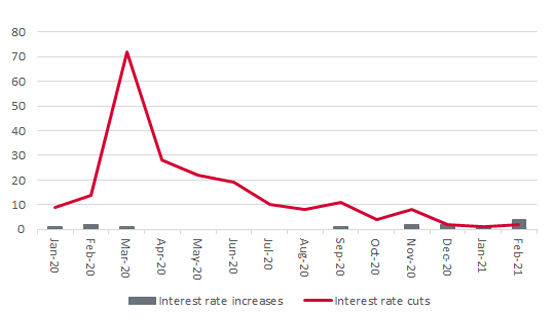

Zambia, Venezuela, Tajikistan and Armenia do not make a habit of featuring in this column, not least as they are a bit off the beaten track, even for the most intrepid adviser or client. But they catch the eye because each member of this quartet has seen an increase in interest rates this year, to take the total for 2021 so far to five increases and two cuts from global central banks (Mozambique is the fifth for those who are interested).

Five central banks have raised rates so far in 2021

Source: cbrates.com

“Many advisers and clients are unlikely to be stirred by events in Zambia, Venezuela, Tajikistan and Armenia but they may need to pay attention for three reasons.”

Those who are not interested will ponder the relevance of this possible trend, but they may need to pay attention for three reasons.

None of these things may come to pass. It could be that the deflationary force of interest payments, demographic trends and central bank intervention keep fixed-income investors in clover as they combine to keep interest rates and inflation well and truly anchored, to the benefit of the bond portion of any portfolio, especially the long-duration segment. Yet if any of the above three trends keeps running, then the meagre coupons offered by most fixed-instruments would leave them looking like return-free risk and speak in favour of short-duration exposure for anyone seeking bond-like ballast in their asset allocation plan.

“If any of the above three trends comes to pass, then the meagre coupons offered by most fixed-instruments would leave them looking like return-free risk and speak in favour of short-duration exposure for anyone seeking bond-like ballast in their asset allocation plan.”

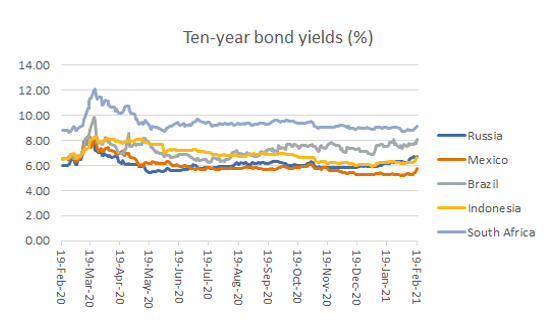

A quick look at the benchmark 10-year bonds of key emerging markets might suggest that investors are taking risk off the table. Selling bonds here means yields are creeping up and prices creeping down. They might not look like big moves, but the very right-hand side of those lines show an upward shift in bond yields – to 6.59% from 6.15% in the last month alone in Russia.

Emerging market bond yields are moving higher

Source: Refinitiv data

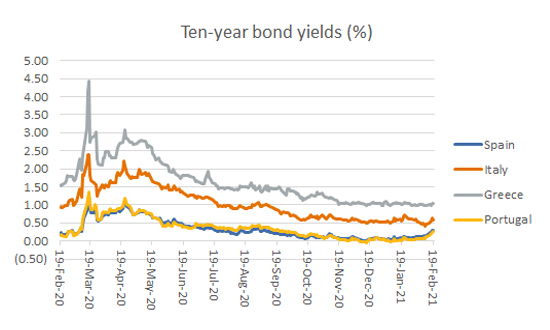

A look at developed market bonds suggests concerns over gathering debt. In Europe, for example, benchmark 10-year bond yields are creeping higher, despite the European Central Bank’s quantitative easing (QE) scheme. No wonder, when advisers and clients consider that the world’s debt pile soared by $24 trillion to a record $281 trillion in 2020, according to the Institute of International Finance. That was an extra 35 percentage points of GDP to take the debt/GDP ratio to 355%. Remember that the Global Financial Crisis started in 2008 when the global debt was ‘just’ $187 trillion.

Developed market bond yield are going up

Source: Refinitiv data

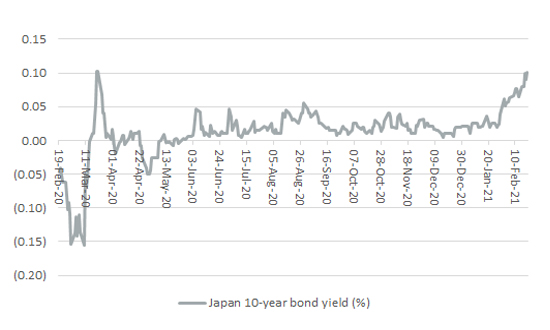

Even the yield on 10-year Japanese Government Bonds (JGBs) stands at 0.10%, the top of the Bank of Japan’s target range and no different from late January 2016. Perhaps even loyal holders of JGBs are contemplating the return of inflation after 30 years.

10-year JGB yield sits at top of BoJ’s target range

Source: Refinitiv data

“In a worst-case scenario, central banks may want to raise rates to curb inflation, if it really does run hot, but struggle to do so, because of the immediate impact this would have on economic growth – and financial asset prices.”

Again, all of these trends could yet fizzle out. In a worst-case scenario, they become more pronounced. Central banks may want to raise rates to curb inflation, if it really does run hot, but struggle to do so, because of the immediate impact this would have on economic growth – and financial asset prices. In this context, China is an interesting test case.

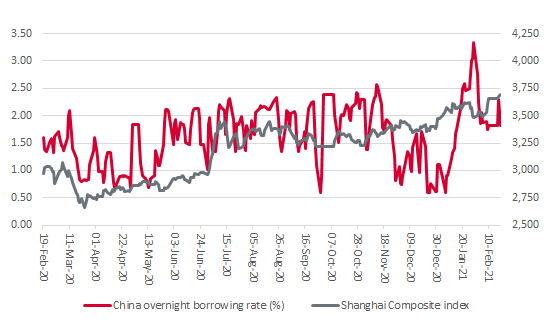

China did not hike overnight lending rates for long

Source: Refinitiv data

The People’s Bank of China jacked up overnight borrowing costs in late January but quickly backed off as the Shanghai Composite index wobbled. As soon as policy was eased, share prices rose. The monetary authorities have a delicate balancing act ahead of them.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.