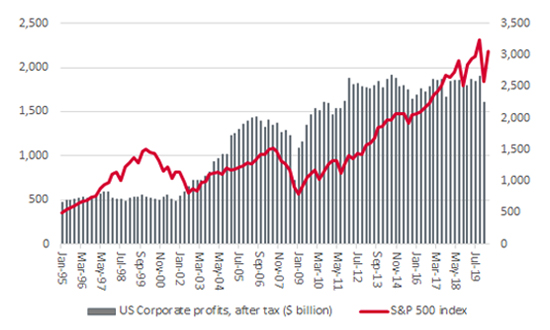

As America’s benchmark S&P 500 index barrels beyond the 3,000 mark once more, the US equity market continues to price in a rapid earnings recovery, or substantial monetary stimulus (and support for financial markets from the Federal Reserve), or further fiscal stimulus from Capitol Hill – or a combination of all three. Advisers and clients must now decide whether that is the correct view on all three points as, if they fail to deliver, there could be more volatility ahead.

“In the near term, it does seem as if the performance of US equities is disconnected from American corporate earnings.”

This is because, in the near term, it seems as if the performance of US equities is disconnected from American corporate earnings.

US stocks have surged even as profits have sagged

Source: FRED – St. Louis Federal Reserve database, Refinitiv data

This can happen for a while – markets are forward-looking mechanisms after all and they can be pretty canny at sensing upturns or downturns long before it shows up in companies’ quarterly earnings reports. But, ultimately, a company is only worth the cash that it generates over its lifespan and the profits it makes are a key part of that cash flow, so if the profits do not materialise, then the spectacular surge in US share prices could start to mean the risk-reward profile of US equities is more slanted toward risk and away from reward.

“If advisers and clients look closely at the trend in aggregate American corporate earnings, they might get a shock, because Q4 2019 was no higher than Q2 2014, in nominal dollar terms.”

According to data from the St. Louis Federal Reserve, aggregate corporate US profits slipped by 11% year-on-year in Q1 2020 to $1.6 trillion. Given the creeping effects of COVID-19 in Asia and then Europe, and then the end-of-March lockdown in America itself, this will come as no surprise to advisers and clients. But if they look closely at the chart that compares US corporate income with the S&P 500, they might get a shock, because Q4 2019 was no higher than Q2 2014, to suggest that firms had been struggling to make progress for some time (with the exception of a select group of technology stocks, as discussed here two weeks ago). Tech, plus some financial engineering in the form of share buybacks and President Trump’s 2017 tax cuts, put a fancy gloss on modest underlying rates of progress.

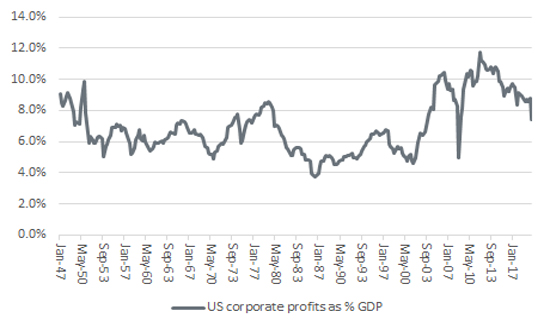

This can be seen more clearly through a study of US corporate profits as a percentage of GDP. By this metric, earnings peaked almost eight years ago. This makes the S&P 500’s monster gains since then seem all the more remarkable, although advisers and clients could counter by asserting that this calculation is just useless when it comes to analysing stocks.

US corporate profits fell to lowest percentage of GDP since Q1 2009 in Q1 2020

Source: FRED – St. Louis Federal Reserve database, Refinitiv data

However, those advisers and clients who believe in mean reversion will not be surprised, arguing that this is typical of an economic cycle. Premium returns on capital attract more capital until investment in fresh supply overwhelms demand, margins contract, and capital is destroyed as errors are punished. Excess capacity is then wiped out, new innovations are forged through necessity and the cycle starts again. On the face of it, US corporate profits were heading back to their long-term average of 6% of GDP even before the pandemic struck.

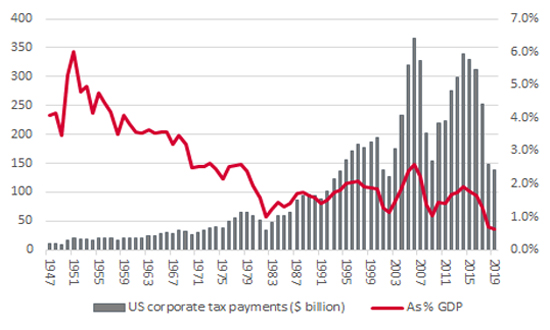

The drop in earnings has started to hit the US corporate tax take, although the 2017 Tax Cuts and Jobs Act, which slashed the headline corporation tax rate from 35% to 21%, had something to do with this too.

US corporate tax take is near historic lows as a percentage of GDP

Source: FRED – St. Louis Federal Reserve database

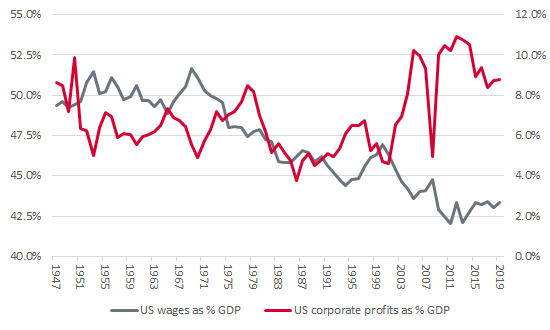

“It is not just tax payments that stand at lowly levels. Labour’s take-home portion of US GDP is hovering near post-WWII lows.”

It is not just tax payments that stand at lowly levels. Labour’s take-home portion of US GDP is hovering near post-WWII lows, as salaries and compensation represented barely 43% economic output in 2019. From the start of the Reaganomics revolution in the early 1980s to their peak, US corporate profits as a percentage of GDP rose by some five to six percentage points. At the same time, workers’ share of the pie fell by – yes, you guessed it, five to six percentage points.

Capital has won out over labour for the last 30-plus years in the US

Source: FRED – St. Louis Federal Reserve database

“A tight labour market had begun to give the whip hand back to workers. It now remains to be seen whether COVID-19 changes that – and how.”

A tight labour market had begun to give the whip hand back to workers. It now remains to be seen whether COVID-19 changes that – and how.

On one hand, some investors might like to think that the less well-paid who work on the frontline in stores, warehouses and hospitals would get healthy pay increases in recognition for both the low starting point and their huge contribution to keeping the show on the road. Higher taxes to help plug the Federal Budget deficit that is already yawning ever-wider could be a further hit on corporate profits and provide a nasty one-two punch for investors at a time when they are looking for a profit to rebound to sustain valuation multiples that are lofty by historic standards.

On the other, it might be unwise to bet against corporate America. Firms that have run smoothly without furloughed staff may decide that not all of them are needed when lockdowns end and business starts to pick up again. Bosses who have become accustomed to managing remotely may decide this can be taken one step further and offshore their staff to cheaper, emerging economies, ironically just as – perhaps – the viral outbreak and President Trump’s policies lure industrial jobs back onshore.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.