There is a general rule that the most vituperative arguments are those that take place between academics, because the stakes (and the implications for the real world) are so small. Usually, such debates can be watched with detached amusement, but there is one current spat which does command attention, especially from an investment perspective.

In one corner, we have Larry Summers, former US Treasury Secretary under President Bill Clinton, and former economic adviser to Barack Obama. In the other, we have current Treasury Secretary and former US Federal Reserve chair Janet Yellen. (To add spice to proceedings, Summers was reportedly an unsuccessful candidate when Yellen got the post at the US central bank in 2013).

Yellen is actively endorsing the Biden administration’s fiscal stimulus plans, arguing that spending too little could do more harm than spending too much.

Judging by his columns in The Washington Post, Summers seems to disagree, in the view that too much stimulus could unleash inflation. Yellen – perhaps conveniently ignoring how her four years as Fed chair employing ultra-loose policies employed by both her predecessor, Ben Bernanke, and her successor, Jay Powell, cannot point to any sustained progress in stoking inflation – asserts that any such threat is being monitored and will be swiftly contained. Cue much eyerolling from Mr Summers, whose antipathy to the quantitative easing (QE) policies used as ‘temporary’ measures by the Fed since 2008 is also well known.

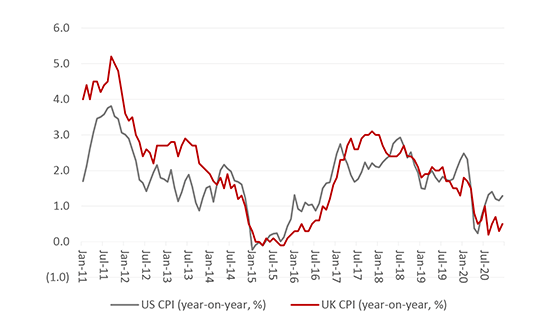

“Inflation is currently so low, with headline readings in the US and UK of 1.3% and 0.5% respectively, that the debate between ex-Treasury Secretary Larry Summers and the current incumbent, Janet Yellen, may seem a little arcane, but it really does matter to advisers and clients.”

Inflation is currently so low, with headline readings in the US and UK of 1.3% and 0.5% respectively, that such a debate may seem a little arcane, but it really does matter.

Inflation is low, but markets remain on a state of alert for its return

Source: Office for National Statistics, FRED – St. Louis Federal Reserve database

If Yellen is right, then advisers’ and clients’ investment portfolios can stay slanted toward momentum and growth strategies and long-duration assets, such as government bonds with a decade to maturity or more, and technology and biotechnology stocks – in other words, what has a great track record over the last decade will keep delivering, if history is any guide.

“If Summers is right and inflation pops higher and it then stays that way, then history suggests advisers and clients need to be exposed to short-duration assets such as ‘value’ equities (cyclical growth and recovery stocks), emerging markets and ‘real’ assets such as commodities and precious metals – the opposite of what has worked for the past decade and more.”

But if Summers is right, then the whole game changes. If inflation pops higher and stays that way, then history suggests advisers and clients need to be exposed to short-duration assets such as ‘value’ equities (cyclical growth and recovery stocks), emerging markets and ‘real’ assets such as commodities and precious metals.

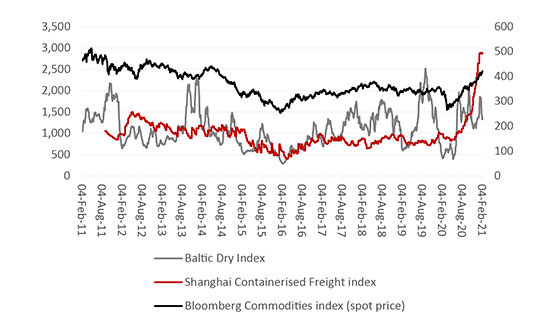

Again, the headline inflation numbers are benign. There will be a base effect for the rest of 2021, as the pandemic-induced recession comes up as a comparator. Doubtless central banks will dismiss that as transitory rather than signs of fundamental cost pressures, even if the price of vital raw materials from oil to metals to crops is on the march if the Bloomberg Commodity index and shipping’s Baltic Dry benchmark are any guide. If there is any good news here, it might be that the Shanghai Containerised Freight index is maybe topping out after a stunning run, but all these trends are indicators of cost pressures building in the pipeline.

