The most common way people measure risk in portfolios is standard deviation, which is often simply referred to as volatility. But is this correct?

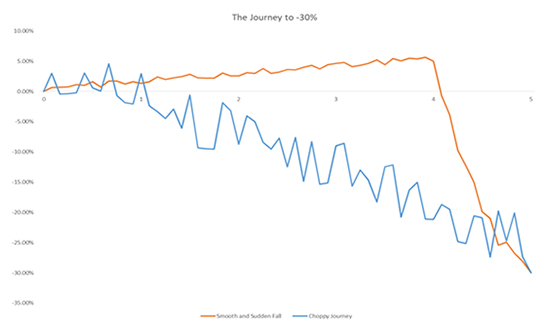

Let’s consider two investments, both delivering a return of -30% over a five-year period.

One has a very steady upward return before a sharp fall over the final year, whereas the other had a choppy time for the entire five-year period.

For illustrative purposes; AJ Bell Investments

As a long-term investor saving for retirement, the end result is a 30% loss of capital – equally bad, whichever path is taken.

The annualised standard deviation of the smooth path with the sudden drop is 6%. The choppy journey has a much higher standard deviation at 17%. However the ‘risk’ for both assets is the same.

The current volatility of the Bloomberg Barclays Gilt Index is 6%.

So what happens if gilt yields return to levels seen in recent history? As recently as April 2011, ten-year gilt yields were 3.5%. By August 2016, in the aftermath of the referendum vote, yields had fallen to 0.6%. Over this time period the Bloomberg Barclays gilt index returned 54.2%. With an average coupon of around 2.1% for the five-year period, over 40% of this return has come from capital appreciation.

Newton’s third law tells us for every action, there is an equal and opposite reaction. If yields return to 3.5% over a similar time frame, then you would see a 40% capital loss! This is because of the concept of duration. The coupons and final par value of a bond are fixed, so the only way for the bond to deliver the higher yield is for the price to fall. The longer the maturity of the bond, the more the price has to fall to deliver the higher required yield over its remaining life.

In 2000 the average maturity of all gilts in issue was 10 years. Following the financial crisis and the subsequent programme of Quantitative Easing, the government has had the incentive to secure cheap long-term funding by issuing long-term gilts. As at the end of Q1 2019 the average maturity had risen to 17 years. This means gilt prices are now much more sensitive to changes in yields. Historically a rise in yields may have led to modest capital losses. However a 30%+ capital loss over a short period of time is possible if we see a sharp rise in yields back to ‘normal’ levels.

The lesson is that for fixed income returns, which rarely follow a ‘normal’ distribution of returns, standard deviation is a very poor measure of the risk they present.

Using back testing to justify a position in long-dated gilts is like running half way across a battlefield of unexploded mines, and assuming the rest is safe because you have got halfway with no hitches. It is much like saying property prices never fall (until they do!).

It is true that the art to good portfolio construction is ensuring a mix of assets that will behave in different ways, especially in the shorter term. It is also true that over the last thirty years gilts have been the best way of achieving this. However, it is not the only way. Other protective assets can be used, such as safe haven currencies, alternatives or even defensive equities (which may be more fairly valued). One of the main reasons for smoothing the journey is purely a behavioural one – investors suffer from loss aversion, so avoiding losses even in the short term ensures they don’t make irrational decisions, such as selling all their investments.

One lever an investor can pull to reduce the capital loss that would be suffered from the return to normal yield levels is to shorten the duration. The positions would still suffer capital losses, but on a much smaller scale (around 5%). At the same time, it still does help to smooth the journey when equity markets fall, avoiding some of the negative investor behaviours this would lead to.

By keeping the asset allocation dynamic, rather than a fixed weighting in bonds and equities, a shorter-duration position can be taken into account when modelling asset allocation, ensuring other risk balancers such as cash, currencies and international fixed income are included in the right weights in portfolios.

Rather than asking if you should be short duration, it is perhaps easier to ask how you buy insurance. Do you just renew with the same company every year, even though the price of your premiums has been going up 10% a year, or do you search around – switching to cheaper insurance from another provider?

The current level of gilt yields is equivalent to overpaying for your insurance, so shop around and combine different asset classes together alongside shorter duration gilts to deliver the same level of protection, without the capital risk.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.