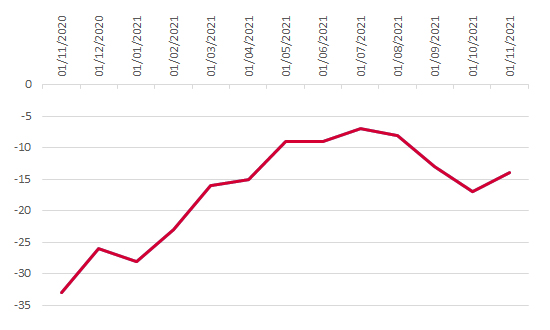

A confident consumer spends cash and drives economic growth. When that confidence is shaken by, for example, rising prices, then people tend to save rather than spend, restricting that growth. So, the latest GfK consumer confidence survey might have surprised some investors.

The numbers had been falling since August as energy and food costs shot away in the other direction and there were growing concerns about rising cases of COVID particularly in some parts of Europe. But whilst consumers are concerned about their day-to-day personal financial health, despite all the tailwinds, Christmas has come early.

Christmas boosts consumer sentiment

Source: Refinitiv

“Investors are consumers too and it’s not just sprouts they’re willing to pay more for if they’re confident about their financial futures.”

Forewarned about the prospect of shortages on the shelves, would-be Santa’s have shopped smart and that spend can be seen in October’s retail figures as well as the UK’s latest consumer confidence update. After 2020’s disappointment, it seems 2021 is on track to be a Christmas with all the trimmings as people reconnect with family and friends – but how long will the festive glow last?

The answer to that question is something investors need to pay heed to, because of the correlation between consumer confidence and stock market valuations. Investors are consumers too and it’s not just sprouts they’re willing to pay more for if they’re confident about their financial futures.

Add to that the issue of company revenue; wavering consumer confidence means less consumer spend, and that equation can potentially lower profits. If these latest figures are a blip, which seems more than likely, and the overall trend continues, then we are in for some tough months ahead.

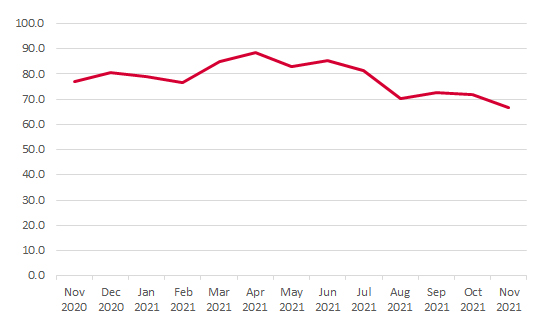

“Rather like here in the UK, there have been many positive factors keeping the economy rolling Stateside – including rising wages, a healthy labour market and COVID savings. But rising prices are gradually eroding that optimism...”

US consumers feel the inflation burn

Source: University of Michigan Consumer Sentiment Index

It’s not just in the UK where the consumer has been flagging; the latest figure from the US put consumer sentiment at a 10-year low. Rather like here in the UK, there have been many positive factors keeping the economy rolling Stateside – including rising wages, a healthy labour market and COVID savings. But rising prices are gradually eroding that optimism, living standards are taking a hit and many people expect any extra they might have accrued over the last year will be wiped out by inflationary pressures.

And whilst London markets have had a long, slow trek back to form, US markets keep hopping from record high to record high, and here there does seem to be a distinct disconnect between buoyant investors and the consumer.

But even if UK markets do appear more grounded in the ‘here and now’, there are still questions about how much investors have really priced in the changes anticipated over the next few months.

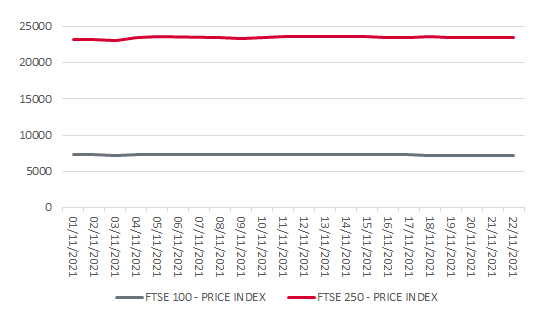

UK market movements

Source: LSE

“When you look at the fortunes of the FTSE 100 since close of play on 4 November, three fifths of its constituents have seen share prices rise.”

Despite all the uncertainty and with an anticipated, if later than advertised, rate rise on the cards, the FTSE 100 clawed its way back to pre-pandemic levels earlier this month. And even though outlook after outlook from UK companies seems to have contained a warning about rising prices and labour and supply shortages, when you look at the fortunes of the FTSE 100 since close of play on 4 November, three fifths of its constituents have seen share prices rise.

Here again consumer confidence comes into play, as both Japan and China have reported strong figures this month.

But whilst London’s blue-chip index can take heart from Asia, the FTSE 250 is beginning to show signs that investors are paying attention to what’s going on closer to home. Less than half of companies in the index have made positive gains since the Bank of England hold. Amongst those losing ground are many travel and tourism stocks, including TUI, EasyJet and Wizz Air; cash-strapped consumers won’t have the confidence to book ahead, and clearly COVID concerns have also played a part. And though retailers are enjoying their moment in the golden quarter, even Marks and Spencer’s sparkle might start to dim once the rush of gift buying runs its course.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.