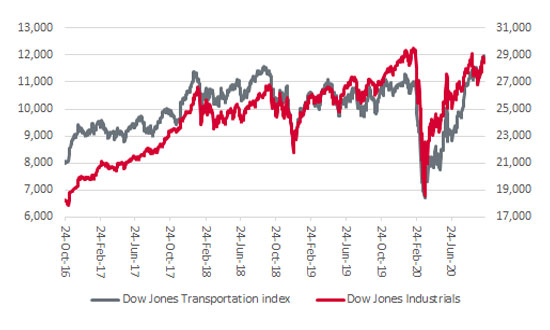

Regular readers will know this column is a big fan of Richard Russell’s so-called ‘Dow Theory,’ which argues that if the Dow Jones Transportation index is thriving, then the better-known Dow Jones Industrials index should flourish too.

The logic here is that it can only be good news if the share prices of the firms moving goods around the world by road, rail, sea or air are doing well. If something is sold, it has to be shipped. Conversely, weak transport stocks could mean unsold goods are piling up on shelves or in warehouses and in turn forcing cuts in production and shipments, with the ultimate result that companies cut back on jobs and investment to the detriment of wider economic activity.

“According to the strictures of Dow Theory, it could be a good sign for those investors with exposure to US equities – and stock markets worldwide – that the Dow Jones Transportation index has just barrelled past its September 2018 high.”

It could therefore be a good sign for those investors with exposure to US equities – and stock markets worldwide – that the Dow Jones Transportation index has just barrelled past its September 2018 high and moved to within touching distance of the 12,000 mark for the first time in its history.

The Dow Jones Transportation index is rising a lot more slowly than the Dow Jones Industrials

Source: Refinitiv data

Even more intriguingly, the Dow Jones Transportation index is now up 13% over the past 12 months, while the better-known Dow Jones Industrials is just 7% higher. Dow Theory would suggest that the Transports leading the Industrials is a sign of better things to come.

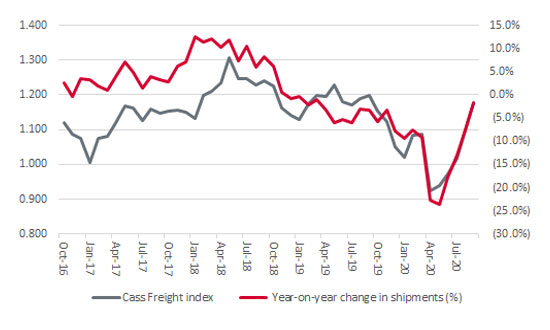

Yet sceptics will question how this can be, when the recovery from the deep downturn suffered in the first half of 2020 still feels so fragile. The latest updates from the Cass Freight index, which measures monthly freight activity in North America, do not seem to offer much by way of immediate encouragement.

September’s reading showed a 1.8% year-on-year fall in shipment volumes. This is the twenty-second consecutive month to show a year-on-year drop and the index actually peaked back in May 2018, as if to imply the US economy was already in trouble even before the pandemic hit home.

“The Cass Freight index for North America has just shown a year-on-year decline for the twenty-second consecutive month […] and the index actually peaked back in May 2018, as if to imply the US economy was already in trouble even before the pandemic hit home.”

Yet the Cass analysis reads in a much more upbeat fashion. That 1.8% year-on-year drop is the lowest rate of decline since March 2019 and the index is now 28% higher than its April trough. Moreover, notes Cass, “We see [the index] staying strong through year-end, as inventories remain relatively lean, and we expect freight to keep moving.”

US freight volumes seem to be recovering

Source: Cass, FRED – St. Louis Federal Reserve database

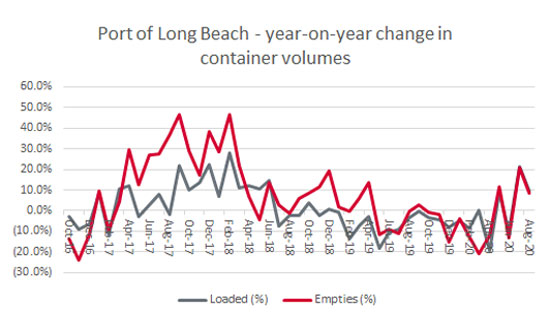

Cass flags improved consumer confidence, better business sentiment as companies reopen following spring’s lockdowns and also improved global trade flows. The final point seems to tally with data made available by the Port of Long Beach, America’s second-biggest port after that of neighbouring Los Angeles. Loaded container volumes, for import or export, grew for the third time in four months in August.

US container shipping seems to be recovering

Source: Port of Long Beach

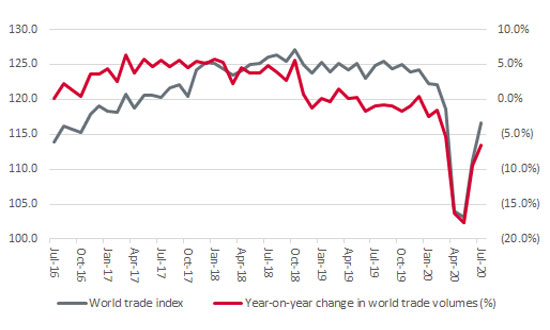

This perspective also seems to tie in with the monthly World Trade Monitor published by the CPB Netherlands Bureau for Economic Policy Analysis. It too is showing improved momentum in trade flows, even allowing for the still-vexed nature of US-China trade relations and the Brexit talks between the UK and the EU.

World trade volumes are recovering too

Source: cpb.nl – World Trade Monitor

“A further source of news flow also backs up the case for transport stocks moving higher and that is Copenhagen-quoted AP Møller Maersk, which is the world’s largest container shipping company and therefore a fair proxy for global growth.”

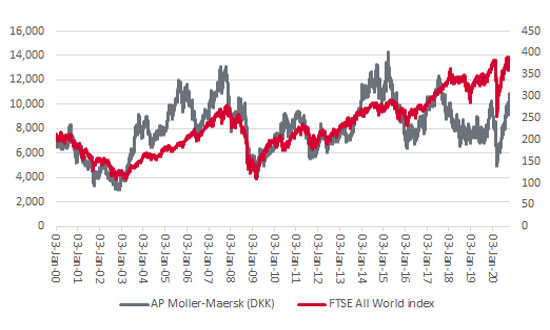

A further source of news flow also backs up the case for transport stocks moving higher and that is Copenhagen-quoted AP Møller Maersk. The finer points of individual company analysis may be of relatively limited interest to time-pressed advisers and clients, but the Danish firm is the world’s largest container shipping company and therefore a fair proxy for global growth.

AP Møller Maersk’s latest trading update (13 October) revealed that container volumes were down just 3% year on year compared to the 16% plunge witnessed in the second quarter, and its shares responded favourably as they reached levels last seen in early 2017.

AP Møller Maersk’s shares are steaming higher

Source: Refinitiv data

AP Møller Maersk also raised its earnings guidance for the year, although some of this was for company-specific reasons, such as cost efficiencies, lower fuel bills and higher freight rates. In addition, volumes are still down year on year, just as they are in the Cass, Port of Long Beach and CPB data, so the global economy is far from out of trouble – the International Monetary Fund and World Bank would not have spent their October meetings crying out for more fiscal stimulus and government spending otherwise. But at least advisers and clients can keep an eye on these data points as a quick guide as to whether the global economy is gathering or losing speed.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.