If this column reads one more story, no matter how well meaning, that global equity markets are ‘up because of hopes for a new US fiscal stimulus package’ (or ‘down because a spending plan agreement on Capitol Hill looks less likely’), someone is going to have to hand it a bucket in which to be violently ill. As argued last week (SHARES, 8 October 2020), ‘hope is not a strategy’ when it comes to investing.

If this is what equity investing boils down to – relying on spending from governments that are already up to their gills in debt and essentially potless – then we really are in trouble.

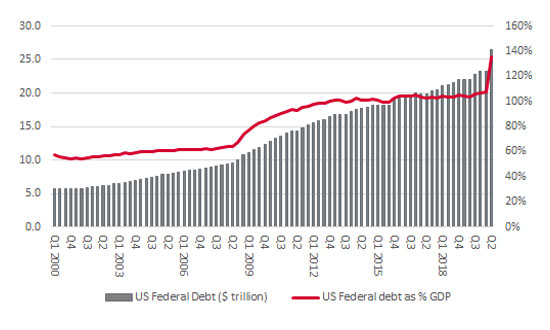

US federal deficit continues to spiral

Source: FRED – St. Louis Federal Reserve database

“Comments, credible or otherwise, about the US budget deficit were only notable by their absence from the first Presidential Election debate in the US.”

Comments, credible or otherwise, about the US budget deficit were only notable by their absence from the first Presidential Election debate in the US. This suggests politicians do not care and are happy instead to rely upon financial repression, in the form of zero interest rates and manipulation of bond markets via quantitative easing (QE), to fund whatever promises they care to make.

They may also be about to get help of another kind.

“Supporters of central bank digital currency (CBDC) projects will argue they represent a potentially useful addition to the policy toolkit, alongside zero interest rates and quantitative easing, while sceptics will wonder where they will lead next, with rampant money creation and inflation seen as potential consequences.”

Supporters of such experiments will argue they offer another potentially useful tool in the central banker’s kitbox, as the existing policy suite of zero rates, QE, inflation targeting and so on struggles to deliver the growth and inflation the monetary (and political) authorities crave, to help them escape from their debt burdens.

Sceptics will wonder where this will lead next, with rampant money creation – to fund government debts, interest payments and spending plans – and inflation both possible consequences, unintentional or otherwise. These doubters may be in the camp that warms to gold in such circumstances or even cryptocurrencies which, rather to this column’s surprise it must be said, refuse to go away.

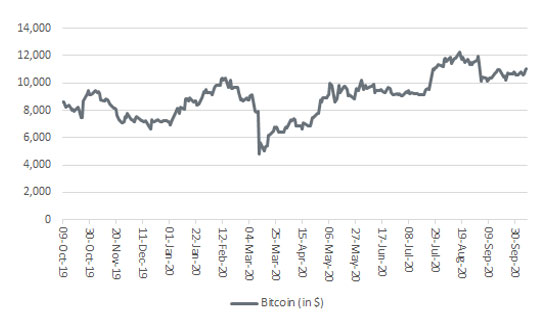

Bitcoin may still be trading well below its 2017 all-time high of nearly $19,000, but it is making plenty of ground.

Bitcoin trades near its 12-month highs

Source: Refinitiv data

According to coinmarketcap.com, Bitcoin’s total value is $210 billion, a fraction below its high for the calendar year. That figure is also pretty much double the value of the FTSE 100’s largest stock by market cap, AstraZeneca. The total crypto universe, which now comes to over 3,600 different counters, is currently valued at $361 billion according to the same website.

“Some may argue that cryptocurrencies’ return to favour supports their view that central bank policies are debasing existing currencies and merely one step down the path toward a reset of how fiat money works, with CBDC experiments the next logical development.”

Some may view this as another reason to view financial markets in the round as worryingly frothy, as a plentiful supply of liquidity from central banks (and those ‘hopes for fiscal stimulus from Government’) keep them bubbly. Others will argue that cryptocurrencies’ return to favour supports the view that central bank policies are debasing existing currencies and merely one step down the path toward a reset of how fiat money works, with CBDC experiments the next logical development. Perhaps Facebook’s (FB.:NDQ) work on its own blockchain-based payment system, Libra, is prompting central banks to get cracking on their own version.

Regulators are clearly still sceptical. Attempts to launch exchange-traded funds (ETFs) dedicated to tracking cryptocurrencies have foundered in the US and Britain’s Financial Conduct Authority has just banned the sale of derivatives and exchange-traded note (ETN) trackers related to Bitcoin to retail investors, citing in particular “the inherent nature of the underlying assets, which means they have no reliable basis for valuation”.

No matter how sceptical many financial market watchdogs or participants may be, it can still be argued that if someone, somewhere, thinks that cryptocurrencies have a value, then a value is what they have.

Granted, such an argument would have left more than one Dutch tulip trader in trouble around 400 years ago. Questions over the cost of the Bitcoin mining process, the level of mining, transaction fees and the efficiency of cryptocurrencies as a payment system relative to cash, or existing credit and debit networks, will also deter many from using Bitcoin, let alone treating it as an investable asset class.

Yet the cap on the supply of Bitcoin to 21 million will continue to appeal to some investors as they see government deficits balloon and central banks draw up plans for digital currencies and seek out a place to preserve (or even hide) wealth. Gold bugs may argue that Bitcoin has no physical backing or practical use but critics of the precious metal will assert the ‘barbarous relic’ is an inert element that generates no yield and is not exactly in frequent use when investors pay for their weekly groceries, either.

Libertarians may also jump in at this point, citing how central bank-backed digital currencies could be the ultimate surveillance tool in any civilised country, let alone despotic, corrupt ones.

“The battle lines remain drawn. The ability to pay tax in cryptocurrency (or even buy groceries) would be a tectonic shift but that looks a long way away.”

As such, the battle lines between true believers and nocoiners (and gold bugs) remain drawn. The ability to pay tax in cryptocurrency (or even buy groceries) would be a tectonic shift but that looks a long way away. For the moment, the former are having a better year of it than the latter and the forced shift from cash to cashless payment during the current pandemic is unlikely to do the cause of digital currencies any harm, as more and more people become used to using their card or mobile device to make a payment in person, let alone online.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.