I left it ridiculously late to book a restaurant for a Mother’s Day meal. Everywhere I tried couldn’t fit me in – enjoying the felicitous meeting of fantastic weather and one of the industry’s biggest money-making moments. Despite the well-documented pressures beginning to exert themselves on consumer spending people were out in their droves, and looking at the latest credit card spend data it’s clear this weekend wasn’t an anomaly.

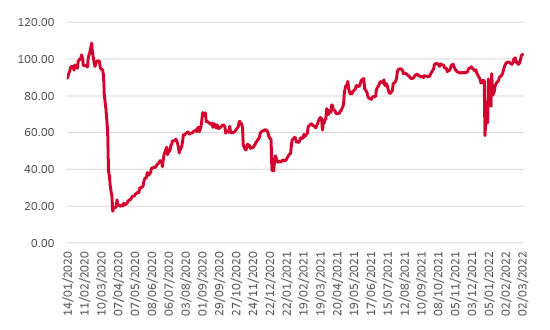

The latest credit card data shows socialising spend was back at pre-pandemic levels in February and early March

Source: Office for National Statistics and Bank of England calculations

For the first time since before the pandemic people have found the confidence to get out and socialise up a storm. There may have been more than a few postponed Christmas parties to bolster the numbers, but the end of Covid restrictions has signalled a sea-change and one the beleaguered hospitality sector will do its best to cling onto. But it’s got a whole load of headwinds to battle against, not least of which is that cost-of-living crisis which has driven the share price of almost all bar and restaurant operators significantly lower since the start of the year.

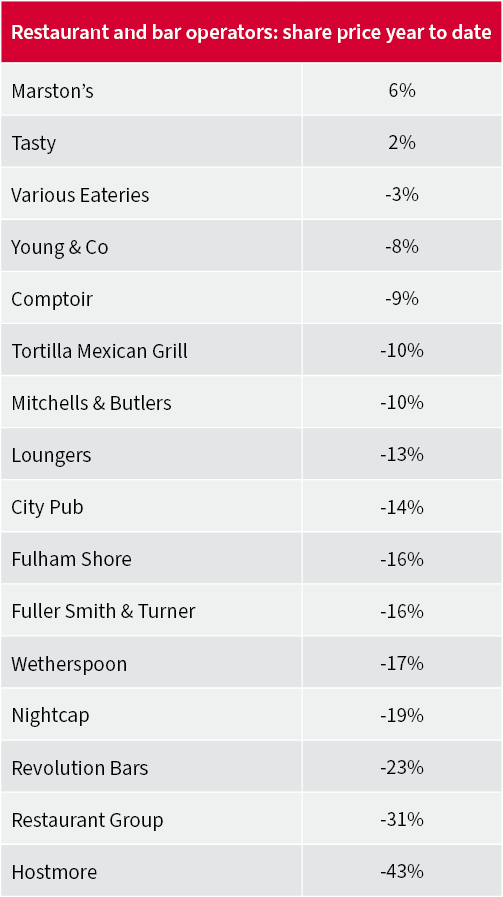

"Investors are nervous, considering how inflationary pressures will impact the earnings potential of an industry trying to get back on its feet".

Restaurant and bar operators: share price year-to-date

Source: SharePad, data as at 28/03/22

Investors are nervous, considering how inflationary pressures will impact the earnings potential of an industry trying to get back on its feet. Prices are already rising with pub chain Marston’s reported to have tacked 45p onto every pint, and just a quick glance at any menu you pick up at the moment tells the same story. Shackled with extra wage costs, extra energy costs and extra costs everywhere else you might look businesses are making adjustments and hoping the hikes don’t put people off.

At the moment consumers seem to be prepared to pay a premium to “live” again. The opportunity to break bread with friends, family and co-workers at a place that isn’t the kitchen table is a little intoxicating even without adding alcohol, and though those drinks cost substantially more than they would if they’d been bought at the supermarket the added extras seem to be worth the extra pennies. The latest retail sales figures produced by the Office for National Statistics showed a drop in instore food and drink sales in February, with speciality stores hardest hit as consumers made difficult choices about where to spend their cash.

"The hospitality sector is worried, particularly as the cut in VAT at the pump precedes an increase in VAT at the bar".

But February can only hint at what’s to come. With inflation now standing at 6.2%, and warnings that this year will deliver the fastest drop in living standards households have experienced since the mid 1950’s, discretionary spend is going to become a whole lot less discretionary. This month is expected to be a tipping point as the big jump in energy prices finally filters through to the retail market. That jump is a legacy issue, but it comes as the war in Ukraine is adding to cost pressures, and measures announced by the Chancellor to help households cope aren’t expected to make much of an impact.

And the hospitality sector is worried, particularly as the cut in VAT at the pump preceeds an increase in VAT at the bar. The irascible boss of Wetherspoons might know how to work a good soundbite but his warning that the return of 20% VAT on hospitality spend is a form of discrimination has struck a chord with many in the industry. Consumers might have been able to pay more to go “out out” in February, but will that be true by the end of April?

The industry had clearly started the process of digging itself out of the hole Covid had knocked it into".

Whilst the retail sector has been able to cope fairly effectively with lockdowns by shifting online, bars and restaurants weren’t able to pivot so successfully and losses have piled on top of losses. The industry had clearly started the process of digging itself out of the hole Covid had knocked it into (Wagamama, the jewel in the Restaurant Group’s crown, reported like-for-like sales for the eight weeks to the end of February were up 21 per cent) but there are already warnings from industry insiders that the cost-of-living crisis could turn out to be a “second pandemic” for the sector.

There are a couple of things for advisers and investors to consider before writing off the sector altogether for the time being. First, people have been starved of much of the joy life has to offer over the last two years and socialising will remain high on people’s list of priorities for some time to come. Second, a meal out might become an “affordable treat” especially if people have to shelve holiday plans or put off buying big-ticket items. And third, if the weather plays ball, especially over that lovely long jubilee bank holiday weekend, there will be a significant boost for venues with outdoor spaces, and Covid certainly made the sector think hard about outdoor spaces.

People are likely to cut back, they’re likely to go for one drink rather than two, a meal every other week rather than every week – so the much hoped for post-Covid boom is expected to be curtailed but not totally eroded.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.