In some ways, markets had little to digest in the immediate wake of the Budget, as so much of the Chancellor of the Exchequer’s speech had made its way into the newspapers the weekend before. Mr Sunak did come up with a couple of surprises all the same, in the form of the superdeduction for capital investment and his plan for eight freeports – designed to boost the UK’s trade flows in a post-Brexit world – but the key questions raised by the Budget, at least from an investment perspective, passed unasked.

“In sum, do UK Government bonds represent return-free risk? And if so, what are the implications for asset allocation strategies and investors’ portfolios?”

In sum, do UK Government bonds represent return-free risk? And if so, what are the implications for asset allocation strategies and investors’ portfolios?

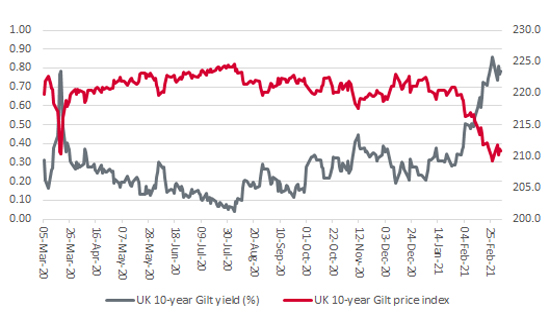

The benchmark 10-year Gilt yield in the UK has surged of late. It is not easy to divine whether this is due to the fixed-income market worrying about inflation or a gathering acknowledgement that the UK’s aggregate £2 trillion debt is only going one way – up. But the effect on Gilt prices is clear, since bond prices go down as yields go up (as is also the case with equities).

Gilt prices are tumbling as yields rise

Source: Refinitiv data

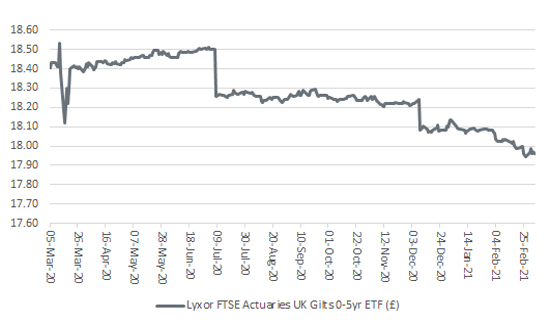

This is inevitably filtering through to exchange-traded funds (ETFs) dedicated to the UK fixed-income market. The prices of two benchmark-tracking ETFs have fallen, albeit to varying degrees. The instrument which follows shorter-dated (zero-to-five year) Gilts has fallen just 2% since the August low in yields.

The price of short-duration Gilts has barely flickered…

Source: Refinitiv data

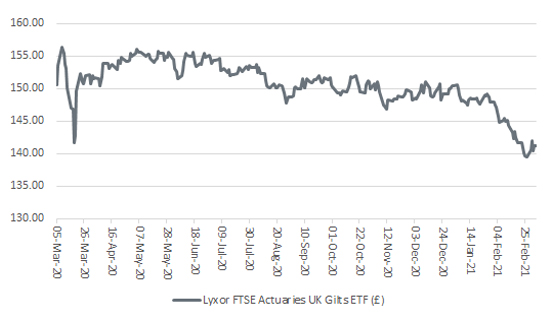

Meanwhile, the ETF which tracks and delivers the performance of a wider basket of UK Gilts (once its running costs are taken into account) has fallen 8% since yields bottomed last summer.

… although a broader basket has fallen quite a bit more

Source: Refinitiv data

That 8% capital loss is at least a paper-only one, unless an adviser or client chooses to sell now, but the yield on offer does not come even close to compensating the holder for that paper loss, which supports the view that bonds now represent ‘return-free risk’.

“The higher bond yields go, the greater the return they offer – and that means, at some point, advisers and clients may decide that the rewards are sufficient compensation for the risks, especially as three arguments could still support exposure to UK Gilts.”

However, the higher bond yields go, the greater the return they offer – and that means, at some point, advisers and clients may decide that the rewards are sufficient compensation for the risks, especially as three arguments could still support exposure to UK Gilts.

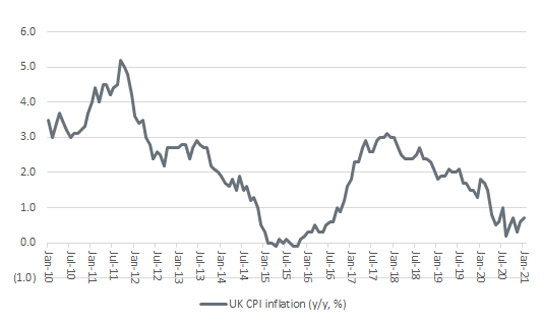

Fears of inflation have yet to be borne out

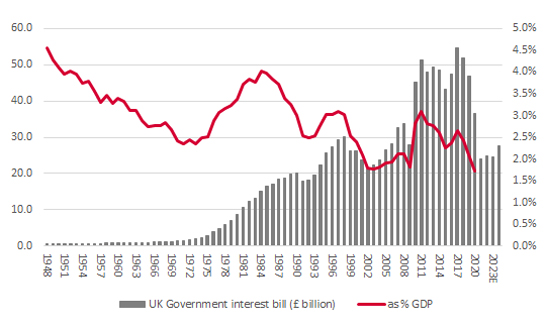

“The UK’s financial situation may not be quite as bad as it seems because the Bank of England’s monetary policy means the Government’s interest bill as a percentage of GDP has hardly ever been lower, at least in modern times.”

UK interest costs are low, relative to GDP

Source: Refinitiv data

In sum, no one has a crystal ball. Therefore, bonds could yet have a role to play in a well-balanced portfolio over time, but it is inflation, rather than risk of default, that looks likely to be the greatest threat to any holder of Gilts.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.