“Doubt is not a not a pleasant condition, but certainty is absurd,” is one of many valuable insights from eighteenth-century French thinker and writer Voltaire and right now investors have much to consider. No one, but no one, knows what is coming next – not even central bankers. If they did, the monetary authorities would hardly still be running policies that were described as emergency measures when they were launched in the wake of the Great Financial Crisis.

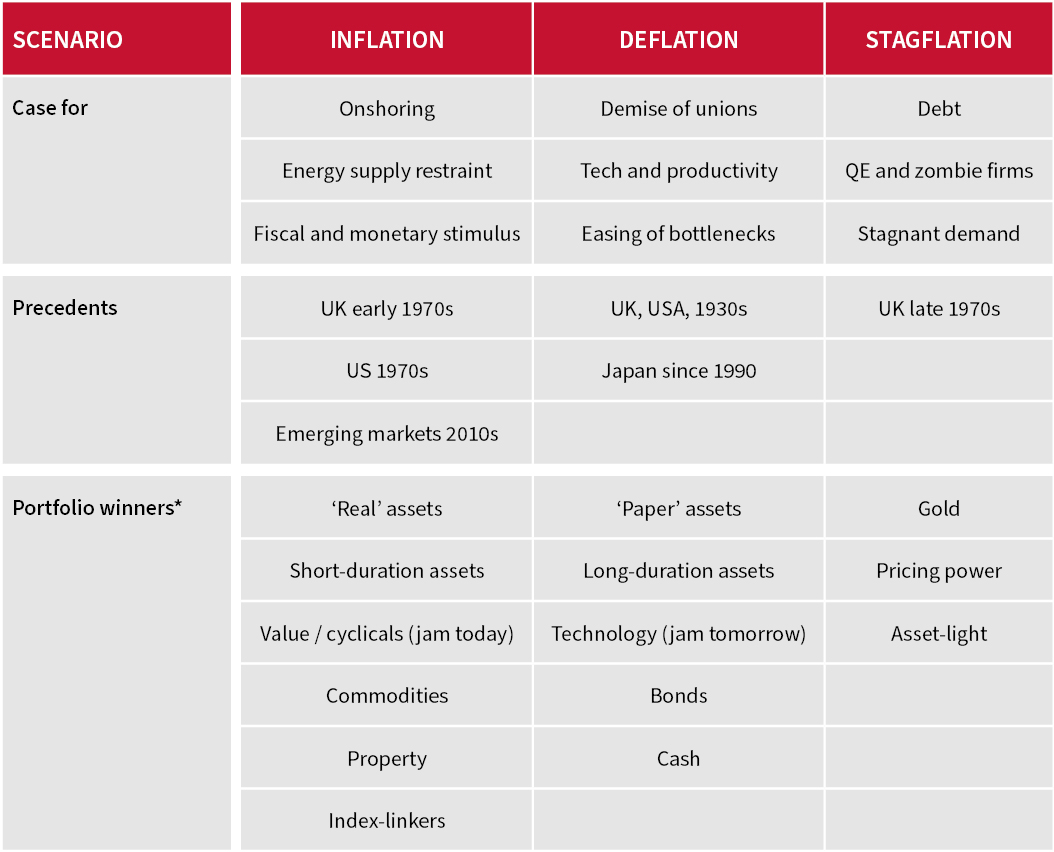

Possible outcomes include an inflationary boom, a deflationary slump or a stagflationary swamp, and the hard part is that each scenario potentially requires a different portfolio solution and asset allocation strategy, at least if history is any guide.

“It is easy to make a compelling case for any one of the three scenarios – inflation, deflation or stagflation – which could yet emerge from the combination of a pandemic, recession and supply-side destruction on one side, and massive monetary stimulus, fiscal stimulus and changes in working and consumption patterns.”

It is easy to make a compelling case for any one of those three scenarios.

Multiple possible outcomes are still possible

*Based on past performance only. The past is no guarantee for the future

“There are precedents for each of inflation, deflation and stagflation, to varying degrees, and advisers and clients can look back on those episodes for guidance as to which asset classes did best then – albeit in the knowledge that the past is no guarantee for the future.”

There are precedents for all three and advisers and clients can look back on those episodes for guidance as to which asset classes did best then – albeit in the knowledge that the past is no guarantee for the future. If it were, as Warren Buffett once noted tartly, “If past history is all there was to the game, the richest people would be librarians.”

