At the time of writing, 25 members of the FTSE 100 Index have elected to defer, cancel or cut their final dividends for 2019 or interim dividends for their next fiscal year. Perhaps the biggest blow to income-seekers has come from the banking sector, where the Prudential Regulatory Authority (PRA) made it clear that neither dividend payments nor buybacks from Barclays, HSBC, Lloyds, Royal Bank of Scotland and Standard Chartered would be seen in a good light.

That cancelled £7.5 billion of dividend payments for 2019 and put on ice forecasts of £15 billion in further distributions for 2020. These are significant numbers when investors consider that, at the start of March (before the COVID-19 outbreak really began to hit home), the analysts’ consensus for aggregate dividend payments from the FTSE 100 in 2019 was £89.5 billion (and £93.5 billion including special dividends). Analysts had pencilled in £91.5 billion for 2020, before any one-off distributions.

“No sooner has the Prudential Regulatory Authority had its say at the banks, than the European Insurance and Occupational Pensions Authority (EIOPA) has begun to apply similar pressure to the UK’s and Europe’s quoted insurers.”

The degree of dividend cuts could become even more acute, depending upon two factors. The first is the duration of the current lockdown and social distancing policies and the shape of the anticipated recession and subsequent economic recovery. The second is the weight of political and public opinion. The former is very hard to forecast. It may be even more difficult to gauge the impact of the latter, although it may be best to prepare for the worst and hope for the best, at least from the narrow perspective of portfolio investment, because no sooner has the PRA had its say at the banks, than the European Insurance and Occupational Pensions Authority (EIOPA) has begun to apply similar pressure to the UK’s and Europe’s quoted insurers.

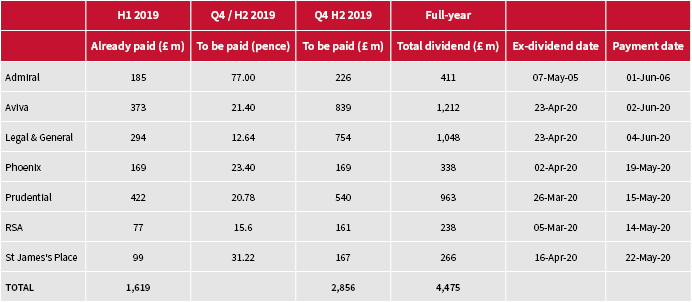

Were the seven firms who are classified as life or non-life insurers by index-compiler FTSE to comply with EIOPA’s requests to cancel their second-half dividends, this would take another £2.9 billion of anticipated income away from advisers and clients.

FTSE 100’s insurers are about to pay out £2.9 billion in dividends

Source: Company accounts

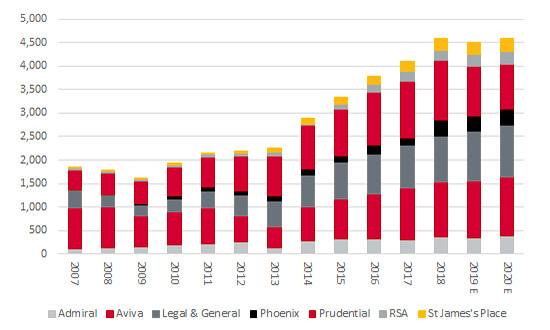

It would also put in play some £4.5 billion in dividends expected in 2020.

FTSE 100’s insurers are expected to pay out a further £4.5 billion in dividends in 2020

Source: Company accounts, Sharecast, consensus analysts’ forecasts. Figures in £ millions.

“At least the issue does not appear to be the insurers’ ability to pay but the EIOPA, like the PRA with the banks, wants the insurers to keep the capital as an extra buffer against potential losses relating to COVID-19 and the associated economic downturn.”

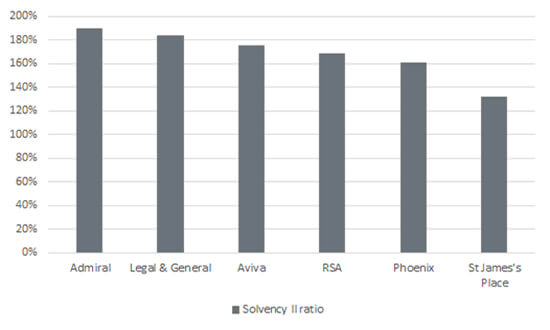

At least the issue does not appear to be the insurers’ ability to pay.

Applying EIOPA’s own Solvency II ratio, which measures how much capital insurers have to hold to be confident they can withstand a worst-case loss scenario, all of the seven FTSE 100 firms appear well buttressed. (Following the demerger of fund manager M&G, Prudential no longer falls under the EIOPA’s purview and it is now regulated by the Hong Kong Insurance Authority, but the company carries a sizeable surplus relative to the Local Capital Summation Method and is therefore also in the clear, at least on paper.)

FTSE 100’s insurers meet all Solvency II regulatory capital requirements

Source: Company accounts. After the M&G demerger, Prudential is not subject to Solvency II and now operates under Hong Kong Insurance Authority rules, whereby it has a $9.7bn surplus relative to the Local Capital Summation Method (LMCS), or 356% of requirements.

This does not seem to be enough to persuade EIOPA, rather as the Big Five banks’ regular clean bill of health relative to the Bank of England’s stress tests and improved Tier 1 capital and leverage ratios did little to throw the PRA off their scent when it came to reining in dividends and buybacks.

The EIOPA, like the PRA with the banks, wants the insurers to keep the capital as an extra buffer against potential losses relating to COVID-19 and the associated economic downturn.

A further similarity is that insurers, like banks, do not always feature prominently in lists of companies most admired by the public. Paying out large amounts of cash to shareholders when tales of refusal to pay out those hit (yet again) by floods or whose livelihood has been destroyed by the lockdown is not necessarily a good look. By contrast, it is a good look for regulators and politicians to take a tough line even if, with plenty of justification, the insurance industry can say it did not need the taxpayer bailouts that the banks hoovered up during the great financial crisis of 2007–09.

“Advisers and clients will therefore want to check the degree of exposure that their selected fund managers and income funds have to the insurers.”

Advisers and clients will therefore want to check the degree of exposure that their selected fund managers and income funds have to the insurers.

This is a new, variable element for income-seekers to address but it is one of several potential long-term implications of the COVID-19 crisis and policy response to it, as and when we (hopefully) begin to shake it off. This column does not have the answers, alas, but advisers and clients might like to consider the following issues as they prepare their long-term asset allocation plans.

These are all issues for the future, but Legal & General’s determination to make its second-half dividend payment could make the insurance industry an interesting test case – for once.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.