Milwaukee, Wisconsin, and Jacksonville, Florida, are home to two of America’s National Football League’s 32 teams: the Green Bay Packers and the Jacksonville Jaguars. Owing to the pandemic, it is not clear at the moment whether gridiron fans will be allowed into their stadia at any stage this season to watch the games, which are due to begin in September.

But two other important events in these cities have already fallen foul of COVID-19. Last week’s Democratic Party convention, slated for Milwaukee, became a virtual affair as the majority of speakers stayed away, even while Joe Biden and Kamala Harris punched their ticket as the party’s chosen pairing for next US Presidential Election – which is due on Tuesday 3 November. Meanwhile, the Republican incumbent in the White House, Donald Trump, had already cancelled his planned convention in Jacksonville, although a pared-down affair took place in Charlotte, North Carolina, earlier this week, as he and Vice President Mike Pence prepared to run for a second term in office.

The race is now on between the Trump/Pence and Biden/Harris teams to give advisers and clients something else to mull over as they continue to wrestle with how the pandemic will continue to affect the world’s largest economy. The political temperature will only rise from here, with three presidential television debates scheduled for 29 September, 15 October and 22 October and one vice-presidential contest on 7 October before Americans head to the ballot box.

In admittedly very crude terms, you might expect the US stock market to prefer a Republican President to a Democrat one, with the Grand Old Party generally seen as being in favour of small(er) Government and less inclined to interfere in business matters and free markets than the Democrats.

“Over 18 presidencies since the election of Harry S. Truman in 1948, the Dow Jones Industrials has, on average, done better under Democratic presidents than it has under Republican ones.”

However, it generally has not worked out like that, at least not in modern times. Over 18 presidencies since the election of Harry S. Truman in 1948, the Dow Jones Industrials has, on average, done better under Democratic presidents than it has under Republican ones. Even more intriguingly with 2021 in mind, the Dow has done much better in the first year of a Democratic term than it has a Republican one, with an average gain of 13.1% compared to 2% from their rival incumbents.

The Dow Jones has tended to perform better under Democratic presidents than Republican ones, especially during the first year of a term

Source: Refinitiv data. * John F. Kennedy assassinated in November 1963 and replaced by Lyndon B. Johnson. ** Richard M. Nixon resigned August 1974 and replaced by Gerald R. Ford. *** Data for Donald J. Trump as of 17 August 2020

It therefore is not as simple as ‘Republicans good, Democrats bad’ when American politics is assessed through the very narrow prism of the US stock market. This is particularly the case now, when the Republicans were running up the sort of budget deficits that would make even the most ardently pro-spending Democrat blush, even before the pandemic forced an emergency fiscal response.

Moreover, if advisers and clients cast their minds back four years ago, the Democrats’ Hillary Clinton was then seen as a bit of a shoo-in for the 2016 election, as the Republican’s Trump had surprised everyone by winning the Grand Old Party’s nomination. Trump was also widely perceived as a potentially negative result for markets, thanks to his sabre-rattling on issues such as diplomatic relations with China, Iran and Mexico and desire to rip up several trade agreements, including the North America Free Trade Agreement (NAFTA).

But that isn’t how it turned out.

“It may still trade below its all-time high, but the Dow Jones Industrials index is up by some 40% since Trump’s inauguration on 20 January 2017.”

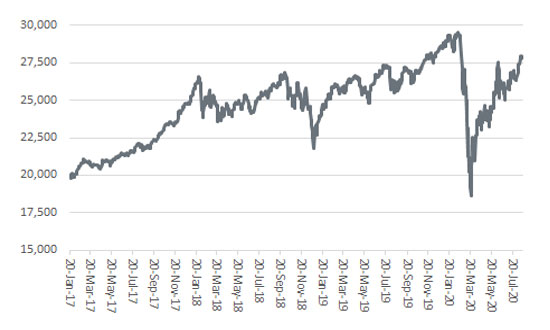

It may still trade below its all-time high, but the Dow Jones Industrials index is up by some 40% since Trump’s inauguration on 20 January 2017, thanks to what had been a steady economic expansion, tax cuts and an accommodative US Federal Reserve, which had pretty quickly backed away from raising interest rates and sterilising Quantitative Easing, even before COVID-19 swept around the globe.

Dow Jones Industrials has powered higher during Trump presidency

Source: Refinitiv data. Covers period since inauguration ceremony on 20 January 2017.

This suggests that there is more than just politics at play when it comes to how a stock market performs, with monetary policy, economic performance and the possibility of exogenous shocks (such as a pandemic) all factors to be considered, among others, even before we get to the vexed issue of valuation.

“How much of a bearing November’s winner has upon financial markets’ performance will to a degree depend upon which party wins the House of Representatives and the Senate, so advisers and clients will need to consider this too.”

That said, Trump has undeniably been influential, from his market-pumping tweets to his economy-pumping tax cuts. How much bearing November’s winner has upon financial markets’ performance will to a degree depend upon which party wins the House of Representatives and the Senate, so advisers and clients will need to consider this too. Trump has achieved less in the second half of his term as the Democrats have controlled both houses on Capitol Hill.

The tricky things is sorting out the policies that are just electioneering and slogans from the plans that may actually be enacted. As the economist Robert Sowell once noted: “Economists are often asked to predict what the economy is going to do – but economic predictions require predicting what politicians are going to do and nothing is more unpredictable.”

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.