Whatever the outcome of the banking wobble, which for now seems contained to US regional lenders and one badly run Swiss institution, one possibility is that it constrains lending and credit growth and hits the wider economy: amid the wider loss of trust, senior loan and credit risk officers may now be more wary to lend; banks may wish to keep more capital on their balance sheet for fear of deposit flight; and corporations in particular may be reluctant to take on more debt in an environment of higher bond yields.

Only time will tell whether these fears are borne out, but this discussion puts additional focus on the debate over whether inflation, deflation or stagflation is the ultimate outcome of the post Great Financial Crisis era, ultra-loose monetary policy experiments, a pandemic, trade wars and the worst physical war in Europe for more than seventy years.

Two months ago (17 Feb ’23) this column flagged how one of its favourite indicators, the Dow Jones Transportation index, looked like it had hit the buffers. Lo and behold, doubts over the overall health of the US economy have crept in and stock markets have become more volatile.

“The scenario priced in by the rally from last autumn’s lows – cooling inflation, lower interest rates and a soft landing (or no landing at all) – now feels less likely.”

This is because the scenario priced in by the rally from last autumn’s lows – cooling inflation, lower interest rates and a soft landing (or no landing at all) – now feels less likely. Five more indicators (aided by a sixth) may help advisers and clients spot what is coming next and allocate capital accordingly.

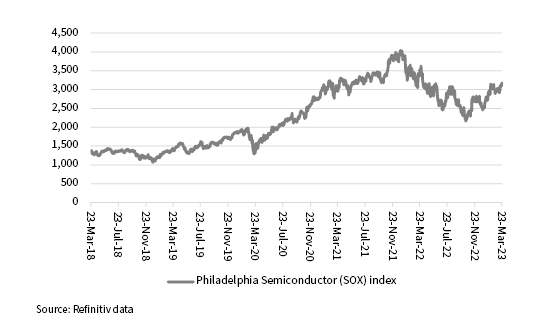

The first indicator is this column’s old friend the Philadelphia Semiconductor index, or SOX. The silicon chip industry is worth $600 billion a year and chips are everywhere from smartphones to cars and robots to laptops, while chip stocks are beloved by momentum players who feast off earnings upgrades and recoil from downgrades. The SOX was early to price in 2022’s recession fears. It now seems to be pricing in a renewed upswing in activity.

The SOX suggests better times lie ahead

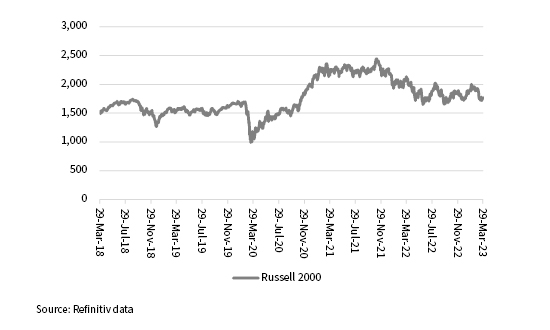

“America’s Russell 2000 is going nowhere fast to paint a less encouraging picture of the economic outlook for the world’s largest economy (and, by extension, for the rest of us).”

That could point to inflation, too, but at least it represents some good news. Small cap stocks seem far less convinced. America’s Russell 2000 is going nowhere fast to paint a less encouraging picture of the economic outlook for the world’s largest economy (and, by extension, for the rest of us).

Small caps are still struggling

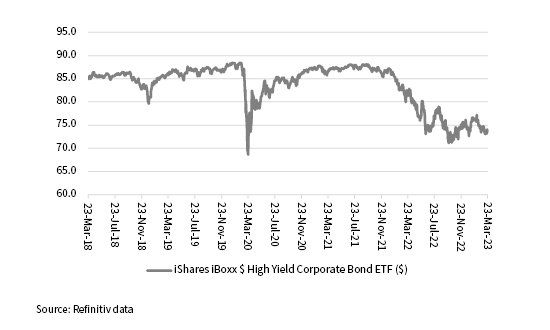

“This junk bond tracker has dipped below $80 only four times in its history – 2008 (Great Financial Crisis), 2016 (mid-cycle growth stumble), 2020 (COVID) and now. This suggests economic trouble, and perhaps rapid disinflation or even deflation, lies ahead.”

A darker picture still emerges from high-yield (or ‘junk’) bonds. Highly indebted firms are more geared into economic upturns (which boost cashflow and their ability to pay interest on time) and downturns (which have the opposite effect). The iShares iBoxx $ High Yield Corporate Bond ETF (HYG:NYSE) tracks and delivers the performance, minus its fees, of nearly 1,200 ‘junk’ bonds and it has a trading history that goes back to 2007. This junk bond tracker has dipped below $80 only four times in its history – 2008 (Great Financial Crisis), 2016 (mid-cycle growth stumble), 2020 (COVID) and now. This suggests economic trouble, and perhaps rapid disinflation or even deflation, lies ahead.

High yield debt is flagging trouble ahead

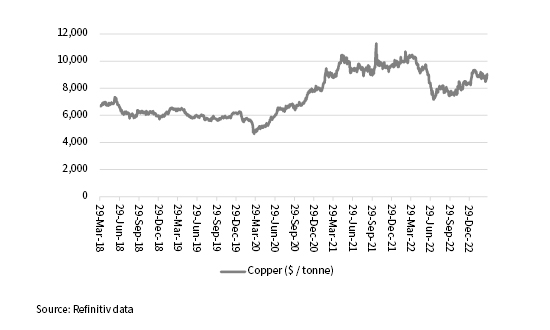

Better news comes from an industrial metal. ‘Dr. Copper’ is so called because it is seen as a good guide to global economic health, because its malleability, ductility and conductivity mean it has so many industrial uses, from cars to building construction to consumer goods. The metal is trading at almost $9,000 a tonne and rallying.

Dr Copper is pointing to inflation (or stagflation?)

However, that could also be indicative of the worst of all worlds – stagflation. The ETF which tracks long-dated US Treasuries seems to be frightened of this, looking at its soggy price chart.

US long-dated bond ETF seems preoccupied by stagflation

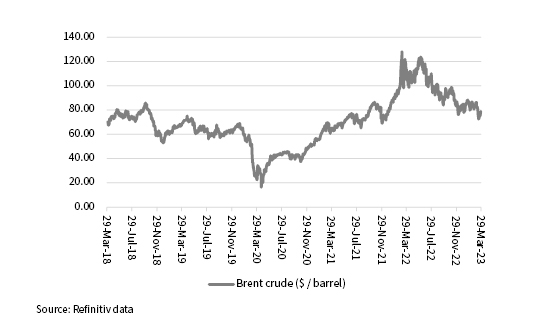

“The lower the price of crude goes, the less attention it gets, so if there is one nasty surprise lurking in the wings in 2023 a spike in oil would be it.”

Stagflation still seems the least likely outcome, but inflation is proving stickier than some economists had hoped. One other asset might have a big say in the ultimate outcome and that is oil. The lower the price of crude goes, the less attention it gets, so if there is one nasty surprise lurking in the wings in 2023 a spike in oil would be it, as it would thoroughly puncture hopes for a peak in inflation, rate cuts and a soft landing in one go.

Any rebound in oil could be difficult for markets to handle

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.