China's economic trajectory post-Covid has witnessed a downturn, particularly in the real estate sector, yet the country still maintains a decent GDP growth, albeit at a slower pace compared with pre-Covid times. Property-market-related activity accounts for a significant portion of China’s GDP, and the government has been attempting to reform the sector for much of the last five years, exemplified by the debt struggles faced by developers such as Evergrande. This has raised concerns in the market.

The global political landscape further influences China's economic outlook. With major elections looming worldwide, including notable developments like the wins in Super Tuesday, for Republican candidate, and former US President, Donald Trump, the potential for a 10% tariff on all US imports could reshape competitive dynamics. China, being both an exporter to the US and a global competitor, is bound to face repercussions which create further uncertainty.

To avoid all this uncertainty as long-term investors, we are not specifically targeting exposure to China nor are we making a call on its prospects relative to other countries within these regions. Some of the concerns about China surround its changing demographic profile, which we acknowledge, and the contrast that poses with other emerging markets. For the second consecutive year, in 2023 deaths in China surpassed births, raising questions about the long-term sustainability of the workforce and consumer base. Countries such as India with its younger workforce which could lead to higher potential GDP growth, help to balance these demographic risks within the indices. Hence, we implement our exposure via Emerging Market and Asia Pacific ex Japan indices, taking a broad approach that reduces country-specific risk and exposure.

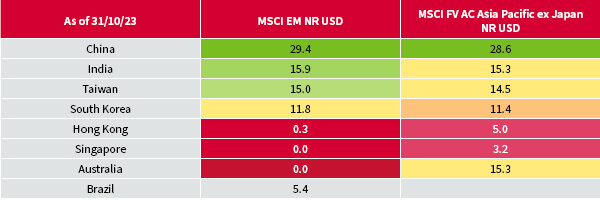

Indices offer a cheaper and more efficient way to implement our economic exposure to these regions. The indices we use automatically adjust our exposure based on changes in market capitalisation to ensure alignment with market trends based on a rules-based methodology. This systematic rebalancing mechanism of our index approach helps maintain the desired level of exposure to different markets while capturing opportunities for growth and managing risks effectively.

Overall, utilising indices streamlines our investment process, allowing us to focus on strategic and tactical asset allocation and delivering optimal outcomes for our clients. All the aforementioned concerns have resulted in a decrease in the China weightings of our portfolios over the past year. The poor performance of Chinese equities on absolute and more importantly relative bases has led them to becoming a smaller constituent of the Emerging Market and Asia Ex-Japan indices, having previously been the dominant force.

Source: Morningstar

Source: Morningstar

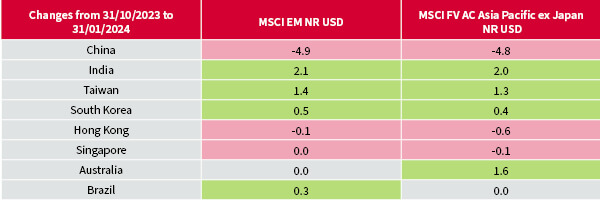

The exposure to China in the MSCI Indexes has reduced by more than 4% from 31/10/2023 to 31/01/2024, hence the allocation within portfolios has automatically decreased over the year. Within MPS 6 the standalone China exposure has been reduced to reflect this.

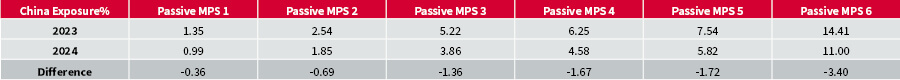

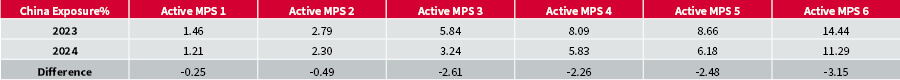

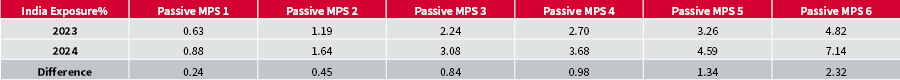

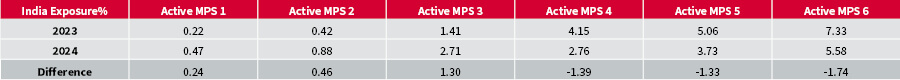

This reduction in Chinese exposure is evident across all Passive MPS categories, ranging from -0.36% to -3.40%. On the other hand, exposure to India has increased in the portfolios to balance this out.

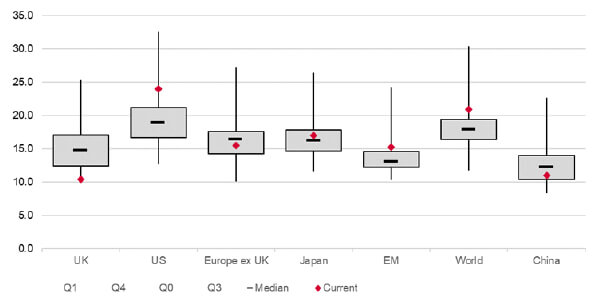

Despite the negative sentiment, there is a case to be made about attractiveness of China looking at the valuations. China is trading at 11.04x Price-Earnings Ratio compared to a historical average of 12.7x which some investors are seeing as a good opportunity to ‘grab it cheap’. On the opposite end of the spectrum, there's a prevailing debate suggesting that China's affordability is not without reason, especially in light of escalating geopolitical tensions and the potential for a global recession. With China maintaining a notably high gross domestic savings rate of around 46% of GDP, the discourse surrounding the role of savings in driving economic dynamics has been reignited. Some argue that this figure could significantly influence global interest rates and balance of payments, prompting deeper consideration of its broader impact.

Source: AJ Bell Investments, 20/02/2024

Investing always carries an inherent uncertainty, and attempting to time the market perfectly is a challenge that even the most seasoned investors face. Our portfolios are designed with the long term in mind; therefore, we do not reposition them based on the short- or medium-term outlook. Where the Investment Team sees an opportunity to enhance the risk-adjusted return, either by increasing the return or reducing the risk, a tactical adjustment may be made to the strategic asset allocation (SAA) otherwise our allocation via indexes automatically adjusts our exposure like in the case above. There are valid arguments on both sides of the debate posing a challenge in predicting if it will be the “year of the dragon” for Chinese markets, but with valuations low compared to history and global investors being significantly underweight, we remain comfortable having exposure, albeit balanced with exposure to the fast-growing Indian economy at the same time.

The Investment Asset brings together regular insights and literature updates from the Investments Team. As an asset in staying up to date with the latest news and analysis, the Investments Asset covers changing macro-economic trends, market updates and events from around the globe.

The value of investments can go down as well as up and your client may not get back their original investment.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.