It is a year to the sixtieth US Presidential Election, on 5 November 2024, and although financial markets are more concerned right now about events in the Middle East, the oil price and inflation, they will soon start to take a keener interest in the race to the White House.

Incumbent President Joseph R. Biden will start his campaign for the Democratic Party’s nomination in January with the Iowa caucus and the expectation is that he and current Vice-President Kamala Harris will prevail, especially as only Marianne Williamson is the only confirmed opponent for the moment. Around a dozen Republicans have entered to race the lead the Grand Old Party and the contest will begin in Iowa and New Hampshire in January. Donald Trump leads the polls and if they are accurate then America will get its first Presidential rematch since 1956. Biden may well welcome that precedent, since that was when Dwight Eisenhower beat Adlai Stevenson for the second time to retain the Presidency (even if the two-time victor was a Republican).

“Advisers and clients may also look to history to see what the election may mean this time around, even in the knowledge that the past is no guarantee for the future. A study of post-1945 ballots shows that the US stock market traditionally gets an attack of the nerves in the final year of a Presidency, as it is the weakest year, on average, using the Dow Jones Industrials as a benchmark.”

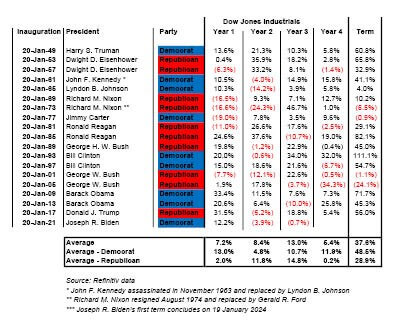

Advisers and clients may also look to history to see what the election may mean this time around, even in the knowledge that the past is no guarantee for the future. A study of post-1945 ballots shows that the US stock market traditionally gets an attack of the nerves in the final year of a Presidency, as it is the weakest year, on average, using the Dow Jones Industrials as a benchmark.

US stock markets tend to approach Presidential elections with some caution

Source: Refinitiv data. Based on calendar year from inauguration day (20 January) and the performance of the Dow Jones Industrials index

* John F. Kennedy assassinated in November 1963 and replaced by Lyndon B. Johnson

** Richard M. Nixon resigned August 1974 and replaced by Gerald R. Ford

*** Joseph R. Biden’s first term concludes on 19 January 2025

This caution in the final year of a Presidency is more pronounced under the Democrats and may reflect nothing more than markets’ fears of a swing to the left, even if the Dow Jones does better, on average, under them than under the Grand Old Party. Nor should advisers and clients forget that Trump was perceived as a risk to markets before his election in 2016, thanks in particular to his policies on trade and international relations.

As such it may not pay to get too caught up in the identity of the winner of either the Party races or indeed the Presidential election, where the thought of an 81-year-old Biden grappling with the 78-year-old Trump for the second time is prompting independents to consider a run. Robert F. Kennedy is planning just such a bid and that could make predictions even more dangerous than usual – H. Ross Perot’s Reform party’s presence in 1992 opened up the door to a Democratic win for Bill Clinton over the incumbent Republican, George W. Bush, at least in the eyes of some, not least because Perot bagged 19% of the vote.

“George Bush’s 1992 defeat was as much down to the US recession of the time. The state of the US economy will have a huge influence on both the 2024 ballot and the American financial markets for good measure.”

However, George Bush’s 1992 defeat was as much down to the US recession of the time. The state of the US economy will have a huge influence on both the 2024 ballot and the American financial markets for good measure.

Federal Reserve policy will be one huge factor here and the central bank is independent – although some may be tempted to argue it caved into Presidential pressure when it pushed through three interest rate cuts in 2019.

In addition, corporate profits and especially cash flows drive equity valuations over the long term, and they are largely (though not exclusively) the result of the broader economic cycle.

Going back to the data, the impact of the wider macro backdrop upon US equity market performance seems pretty clear. Investors and voters alike gave credit to Ronald Reagan for the reforms he promised and then initiated to drag the US out of an economic funk in the early 1980s.

“The recessions of 1948-49, 1954-55, 1957-58 and 1960-61 did not unduly harm stock market performance under Truman, Eisenhower, Kennedy and Johnson but the Dow Jones sagged during the 1970-71 and 1973-75 downturns during the Nixon/Ford years. George W. Bush had nothing to do with the tech bust at the turn of the millennium or the collapse of the US housing market but the recessions of 2001 and 2008-09 mean that the Dow did badly across both of his terms.”

The recessions of 1948-49, 1954-55, 1957-58 and 1960-61 did not unduly harm stock market performance under Truman, Eisenhower, Kennedy and Johnson but the Dow Jones sagged during the 1970-71 and 1973-75 downturns during the Nixon/Ford years. George W. Bush had nothing to do with the tech bust at the turn of the millennium or the collapse of the US housing market but the recessions of 2001 and 2008-09 mean that the Dow did badly across both of his terms.

The economic booms of the 1950s and 1980s and the recovery from the 2007-09 bust (helped by Fed largesse) meant the stock market did well under Truman, Eisenhower, Obama and Trump.

But advisers and clients must also account for equity valuations.

Shiller CAPE methodology still suggests US stocks are expensive

Source: http://www.econ.yale.edu/~shiller/data.htm

Using Professor Robert Shiller’s cyclically adjusted price/earnings (CAPE) ratio as a benchmark, the S&P was trading on historically low valuations in 1949 and 1953 when Truman and Eisenhower took office, while the ravages of inflation in the 1970s meant that the valuations were rock bottom when Reagan took over in the early 1980s.

“George W. Bush came to power just as the technology, media and telecoms bubble had driven valuations that made even the dizzying (and disastrous) heights of 1929 seem modest. In his case, almost the only way was down and with the Shiller CAPE multiple back near historic highs, the next President, and advisers and clients, could be forgiven for wondering what may come next.”

By contrast, George W. Bush came to power just as the technology, media and telecoms bubble had driven valuations that made even the dizzying (and disastrous) heights of 1929 seem modest. In his case, almost the only way was down and with the Shiller CAPE multiple back near historic highs, the next President, and advisers and clients, could be forgiven for wondering what may come next.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.