Regular readers of this column will know (or even bewail) its status as a bit of a trainspotter, quite literally when it comes to transport stocks. Owners of planes, ships, trucks and trains are right at the front line of the economy, because when things are going well their services are in demand, as goods must be shipped, and inventory replenished and also because the opposite holds true when things are going badly.

“Equity markets seem convinced there will be no economic landing (not even a soft one, let alone a hard one), and Government bond markets also appear to be pricing in sustained inflation and, by implication, higher nominal growth.”

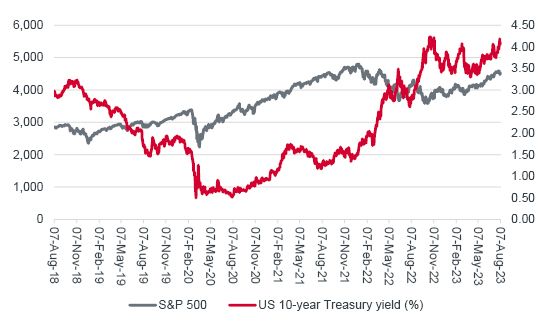

This is particularly important now, since equity markets seem convinced there will be no economic landing (not even a soft one, let alone a hard one), and Government bond markets also appear to be pricing in sustained inflation and, by implication, higher nominal growth. At least, that seems to be a logical inference to draw from how both America’s S&P 500 equity benchmark and the yield on 10-year US Treasuries are barrelling higher.

US stock and bond markets look to be pricing in higher (nominal) economic growth

Source: Refinitiv data

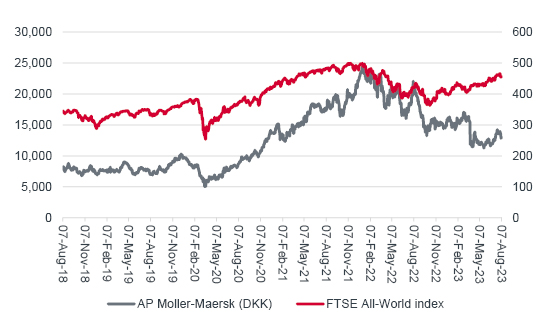

But the picture may not be quite so simple. The latest monthly trade figures from China were awful, as exports fell 14.5% year-on-year and imports by 12.4% in July. These can be partly explained away by the impact of American (and global) sanctions and tariffs on key industries, but the world’s second-largest economy is hardly flying, if these numbers are a dependable guide. Moreover, the new chief executive of AP Møller-Maersk, the world’s largest operator of container ships, has just cut the company’s forecast for global demand to a drop of 1% to 4% in 2023, compared to 2022. While advisers and clients could be forgiven for ignoring the views of one Danish firm, it might be unwise to do so. Until the past year or so, its shares have been a fair guide to the trajectory of the FTSE All-World index.

Global stocks are rising even as shares in vital container shipper sink

Source: Refinitiv data

The key words there may be “until the past year or so.” AP Møller-Maersk’s shares may be sinking to levels last seen almost three years ago, when the pandemic was still rife, but the FTSE All-World index is buoyant and the reason for this apparent parting of the ways may take us back to our starting point – America.

“The US stock market represents around two-thirds of global market capitalisation, so it can be argued that the world will follow wherever America goes.”

This is because the US stock market represents around two-thirds of global market capitalisation, so it can be argued that the world will follow wherever America goes. This may be good news for investors with hefty equity exposure, if the S&P 500 and US Treasuries are right and nominal economic growth is going to keep on proving stronger, and inflation more persistent, than markets expect. It may be less good for bond holdings, however.

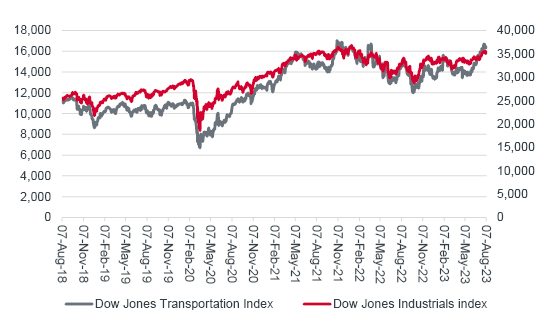

“A further reliable yardstick also suggests the US economy could keep on powering ahead. The Dow Jones Transportation index, a 20-stock of aviation, trucking, shipping and rail specialists, is closing back in on 2021’s all-time high.”

A further reliable yardstick also suggests the US economy could keep on powering ahead. The Dow Jones Transportation index, a 20-stock of aviation, trucking, shipping and rail specialists, is closing back in on 2021’s all-time high. Dow Theory, as developed by Robert Rhea way back in the 1930s, suggests that the Industrials will follow where the Transports go.

US transport stocks are tugging the industrials higher

Source: Refinitiv data

However, all of this begs the question of why the US economy continues to power along when so many others are plodding, including China. Supporters will lean toward the concept of American exceptionalism, its free-market philosophy, light-touch regulation and the deep pools of capital which support innovation without fear of, or any stigma attached to, failure.

Others will look for a more tangible explanation in the form of Bidenomics, a concept that seems to rely more heavily upon state intervention and support. The Inflation Reduction Act and the Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act of 2022 pumped over $1 trillion into the US economy and boosted many sectors in the process, including engineering and construction, as the White House pushed to onshore production and enhance its national capabilities in key industries ranging from silicon chips to renewable energy.

“The Biden Presidency’s policies mean US Government spending is surging even as tax receipts weaken (itself perhaps a sign that the underlying economy is not quite as strong as equity markets like to think).”

The benefits to US economic growth and corporate earnings seem clear, but there is one potential snag. The Biden Presidency’s policies mean US Government spending is surging even as tax receipts weaken (itself perhaps a sign that the underlying economy is not quite as strong as equity markets like to think). The US budget deficit for the fiscal year to September 2023 already exceeds that for 2022, with data for the final three months yet to come.

As Fitch’s downgrade of America’s credit rating to AA+ from AAA in July makes clear, this is not sustainable. The IRA and CHIPS Acts have to generate a return, or there could be trouble ahead on more than one level, although the chances of President Biden turning off the spending taps ahead of the November 2024 election are presumably slim.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.