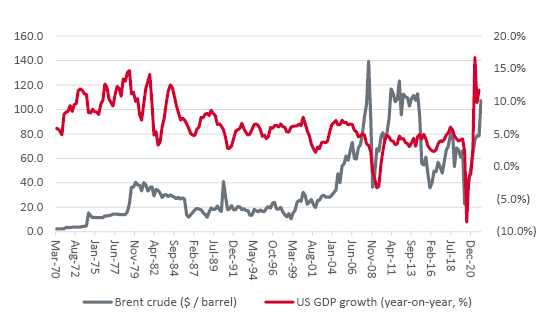

Central bankers, politicians, company management teams and the public, quite understandably, continue to fret about oil prices.

“Costly crude is in effect a tax, as it increases costs, squeezes margins and cash flow at companies, and crimps consumers’ disposable income and their ability to spend.”

Costly crude is in effect a tax, as it increases costs, squeezes margins and cash flow at companies, and crimps consumers’ disposable income and their ability to spend. An oil price of $147 a barrel may not have caused the recession of 2007-09 but it may have tipped a fragile, indebted global economy – and febrile, over-leveraged financial markets – over the edge. The oil price shocks of 1973 and 1979 did a lot of damage too, as they stoked inflation and pushed the US toward an economic downturn.

Oil price spike brings back bad memories of 2007 (and 1973-74)

Source: FRED – St. Louis Federal Reserve database, Refinitiv data

Crude had nothing at all to do with the US downturn of 2001 (as that was an investment bust in the wake of the technology, media and telecoms bubble). But it seems reasonable to ask the question whether oil is again about to wreak havoc and prompt a recession, or at least stagflation.

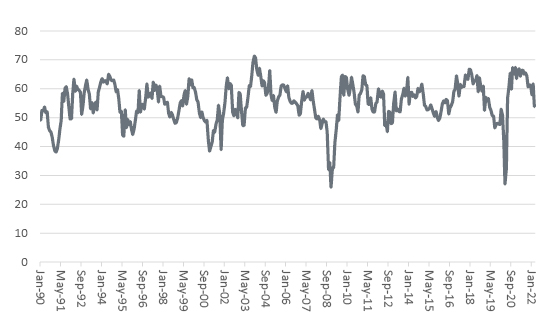

There is some evidence of a slowdown in the world’s largest economy, the US (and where the US goes it is fair to assume the rest of the West will follow). In the latest US purchasing managers’ index (PMI) for manufacturing, the new orders reading slumped by 7.9 points to just 53.8. That was the biggest drop since April 2020 and if that reading goes below 50 then there could well be trouble ahead.

US manufacturing is seeing a slowdown in order intake

Source: US Institute for Supply Management

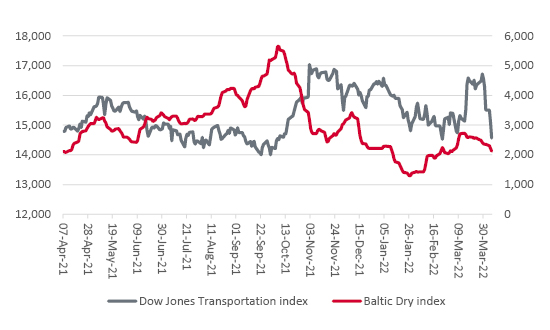

“The Dow Jones Transportation index has slumped in the past month, and it peaked last November. The Baltic Dry shipping index has also sprung a major leak.”

This could be just the result of supply chain friction rather than weak end demand, so it may not pay to jump to conclusions. But the Dow Jones Transportation index has slumped in the past month, and it peaked last November. The Baltic Dry shipping index has also sprung a major leak.

Has the Dow Jones Transportation index hit the buffers?

Source: Refinitiv data

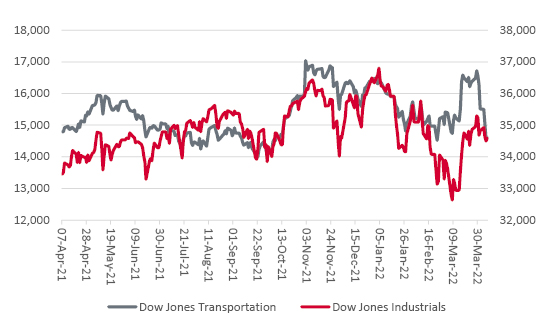

Regular readers of this column will know of Richard Russell’s Dow Theory, and its assertion that the economy, and by extension the Dow Jones Industrials, cannot do well if the Transportation index is not doing well. If the economy is strong and goods are selling, the stocks must be replenished and shipped. If the economy is weak and goods are not selling, then shelves do not have to filled, goods do not have to be manufactured and moved and trucks, planes, trains and ships stay idle.

“So far, the Dow Jones Industrials is doing its best to ignore the Transportation index’s loss of momentum, but this is a trend that requires careful attention.”

So far, the Dow Jones Industrials is doing its best to ignore the Transportation index’s loss of momentum, but this is a trend that requires careful attention.

Dow Jones Industrials is trying to ignore Transportation’s decline

Source: Refinitiv data

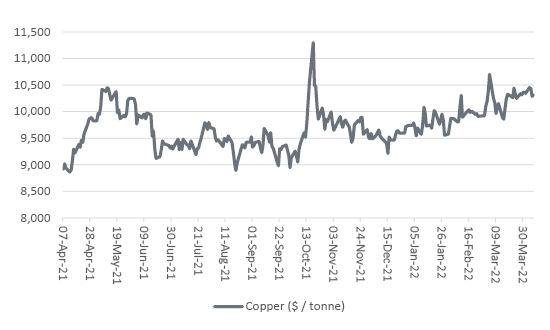

One bright spot remains copper. The malleable, conductive, ductile metal has so many uses in infrastructure, cars, electrical goods, construction and more than it is seen as a good guide to the health of the economy, hence its nickname, Dr. Copper. The good news is the commodity’s price remains strong, despite fears over China’s economy.

Copper’s price strength is a positive sign

Source: Refinitiv data

The economic picture is far from clear cut and, frankly, if it were then share prices would have priced it in and moved on by now. The economy is not the stock market and vice-versa. If a recession does hit, the markets will at some stage decide the outlook is so bad that it can only get better and start to discount an upturn, long before the data show any signs of improvement.

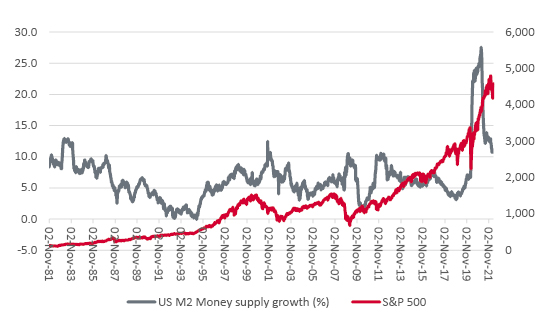

“Money supply growth is sagging in the USA, even before the Fed really tightens policy, and that could be the biggest challenge of all, at least for financial markets.”

There is also the potential for policy intervention. Central banks and governments have shown they have little or no appetite for a recession or austerity, or the risk of financial market turmoil spilling over into the real economy. They have quickly cut interest rates or spent money. The difference this time is inflation is roaring, rates are already low and coffers relatively empty. Indeed, money supply growth is sagging in the USA, even before the Fed really tightens policy, and that could be the biggest challenge of all, at least for financial markets.

US money supply growth is slowing

Source: Refinitiv data

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.