Commodities and transport costs could be hinting at inflation

Source: Refinitiv data

“Companies are already paying attention to early signs of inflationary pressure – because they must. Fixed-income investors are paying attention, too, because government bond yields are rising, albeit from historically low levels.”

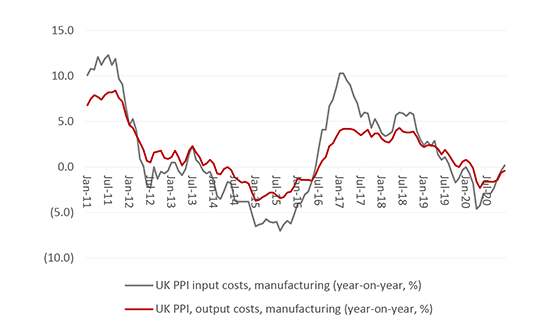

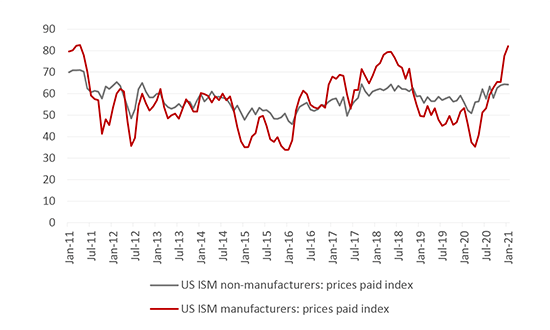

Companies are already paying attention – because they must. Input costs and output prices are showing some momentum in the UK, even if they reflect the modest overall headline inflation figures for the moment, while American firms are flagging a sharp increase in their costs in the latest purchasing managers’ indices. Muted demand, owing to the pandemic, lockdowns, and increased unemployment, could keep a lid on this trend but a strong bounce-back at a time when supply is crimped by company closures and supply chain disruption remains a possibility, too.

Companies are starting to notice higher costs in the UK…

Source: Office for National Statistics

… and the US

Source: US Institute for Supply Management

Fixed-income investors are paying attention because government bonds yields are rising. They still stand at what remain historically low levels, though, so it would be wrong to say bond investors are in a tizzy.

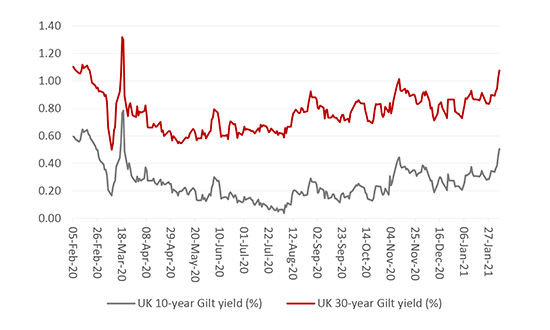

UK Gilt yields are ticking higher…

Source: Refinitiv data

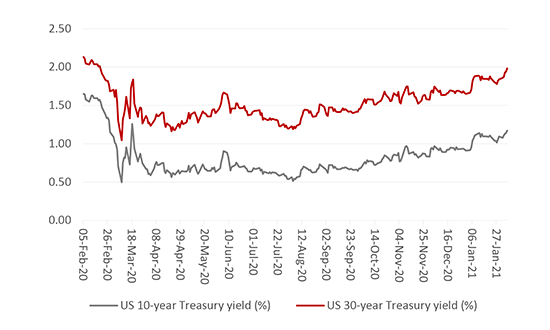

… as are US Treasury yields

Source: Refinitiv data

They still seem to believe the Yellen narrative that inflation can be managed and – presumably – that central banks can just keep throwing money at fixed-income markets via QE to put a lid on bond yields. That would keep bond prices high but gilts’ and treasuries’ skinny yields would offer holders little or no protection if the inflation genie (devil?) finally pops out of the bottle.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.