Talk of recession gives investors pause for good reason and over the last year there’s been plenty of rebalancing of portfolios undertaken as global economies spluttered and, in some cases, stalled. One of the first casualties is often hospitality businesses; perceived wisdom is that people cut out discretionary spend, all those nice-to-haves, when times get tough. Certainly, there’s been plenty of evidence that people are cutting back, but recent earnings updates show they’re not cutting out entirely: something that’s stoked renewed interest in a sector that’s seen valuations plummet since the start of the year.

Recent recessions have seen customers trading down and there are plenty of big names hyper-aware that value creates opportunity, but with employment levels still high there are consumers whose budgets are, at the moment, remarkably resilient. But where is the sweet spot, especially as we head towards a predominantly covid-free Christmas?

Ultimately it will come down to customer base and the ability of brands to really understand and capitalise on that base.

Brian Niccol, Chairman and CEO at Chipotle Mexican Grill, commented during a recent earnings call that the “majority of (its) customers are from higher-income households, which continue to increase purchase frequency” something which has enabled the business to pass on costs with “minimal resistance” and helped it grow revenues by 13.7% YOY. For him it’s about giving customers the best “experience” and making sure that “pricing stacks up relative to people’s alternatives.”

Knowing those alternatives, knowing the customer inside and out, has never been more crucial to success. More than half of Starbucks’ US customer base are Gen Z or Millennials, a customer that “tends to have significantly more discretionary money at their disposal,” according to the company’s Interim CEO Howard Shultz.

Despite gloomy global sentiment September delivered the brand’s biggest sales week ever, with young coffee lovers downing expensive cold caffeine beverages by the bucketful. It tracks customer trends through its rewards app and targets promotions with pinpoint precision to 29 million members – a number which shot up 5% in the last quarter alone. Mr Shultz says that customer loyalty to Starbucks has been “quite significant and predictable” and that despite “almost 6% price increases” loyalty and transaction numbers haven’t been affected.

But whilst wealthier people continue to buy pricier food and drinks, lower income families are being drawn in by the value offer presented by the likes of McDonalds and KFC owner Yum Brands. People do still want to enjoy their lives even if they’ve got less money to play with. It’s the ‘lipstick effect’ that was spoken about so often during the financial crisis: consumers want a bit of comfort, a bit of normal, and if they can’t afford big ticket items they’ll settle for little luxuries.

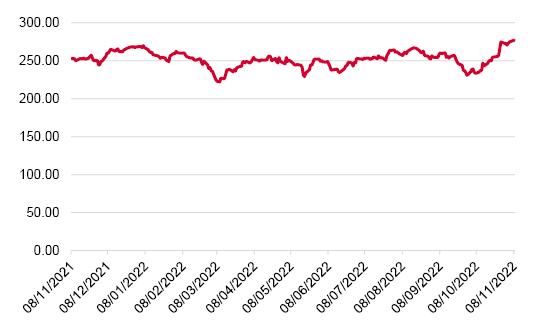

Yum Brands share price performance over 12 months

Source: Refinitiv

Yum Brands CEO David Gibbs is confident his businesses are striking the right note with all their consumers from those looking for pure value to those trading down “…there’s a little bit of K-shaped demand for value on the high end. That’s why you’re seeing us do things like the Double Steak Grilled Cheese Burrito at Taco Bell, which is at a higher price point that normal, but still a great value.”

He believes the recessionary environment is actually one that is likely to be beneficial to the whole business, which has also been keeping a close eye on consumer insights and market analytics to give customers what they want at the price they want to pay.

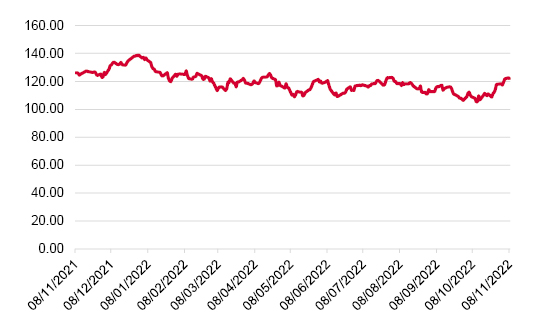

McDonald’s certainly seems to have played the pricing game perfectly, with global comp sales up almost 10% in the last quarter. President and CEO Chris Kempczinski said on an earnings call “when we look at consumer scores around value for money, affordability … we continue to lead in this, and it’s allowed us to push through some of this pricing … (and) consumers are willing to tolerate it.”

McDonalds share price performance over 12 months

Source: Refinitiv

Scale is likely to play a massive part in the ability of companies to successfully navigate a downturn. Chris Kempczinski made it clear some parts of the world were struggling more than others, and said “there is increasing uncertainty and unease about the economic environment,” but said he, and the franchisees he works with, were confident they had the right plans in place to drive growth and would consider implementing country-specific help similar to that used during covid lockdowns.

It’s clear competition for every consumer penny will be fierce this Christmas, with beleaguered retailers hoping people won’t ditch gift buying in favour of experiences. For hospitality there will be a place for fine dining but those aspirational customers, customers who trade up for special occasions, are likely to be fewer and trading down has already become a well-worn phrase. With McDonalds one of the few hospitality businesses actually enjoying share growth this year it’s clear investors are betting value will be the victor, but it’s worth thinking about what value means for different demographics and whether value outfits can generate the volumes needed to maintain margins.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.