There was no surprise when the announcement that Alison Brittain would step down from her position as CEO of Whitbread (WTB) was immediately followed by a share price slump. Investors like stability and a change at the top is a big deal: even if it’s been telegraphed, choreographed, and planned down to the tiniest detail, that change heralds a period of volatility.

How long that volatility lasts often depends on the reason behind the departure and the person appointed to step into the breach. In the case of Whitbread there are questions about the timing coming so soon after shareholders kicked back at remuneration package plans. But there had been hints that retirement could be in the offing before last month’s AGM and certainly Alison Brittain has steered the ship through some particularly trying times.

Succession plans can soothe nerves if they’re delivered correctly, but even with every duck lined up losing a boss who has made shareholders a lot of money can be hard to get over.

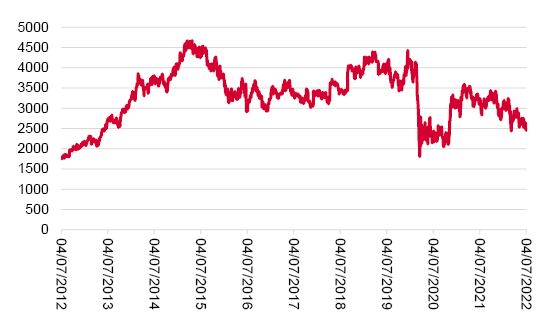

During her reign the business has shrunk, Costa Coffee was hived off to Coca-Cola, covid took its own toll and the share price slumped by more thirty percent. But the last trading update delivered more than green shoots with the lucrative Premier Inn strand going from strength to strength, even if Whitbread’s pub empire is still trying to battle back to fighting weight.

Whitbread’s volatile 10 years

Source: Refinitiv

And her replacement seems to have been thoughtfully chosen. Dominic Paul is a former insider with a real understanding of the way Whitbread works, but he’s also somebody who has had the chance to spread his wings, to develop his own style and the confidence to act without looking over his shoulder, and it’s telling that the share price of Domino’s Pizza Group (DOM) also dropped on news of the shift, a nod to his capability in a top job.

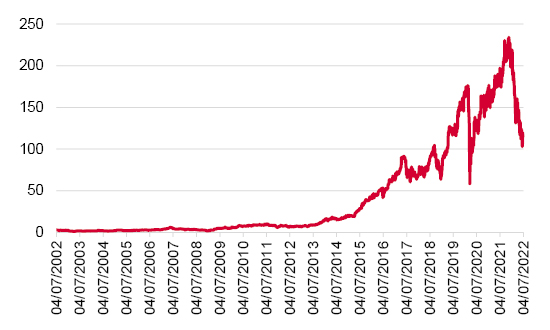

Succession plans can soothe nerves if they’re delivered correctly, but even with every duck lined up losing a boss who has made shareholders a lot of money can be hard to get over. Peter Pritchard is such a boss and Pets at Home (PETS) shares have jumped in value by more than 200% during his time as CEO.

Pets At Home Performance

Source: Refinitiv

The success enjoyed over the last couple of years in particular can’t be ascribed wholly to the man at the top. It was undoubtedly a pandemic winner, cashing in on the boom of pet ownership which occurred when people’s work-life balance was flipped on its head. But under his leadership the business was able to grab hold of that business, focus in on areas of growth like pet clothing, and update the company’s online offer to better serve customers during lockdowns.

These choppy waters would be tough for any CEO to navigate but investors are less likely to put their trust into a boss that’s untried

He left the business on a high but that high was tempered by warnings that inflation was already beginning to bite and analysts at RBC have recently downgraded the stock arguing that the good times are coming to an end. These choppy waters would be tough for any CEO to navigate but investors are less likely to put their trust into a boss that’s untried, and despite Lyssa McGowan’s impressive resume she hasn’t had the chance to prove herself.

And that lack of experience in post is something that’s troubling city bosses. The Financial Times’ City Network, a forum of over 50 senior executives from a range of backgrounds, recently warned that a damaging recession is likely. They worried that many managers haven’t had to deal with the kind of severe economic shocks that could well be heading our way.

Investors, already spooked by the volatility gripping global markets, will be looking for any kind of certainty they can grab onto, whatever is coming down the tracks, and continuity at the top could make all the difference to investor sentiment in the short term.

But in the case of JD Sports (JD) the hasty departure of long-term boss Peter Cowgill, followed by commitments to radically overhaul the corporate structure, leaves investors rather short of certainty and wary of what might still be hiding in the retailer’s closet.

The sudden departure of a boss is never pretty and it’s even more difficult for investors to stomach when the boss in question has delivered the kind of stratospheric rise in share price seen during Mr Cowgill’s tenure.

The rise and rise of JD Sports?

Source: Refinitiv

But despite the business enjoying stellar growth, behind the scenes there are questions about how some of that growth came about. The competition watchdog has already issued one fine for breaching takeover rules and another investigation into price fixing is expected to cost the business millions more.

Familiarity and experience are great, but the roll of CEO is complex and exhausting. If the boss is ready to move on, or if change is needed, familiarity can become a detriment. And there’s a lot to be said for new blood, new energy, and new ideas. Plus, if the corporate structure is sound, if the company culture is set and the ship is a happy one the CEO you know might not be the CEO you need.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.