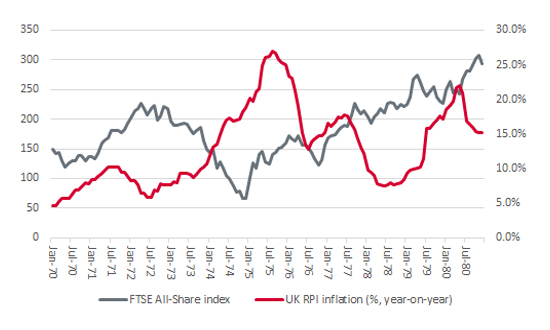

Inflation initially hit UK equities hard in the 1970s

Source: Refinitiv data, ONS

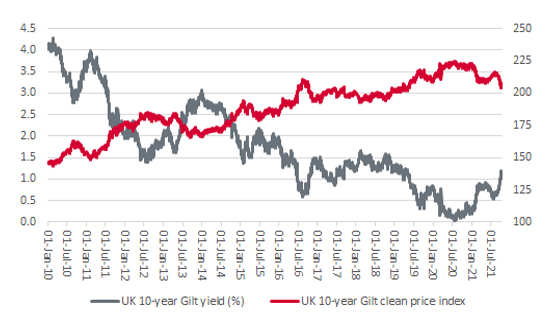

Has a long-term downtrend in bond yields (and uptrend in bond prices) finally broken?

Source: Refinitiv data

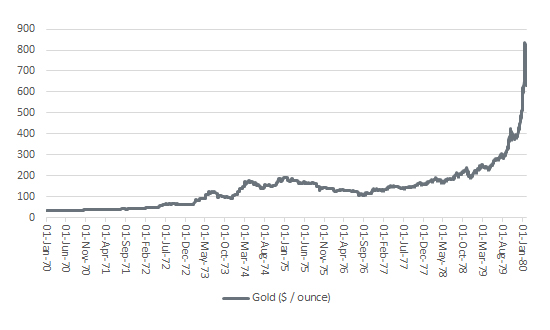

A repeat of the last 10 years’ low-growth, low-inflation, low-rates environment could also lead advisers and clients to stick with another asset class that has worked so well for the last decade, namely growth stocks – such as tech, biotech and social media. These firms are seen as capable of generating earnings growth almost regardless of the economic conditions and as such are highly prized and enjoy premium valuations as a result.Gold proved to be a store of value during the inflationary 1970s

Source: Refinitiv data

“No one knows what is coming. But we do know what markets are pricing in, because equities (‘paper assets’) have outperformed commodities (‘real assets’) hands down for a decade, with growth and tech stocks leading the way. That implies markets still have faith in central banks, see the current inflationary spike as transitory and believe the formula for the last decade will remain the same in the next one.”

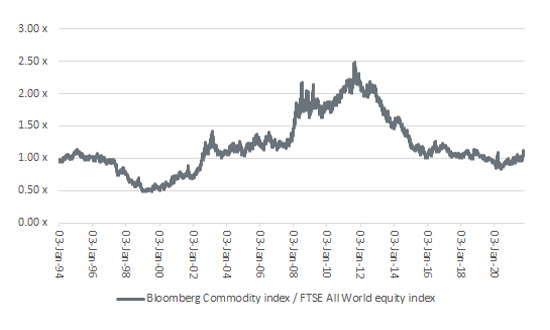

No one knows what is coming. But we do know what markets are pricing in, because equities (‘paper assets’) have outperformed commodities (‘real assets’) hands down for a decade, with growth and tech stocks leading the way. That implies markets still have faith in central banks, see the current inflationary spike as transitory and believe the formula for the last decade will remain the same in the next one. The gradual resurgence of commodities relative to equities must therefore be watched, as this suggests doubts are starting to appear.

Are commodities poised to outperform equities after a decade of underperformance?

Source: Refinitiv data

That could come to pass. But if nothing else, advisers and clients know that any deviation from that path, in the form of inflation or stagflation, could cause volatility and see different asset classes come to the fore.

A portfolio that prepares for all three scenarios via diversified asset allocation might be a plan to consider, complete with some cash for downside protection and scope to buy amid any wider shakedown, even if the adviser or client may then choose to tilt that allocation to the scenario they feel is most likely.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.