It is unlikely that too many advisers and clients will make listening to more announcements from regulators one of their New Year’s resolutions but no-one could accuse the Prudential Regulatory Authority (PRA) of playing Scrooge, at least not this December.

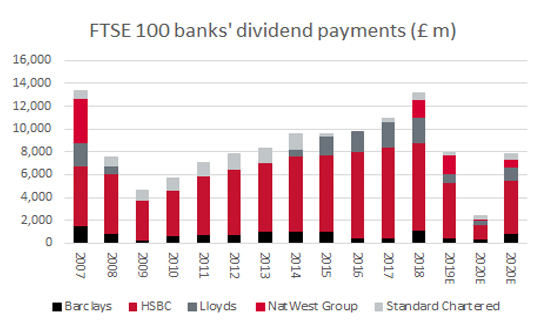

Granted, the PRA may have wounded a few income-seekers’ portfolios with its declaration in late March that the Big Five FTSE 100 banks should not pay dividends (or run any share buyback programmes) in calendar 2020. The lenders responded immediately by cancelling their planned final payments for 2019, keeping £9.2 billion in cash on their balance sheets. Further possible distributions have been withheld, to deprive income-seeking advisers and clients of a further £6.5 billion, based on the payments made for the second and third quarters in 2019.

However, the PRA has now relented and granted permission to Barclays (BARC), HSBC (HSBA), Lloyds (LLOY), NatWest (NWG) and Standard Chartered (STAN) to return to cash to shareholders in calendar 2021. While caps and limits are in place, this still represents good news for those advisers and clients who are seeking income from UK equities.

“The consensus analysts’ forecast of a combined £5.4 billion in dividend increases from banks next year underpins the estimate of an aggregate £10.9 billion improvement in the FTSE 100’s payout for 2021 to a total of £70.8 billion.”

The consensus analysts’ forecast of a combined £5.4 billion in dividend increases from banks next year underpins the estimate of an aggregate £10.9 billion improvement in the FTSE 100’s payout for 2021 to a total of £70.8 billion.

Banks are now permitted to pay dividends again in 2021

Source: Company accounts, Sharecast, consensus analysts’ forecasts

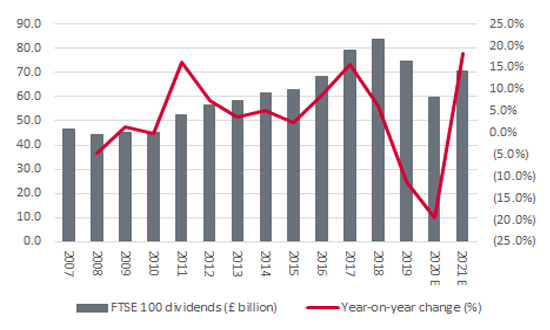

That £70.8 billion figure is, in turn, enough for a 3.8% dividend yield on the FTSE 100. While it is not up there with the 4.5%-plus they were hoping for a year ago (and that after a 15% fall on the FTSE 100 to add capital insult to income injury), it may help to provide some sort of valuation support for the headline index.

FTSE 100 dividends are expected to rebound 18% after 2020’s 20% drop

Source: Company accounts, Sharecast, consensus analysts’ forecasts

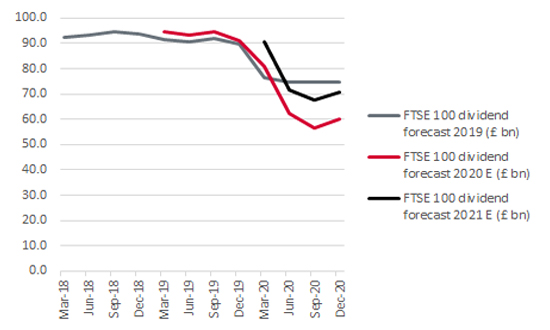

“Although analysts currently expect 2021’s dividend payments to come in below 2019’s final tally of £74.5 billion, Q4 2020 is the first three-month period when dividend payments forecasts for next year overall have not fallen since analysts first rolled them out.”

Although analysts currently expect 2021’s dividend payments to come in below 2019’s final tally of £74.5 billion, Q4 2020 is the first three-month period when dividend payments forecasts for next year overall have not fallen since analysts first rolled them out.

FTSE 100 dividend forecast momentum has turned positive again

Source: Company accounts, Sharecast, consensus analysts’ forecasts

However, not every adviser or client will be convinced that the 3.8% dividend yield is entirely reliable, or sufficient compensation given the potential risks that come with the UK market, in terms of Brexit, the ongoing pandemic and the potentially brittle nature of the economic upturn, given the degree of support that the Bank of England and the Government are having to pump in to try and keep the show on the road.

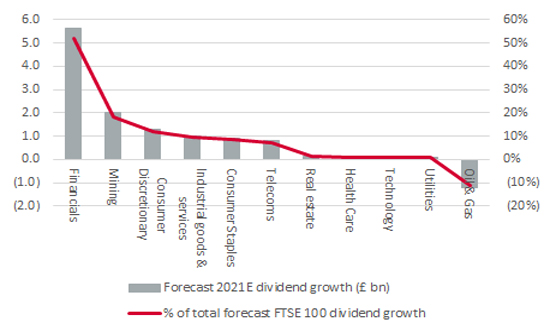

“Four fifths of 2021’s expected £10.9 billion increase in overall FTSE 100 dividends is forecast to come from just three sectors, in the form of Financials, Miners and Consumer Discretionary.”

Analysts are not expecting 2021’s profits or dividends to return to the pre-pandemic levels of 2018 or 2019, to suggest they are not going overboard. But four fifths of 2021’s expected £10.9 billion increase in overall FTSE 100 dividends is forecast to come from just three sectors, in the form of Financials, Miners and Consumer Discretionary. All of this trio could do with an economic tailwind if they are to live up to such expectations.

