As inflation in the USA reaches its highest mark in three decades, central banks look back on 94 interest rate rises worldwide in 2021 and scientists, politicians and medics alike debate the potential impact of Omicron in their particular spheres, investors have plenty to ponder – especially as a busy slate of initial public offerings, plentiful merger and acquisition (M&A) activity and froth in areas such as non-fungible tokens seem all too reminiscent of events which the history books say characterise the final stages of a bubble.

No-one, not even central bankers, knows what is coming next, and whether inflation, stagflation or deflation will result from the combination of the pandemic, lockdowns and supply-chain chaos on one side, and massive amounts of fiscal and monetary stimulus designed to boost demand on the other.

Going “all in” on one scenario is probably not going to be a good idea and portfolio construction will need to address a range of outcomes, as frankly anything is possible (especially given the likelihood of central bank and Government

interferenceaction).

Going “all in” on one scenario is probably not going to be a good idea and portfolio construction will need to address a range of outcomes, as frankly anything is possible (especially given the likelihood of central bank and Government interference action). Keeping an eye on the following charts – and investment decisions – may help investors sense which way the wind is blowing so they can try to obtain the best possible risk-adjusted returns for their portfolios.

For want of a better turn of phrase ‘growth’ has outperformed ‘value’ for the thick end of a decade, thanks to the prevailing, low-growth, low-interest-rate, low-inflation fog which has enveloped the globe.

If that environment persists, firms which are seen as capable of providing secular trends increases in sales, profits and cashflows (or maybe even just the first one) will remain highly prized. If it changes, and inflation and strong nominal GDP growth take over, then there would be no reason to pay high multiples for secular growth when cyclical growth (or ‘value’) would be available at much lower valuations. Industrials and banks could then lead the charge.

“Value’s latest attempt for glory is petering out a little, perhaps owing to worries over COVID variants and the effects of higher prices and clogged supply chains on economic activity.”

One way of measuring whether this shift in leadership is happening is by comparing the performance of the Invesco QQQ Trust (QQQ:NYSE), packed with growth stocks, against the iShares Russell 2000 Value ETF (IWN:NYSE). If the line goes up, value is doing better, and vice-versa. Value’s latest attempt for glory is petering out a little, perhaps owing to worries over COVID variants and the effects of higher prices and clogged supply chains on economic activity.

Will ‘value’ finally end its underperformance relative to growth?

Source: Refinitiv data

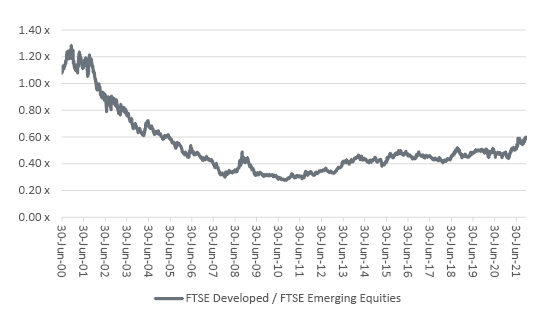

Emerging markets dominated for the first decade of this millennium but developed ones have subsequently ruled the roost. Demographics, debt-to-GDP ratios and the possible trend toward ‘onshoring’ in the West are all factors here but it seems reasonable to expect export-driven emerging markets to fare relatively well if global growth rates pick up. Any attempts by China to loosen monetary policy and stoke growth could also help emerging markets, where the Shanghai market has a big weighting.

Will ‘emerging’ markets come back into fashion?

Source: Refinitiv data

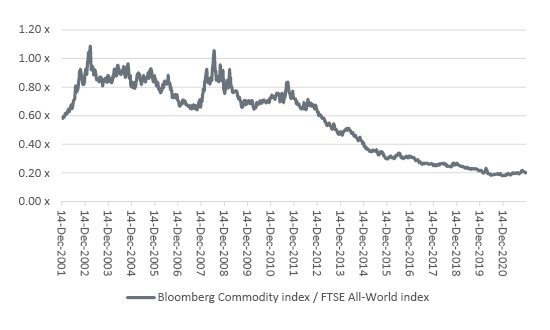

Looking at the relative performance of the Bloomberg Commodity and the FTSE All-World (equity) index, commodities and ‘real’ assets outperformed between 2000 and 2010 but equities and ‘paper’ assets have dominated since.

“If inflation (or maybe stagflation) take hold, ‘real’ assets could come to the fore, relative to paper ones such as bonds or equities, for three reasons.”

Again, this trend could be reasonably expected to continue if we stay stuck in a low-growth, low-rate, low-inflation world. But if inflation (or maybe stagflation) take hold, ‘real’ assets could come to the fore for three reasons: they could be stores of value; central banks may keep printing money but they cannot print oil, gold or property; and investment in new resources finds is dwindling thanks to pressure from politicians, investors and the public alike amid environmental concerns.

Will ‘paper’ assets continue to outperform ‘real’ ones?

Source: Refinitiv data

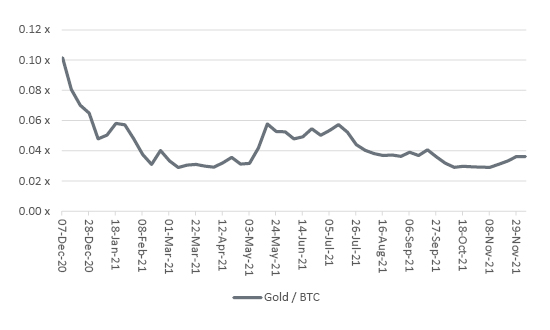

The subject of ‘stores of value’ and ‘haven assets’ can lead to heated debate. It is hard to argue that Bitcoin is a store of value, given the wild price swings of the last five years, and the same accusation can be levelled at gold. Neither produces a yield. And both trade way above their marginal cost of production.

Gold did next to nothing and underperformed Bitcoin again in 2021. But its role as a haven during times of great uncertainty – when it looks like the authorities are not in control – could come into play if inflation gallops higher.”

Yet rampant deficit creation by Governments and money printing by central banks (in an attempt to effectively monetise and fund the extra debt) do persuade many to make an investment case for one or the other (although rarely both). Gold did next to nothing and underperformed Bitcoin again in 2021. But its role as a haven during times of great uncertainty – when it looks like the authorities are not in control – could come into play if inflation gallops higher. The gold price relative to Bitcoin makes for an interesting chart but the metal may remain dormant if inflation fizzles out.

Will gold ever outperform Bitcoin?

Source: Refinitiv data

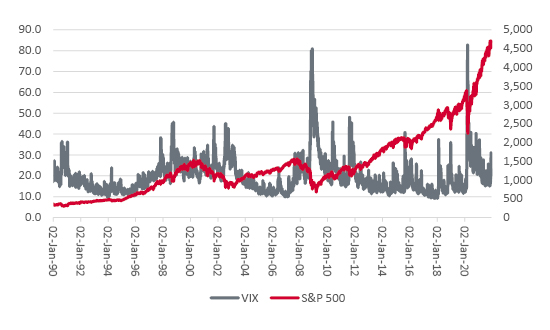

After a brief foray to 30 on news of the Omicron variant, the VIX, or ‘fear,’ index which gauges future volatility in the US stock market, is trading pretty much in line with its long-run average of 19. If markets retain their faith in central bank control, inflation remains subdued and the variant passes by, fear will likely dissipate. But if inflation takes hold and confidence in policy makers ebbs, volatility may make its long-awaited comeback.

Keep an eye on the ‘fear’ index

Source: Refinitiv data

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.