The twentieth-century American journalist Edward R. Murrow may be best-known for his ground-breaking reports from Buchenwald in 1945 and the manner in which he signed off each of his broadcasts by saying “Good night and good luck” – the phrase ultimately being used in 2005 as the title of a film that depicted his battle with communism-obsessed Senator Joseph McCarthy – but this column’s favourite pearl from Murrow is his comment that: “Anyone who isn’t confused doesn’t really understand the situation.”

In the narrow context of financial markets, this seems particularly apposite. Equity markets switched from blind panic in late February and early March to what felt like exuberance by mid-June.

“Equity markets switched from blind panic in late February and early March to what felt like exuberance by May and mid-June, as they went from pricing in an economic disaster to a rapid recovery. The truth may well lie somewhere in between.”

Sentiment has therefore switched from deep pessimism about COVID-19 and its implications to optimism that the damage to health and wealth may not be too long-lasting. The truth may well lie somewhere in between, so late June’s slide in share prices could be seen as sensible, especially as doubts about the health of the global population (let alone its economy) creep in once more.

Given the uncertainty over the pandemic and the range of possible outcomes, this may seem sensible to many advisers and clients, and the range of emotions can be tracked, albeit in a rather short-hand form, by the VIX index.

The so-called ‘fear index’, which can be tracked for free via the internet, measures expected future volatility in the US equity market (there used to be a UK equivalent but it appears to have been discontinued in summer 2019, at least according to this column’s regular data provider).

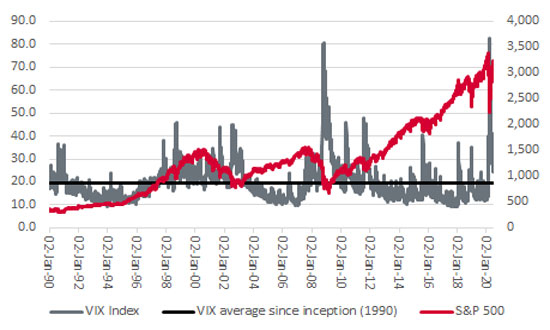

The VIX was launched in 1990 and it has averaged a reading of 19.4 over its 30-year history. The lowest reading ever was 9.1 in November 2017 and the VIX set a new high of 82.7 this year in March, when it surpassed the 80.9 peak seen in November 2008 as the Great Financial Crisis reached its zenith.

A long-term chart shows that the VIX tends to peak as share prices tend to bottom and vice-versa. This makes sense in that valuations will be at their cheapest (and therefore most rewarding) during panics when sentiment is washed out, while valuations will be at their highest (and therefore least rewarding, at least over the long term) when animal spirits are rampant and confidence is high.

The VIX can be a helpful contrarian indicator, at least at the extremes

Source: Refinitiv data

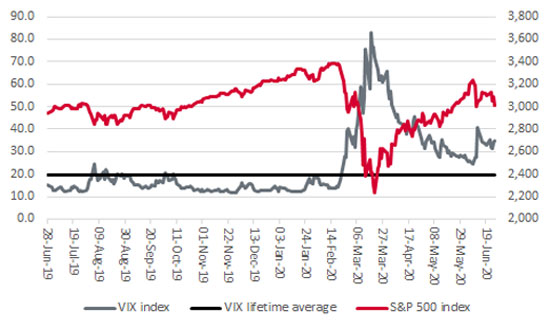

“During the rally in the S&P 500 US equity benchmark since March, the VIX has not once even gone back to its lifetime average of 19.4, let alone below it.”

What is eye-catching about the rally in the S&P 500 US equity benchmark since March is that the VIX has not once even gone back to that lifetime average of 19.4, let alone below it. This would suggest that conviction levels may not be high, given the possible reliance of the advance upon largesse from the US Federal Reserve, which may now be drying up – at least temporarily (see this column, SHARES, 26 June 2020).

It also suggests that investors do not entirely trust the rally since March and are, at the very least, preparing for more lumps and bumps along the way as policymakers and the actions of the wider population try to strike the right balance between physical and financial health in their responses to the ongoing pandemic.

VIX suggests investors do not entirely trust the post-March stock market rally

Source: Refinitiv data

A little bit of Mr Murrow’s good luck, therefore, may not go amiss but this leaves investors with a dilemma, not least because relying on fortune is no sort of strategy at all.

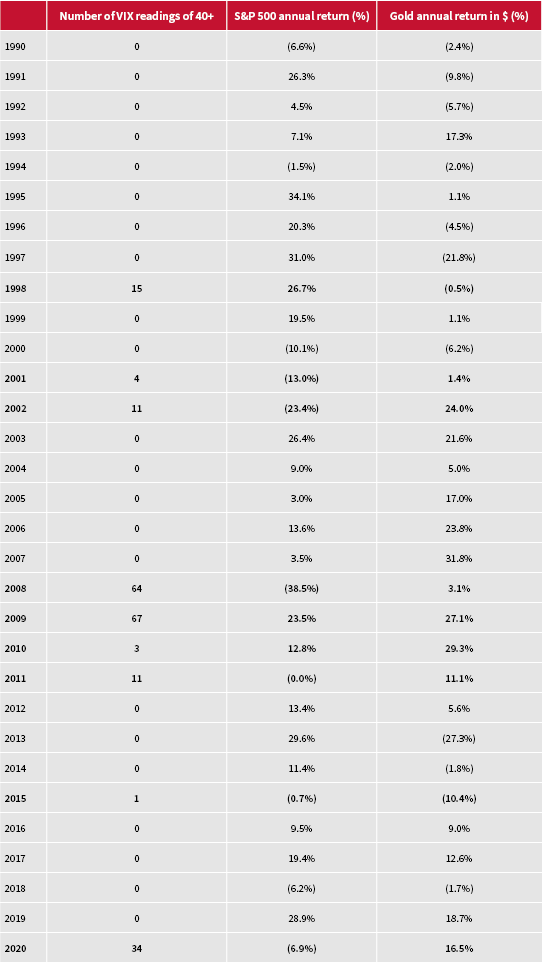

VIX readings over 40 (just over twice the long-run average) are pretty rare – the ‘fear index’ has only got there in nine years out of thirty and for just over 200 days in total (barely 2.5% of the time).

“VIX readings over 40 are pretty rare – the ‘fear index’ has only got there in nine years out of thirty. Across those nine years, the S&P 500 has risen only three times, while gold can point to seven advances.”

Some of the annual samples are very limited but, across those nine years, the S&P 500 has recorded a gain three times (1998, 2009 and 2010), done nothing twice (2011 and 2015) and fallen on the other four occasions (2001, 2002, 2008 and 2020 to date).

That mixed bag again speaks against taking too definitive a view amidst the current uncertainty and perhaps in favour of a diversified portfolio that is designed to cater for, protect against and hopefully benefit from multiple possible outcomes. For example, the S&P 500’s record in those nine years when the VIX hit 40 is pretty mixed, but gold can point to seven gains and just two losses, so the precious metal could be considered as a possible diversifier, especially if advisers and clients fear a sustained economic downturn.

Gold has historically done better than the S&P 500 in years when the VIX hits 40

Source: Refinitiv data

Admittedly, an argument in favour of portfolio diversification is hardly new but, in its defence, this column will reach for a third and final quote from Ed Murrow, by way of conclusion: “The obscure we see eventually. The completely obvious, it seems, takes longer.”

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.