Three sectors dominate the dividend growth forecasts for 2021

Source: Company accounts, Sharecast, consensus analysts’ forecasts

If the economy offers little or no assistance – or even hinders – then these forecasts could find themselves exposed to the downside. Moreover, the banks must still contend with the margin-crushing effects of the Bank of England’s zero-interest-rate and quantitative easing policies, while the Government’s apparent desire to increasingly use them as a tool for lending and keeping debt off its own balance sheet adds to the risk of weaker returns and higher loan provisions.

“Helpfully for those of a nervous disposition, only one of the big five – HSBC – is forecast to be among 2021’s top 20 dividend payers by value within the FTSE 100. (Barclays is the next lender in the forecast rankings, at twenty-first.)”

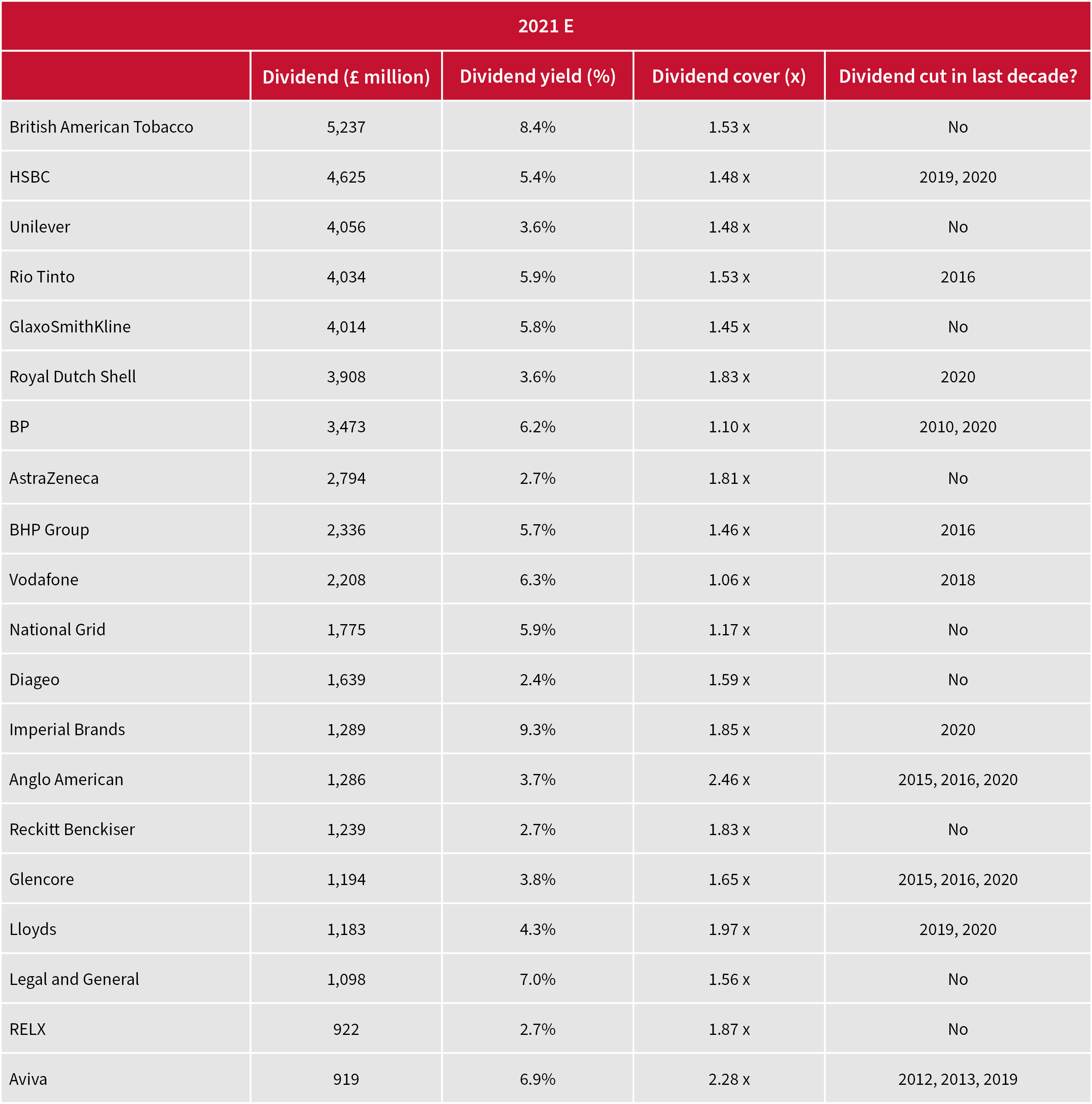

Helpfully for those of a nervous disposition, only one of the big five – HSBC – is forecast to be among 2021’s top 20 dividend payers by value within the FTSE 100. (Barclays is the next lender in the forecast rankings, at twenty-first.)

The 20 forecast dividend payers in the FTSE 100 in 2021

Source: Company accounts

Nevertheless, advisers and clients must again contemplate the concentration risk which has dogged those who have sought income from the UK stock market for some years. Just 10 stocks are forecast to pay dividends worth £32.3 billion, or 54% of the forecast total for 2020. The top 20 are expected to generate 75% of the total index’s payout, at £44.8 billion.

Any adviser or client who believes the UK stock market is cheap on a yield basis and who gleans access via a passive index tracker or a UK equity income fund needs to have a good understanding of, and strong view on, those 20 names in particular – or at least make sure that the fund manager has a clear reason for which ones they are owning or avoiding.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.