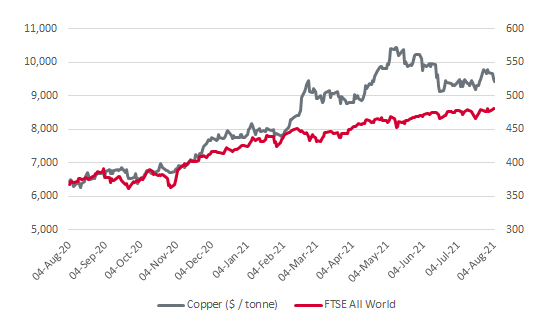

1. Dr Copper. The industrial metal is so called because its malleability, ductility and use in everything from cars to housing to domestic appliances make it a great barometer for global economic health. Copper’s stunning surge over the past year looks to be fizzling out a little, as the metal is 10% off its highs. A fresh advance in copper would help to reaffirm advisers’ and clients’ faith that the inflation/reflation trade is the right one, while further weakness would raise fears of an economic slowdown or even the worst of all worlds: stagflation.

Dr Copper is losing a little shine

Source: Refinitiv data

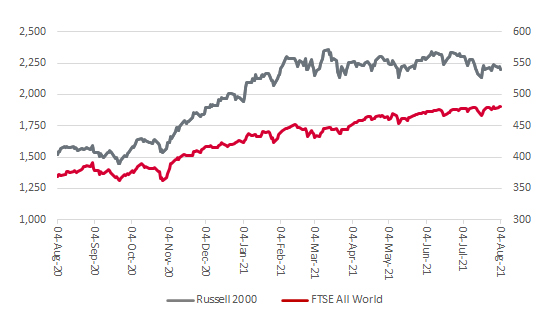

2. Small caps. Market minnows are an excellent indicator of risk appetite – they tend to outperform when advisers and clients are bullish and fall faster than the broader market when they are bearish. The UK’s FTSE Small Cap may be setting new highs, but America’s Russell 2000 is not.

US small caps have stopped making big strides

Source: Refinitiv data

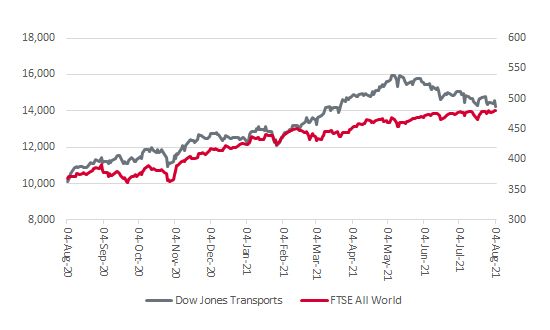

“It is therefore of some concern to see America’s Dow Jones Transports brushing up against the buffers. Bullish advisers and clients will feel happier if transports can start steaming higher once more.”

3. The transportation indices. The old theory goes that if the transports are not performing, the industrials cannot do so either, as if nothing is being shipped, nothing is being sold. It is therefore of some concern to see America’s Dow Jones Transports brushing up against the buffers. Bullish advisers and clients will feel happier if transports can start steaming higher once more.

Transport stocks have run into the sand

Source: Refinitiv data

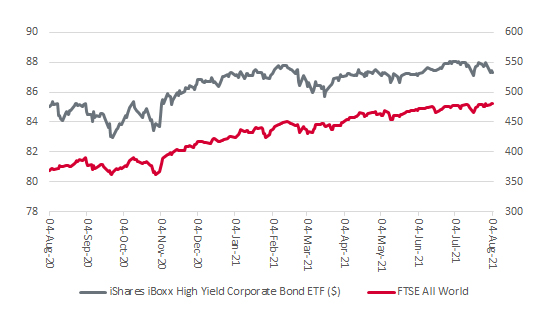

4. Junk bonds. High-yield bonds lie at the riskier end of the fixed-income spectrum as their more pejorative name of ‘junk’ bonds would suggest. The issuers have creaky balance sheets, volatile cash flows or both, and they need to pay a higher coupon as a result to attract buyers of the paper. They can trade a bit like equity, such is their risk profile, so bulls of stock markets will be pleased to see the US-listed iShares iBoxx High Yield Corporate Bond ETF (HYG:NYSE) performing well. This may be down to the ongoing reach for yield in a low-rates world, but the tracker is trading near six-year highs and is not close to going below the $80 level, a move which proved to be a harbinger of wider market volatility in 2008, 2015 and 2020.

Junk bonds continue to perform well

Source: Refinitiv data

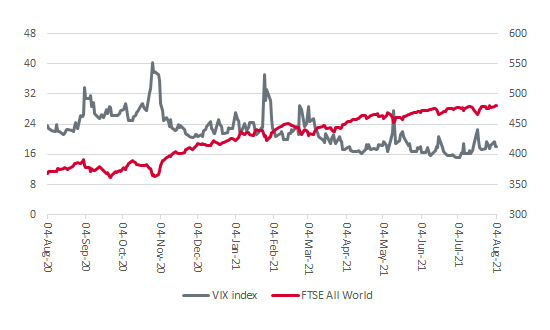

“The VIX is creeping up, just as copper and the Transports are creeping down. This may just be a case of summertime lassitude, but it could be a sign that something is about to give the bull equity market its latest test.”

5. Volatility. Volatility can be the friend of the adviser or client – it can provide chances to sell stock expensively or buy it cheaply – but history shows that stock indices progress best when they make serene progress and a series of modest gains tend to fare less well when trading is choppy and there are big swings up and down. America’s VIX, the so-called ‘fear index’, stands well below its lifetime average of 19, which points to bullish sentiment. Equally, the reading is creeping up, just as copper and the transports are creeping down. This may just be a case of summertime lassitude, but it could be a sign that something is about to give the bull equity market its latest test, be it inflation, the pandemic, central bank policy or (more likely) an exogenous event.

The VIX index is creeping higher

Source: Refinitiv data

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.